Introduction

In the previous article (Part 5 of the series), we developed the Adaptive Crossover RSI Trading Suite Strategy, combining moving average crossovers with RSI filtering to identify high-probability trade opportunities. Now, in Part 6, we focus on pure price action analysis with an automated Order Block Detection System in MetaQuotes Language 5 (MQL5), a powerful tool used in smart money trading. This strategy identifies key institutional order blocks—zones where large players accumulate or distribute positions—helping traders anticipate potential reversals and trend continuations.

Unlike traditional indicators, this approach relies entirely on price structure, detecting bullish and bearish order blocks dynamically based on historical price behavior. The system visualizes these zones directly on the chart, providing traders with clear market context and potential trade setups. In this article, we will cover the step-by-step development of this strategy, from defining order blocks to implementing them in MQL5, backtesting their effectiveness, and analyzing performance. We will structure this discussion through the following sections:

Strategy Blueprint

Implementation in MQL5

Backtesting

Conclusion

By the end, you will have a solid foundation in automating order block detection, enabling you to integrate smart money concepts into your trading algorithms. Let’s get started.

Strategy Blueprint

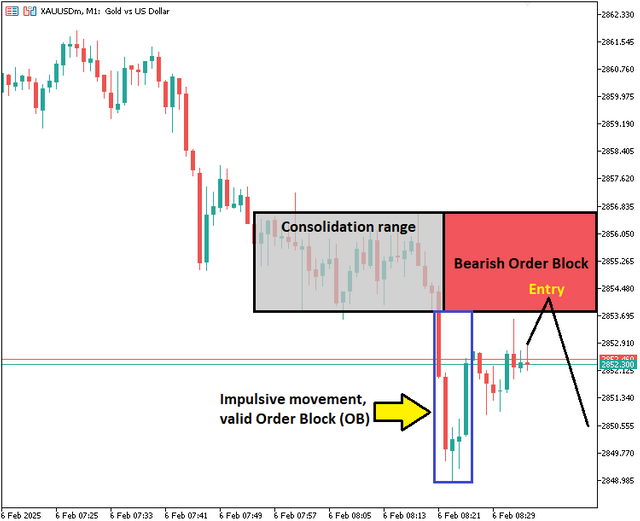

We will begin by identifying consolidation ranges, which occur when the price moves within a confined range without a clear trend direction. To do this, we will scan the market for areas where price action lacks significant breakouts. Once we detect a breakout from this range, we will assess whether an order block can be formed. Our validation process will involve checking the three preceding candles before the breakout. If these candles exhibit impulsive movement, we will classify the order block as either bullish or bearish based on the breakout direction. A bullish order block will be identified when the breakout is to the upside, while a bearish order block will be marked when the breakout is to the downside. Once validated, we will plot the order block on the chart for future reference. Here is an example.

This is not your work.

Source: Automating Trading Strategies in MQL5 (Part 6): Mastering Order Block Detection for Smart Money Trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You've provided a comprehensive overview that not only explains the technical aspects but also inspires those new to the field to explore automation's potential.

The way you've broken down the process from the basics of MQL5 to implementing complex strategies like the Profitunity System showcases your deep understanding of both trading and programming. It's clear you've put a lot of effort into making this accessible, which is crucial in a field that can seem daunting to newcomers.

Your mention of the MQL5 community and resources like the MQL5 Market and the MetaEditor development environment are spot-on for anyone looking to get started or advance their skills. It's also great how you've emphasized the importance of testing and optimization, highlighting that automation isn't just about setting and forgetting but about continuous refinement.

Given the advancements in AI and machine learning, how do you see these technologies integrating with MQL5 in the future? Do you think there's a trajectory where traders might not need to code their strategies but instead train AI models within MQL5?

Keep up the excellent work in sharing your expertise and passion for trading automation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit