Early yesterday morning bitcoin’s blockchain forked — meaning a separate cryptocurrency was created called bitcoin cash.

The way a fork works is instead of creating a totally new cryptocurrency (and blockchain) starting at block 0, a fork just creates a duplicate version that shares the same history. So all past transactions on bitcoin cash’s new blockchain are identical to bitcoin core’s blockchain, with future transactions and balances being totally independent from each other.

For practical matters, all this really means is that everyone who owned bitcoin before the fork now has an identical amount of bitcoin cash that is recorded in bitcoin cash’s forked blockchain.

But it’s not exactly this easy. If you control your own private keys, or hold your bitcoin in an exchange that said it would credit users’ balances with bitcoin cash, you’re fine and can access your newfound cryptocurrency right now.

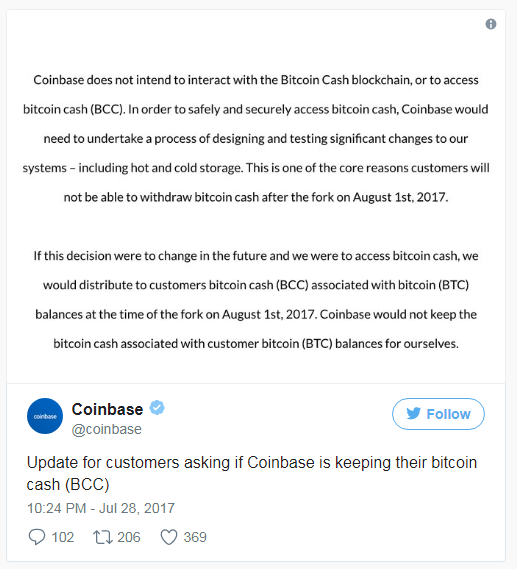

If you held your bitcoin with a provider like Coinbase, which said before the fork they aren’t planning on distributing bitcoin cash to users or even interacting with the new blockchain at all, then you may be out of luck.

To be clear — this doesn’t mean companies like Coinbase and Gemini are taking your bitcoin cash for themselves. It’s just that they think it’s a distraction and not really going to be worth anything in the long run. If this proves to be false and the coins hold value, these companies will most likely end up distributing them to users.

What’s so special about bitcoin cash?

If you know anything about cryptocurrencies you know there are a ton of them. Like thousands of them. Some are legitimate and substantially different (arguably better) than bitcoin, and some are pretty much just copycats trying to make a quick buck.Bitcoin cash is just another modified cryptocurrency.But it’s getting more attention right now for a few reasons:

First, it was created as a result of forking bitcoin core, and not created from scratch. But this isn’t new — other cryptocurrencies have also forked from bitcoin in the past, and are nowhere near as valuable as bitcoin cash currently is. That being said, it does mean that anyone who held bitcoin before yesterday now potentially has access to an equal amount of bitcoin cash, which is giving it a lot of attention, as people are saying it’s “free money.”Secondly, it’s getting attention because the hard fork was timed to coincide with bitcoin core activating a change in its code called BIP 148, which was a highly publicized event in itself. This Bitcoin Improvement Proposal was the result of months of negotiation among major players and activated Segregated Witness, something that will help bitcoin core scale going forward.

Is it worth anything?

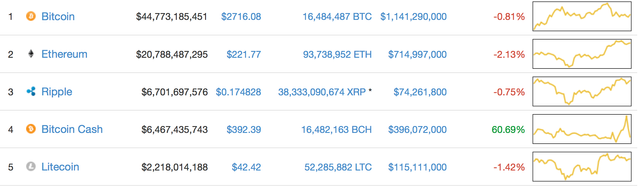

Right now, bitcoin cash is actually worth quite a bit — on paper at least. Some are trading it at around a value of $400 per coin, which makes it the fourth-largest cryptocurrency by market cap right now.

But here’s the thing — it’s currently really hard to sell bitcoin cash. While some exchanges have added the new currency for trading, liquidity is super low, which is why some say the price is being artificially inflated. Because most exchanges aren’t accepting deposits yet, the only bitcoin cash available to trade is currency that was credited by exchanges after the fork. Users holding bitcoin cash outside of exchanges, or in exchanges that don’t support trading, are stuck waiting.

So the moral of the story is that there’s probably a ton of bitcoin cash waiting to be sold, as soon as people can transfer it. That’s because there’s not a whole lot of incentive to keep the coins, especially when people think it is overvalued and want to quickly cash out. And the price has already fallen — take a look at the price moment today in USD. It’s already down from a high of $680 to around $350 on Bitfinex, one exchange that is offering a market for the new currency.

Now this isn’t to say it’s going to be worthless. Just look at Ethereum Classic, a hard fork of Ethereum. After that fork it dropped to about $1 per ETC, but a few months later is now worth around $15 per ETC. Of course, this price pales in comparison to the $220 that regular Ethereum currently trades at.

By the way, if you’re wondering why exchanges aren’t accepting deposits of bitcoin cash, it’s because it’s nearly impossible to send bitcoin cash over the blockchain right now. This is because the newly forked blockchain hasn’t yet adjusted its difficulty, which happens automatically every 2016 blocks. So it’s taking way too long to mine blocks and confirm transactions. For reference, one block today took 10 hours to mine, compared to the 10 minutes it should. Most exchanges require 6 or 7 block confirmations before they credit a deposit, so you can see how it’s basically impossible to move around bitcoin cash.

Now what?

So what’s next? The general consensus in the cryptocurrency community is that most people are just going to sell bitcoin cash as soon as they get the chance to — which, if happens, will further drive down the price. But there’s always a chance that people will flock to this coin and it actually retains or appreciates in value. Essentially, like everything else in crypto, no one knows what’s about to happen next.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://techcrunch.com/2017/08/02/wtf-is-bitcoin-cash-and-is-it-worth-anything/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for this post! As someone new to the cryptocurrency market reading this cleared a lot up :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article, nice information on the exchange and cash flow situation.

I did myself raise question about the current value of Bitcoin Cash in this post:

https://steemit.com/bitcoin/@skivebremsen/bitcoin-cash-money-out-of-thin-air-too-good-to-be-true

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit