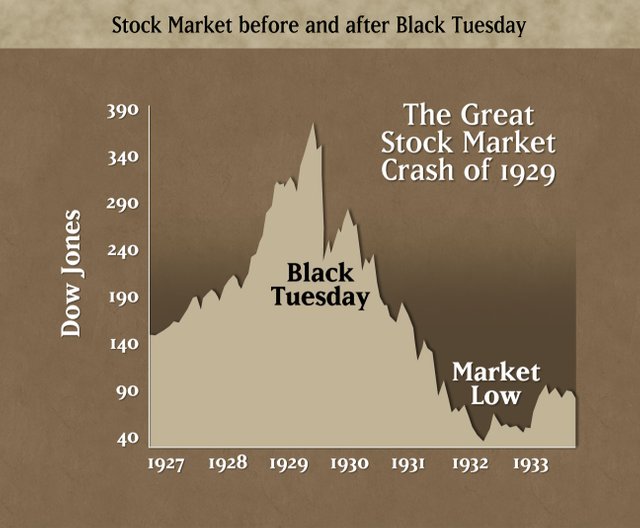

The Stock Market Crash of 1929 commenced the Great Depression. More than four days, share costs fell 25%. It started on October 24, 1929, now known as Black Thursday.

Stock costs fell 11%, at that point recouped, as 12.9 million offers of stock were sold, triple the standard sum. Exchanging on Friday appeared to have returned to ordinary. In any case, the market dropped another 13% on Black Monday, regardless of the investors' endeavours to stop the frenzy. The following day, Black Tuesday, the market fell another 11%.

The loss of trust in Wall Street commenced the Great Depression. The Dow didn't recapture it pre-crash level until November 23, 1954.

-The Market Crash of 2008 was connoted by the 700 point drop in the Dow on September 29, 2008. It was the biggest point drop ever. That was the day the bailout charge flopped in the Senate, inciting far-reaching alarm after the insolvency of Lehman Brothers. Between its pinnacle of on and its base of on March, the Dow lost over half of its esteem. It didn't recover its pre-crash level until.

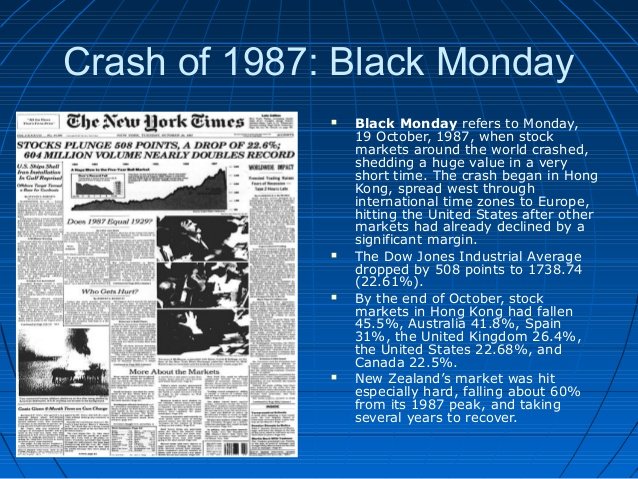

-Black Monday, the crash of 1987, happened on October 19, 1987. The Dow dropped 20.4%, the biggest one-day rate misfortune in securities exchange history. It took two years before the market come back to pre-crash levels. The crash took after a 43% expansion prior that year. Three elements caused it. To begin with, brokers stressed over against takeover enactment travelling through Congress. Second, outside speculators began offering when the Treasury Secretary declared he may give the dollar's esteem a chance to fall. Third, quantitative exchanging programs intensified the misfortunes. Forceful Federal Reserve money related arrangement kept the crash from causing a recession.(Source: Marketwatch, 10 Greatest Market Crashes, October 17, 2012)

-The Dot Com Bubble smashed in March 2000. In 1999, stock costs of cutting edge and PC Companies were driven up by speculators who thought all Tech Companies have ensured cash creators. They didn't understand that corporate benefits were caused by the Y2K terrify. Companies purchased new PC frameworks to ensure their product would comprehend the distinction in the vicinity of 2000 and 1900. Back then, just two date fields were required, not the four required to separate the two centuries. The book Irrational Exuberance ended up plainly popular in light of the fact that it clarified the crowd mindset that made the stock tech rise in 2000.

Good post from you, thanks for sharing this..Hopefully cryptocurrencies will help us in diversification

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

welcome buddy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hope nothing like this is coming soon. I need to prepare myself.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yes sir

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good read @goodaytraders ! Even though no one knows where this is heading, my only advice is not to invest more than you can miss. This will prevent you from being broke but also prevent you for trading emotionally. Emotional traders are the only ones who have a guarantee of losing money.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit