I have invested in 50+ Start-Ups in the past 24 months.

Following will be the lesson’s I’ve learned…and how Steemit qualifies as a great investment opportunity in my book!

This is an amended version of a previous post I have made, to include the investment case for Steemit alongside some rules I follow to eliminate bad Start-up investments, from the sea of opportunities out there.. If you have read this post before, you can scan through to the bold headers...

With access to early stage investments on the rise worldwide, I thought I would share my experience after investing in over 50 start-up in the past 24 months. Crowdfunding and Syndicate based investments have opened up a market that, until 5 years ago, was completely closed to retail investors. Title III Crowdfunding the US is about to shake up the market even further, opening up this type of investment to all citizens (not just high net worth individuals) for the first time.

This has opened up a world of opportunity to retail investors, however it does come at a cost… VERY High Risk. This type of investment should thus, be approached with some trepidation and large amounts of research.

First of all, for anyone that is interested, I thought I would share with you most of my portfolio. If anyone has any questions regarding these investment don’t hesitate to contact me..

My Portfolio

Houseology.com, Curious Brew, Tossed, Vrumi, Den Automation, Oppo Brothers, LandBay, CommuterClub, Tandem, Bank, Beeline Navigation, Pronto, Crowdcube, Redchurch Brewery, Ethos, 1Rebel, Crowdfunder.co.uk, Alquity (Investment Fund Manager), Brewdog, Stockflare.com, MonetaFlex, Pavegen, Workable, Lick (Fro-Yo), Theidleman.com, HUMM Music, Meet Memory, Rateragent.co.uk, Facewatch, Emoov, Clippings.com, Woolandthegang.com, Growing Underground, Street Steam, Gripit (Plaster Board Fixings), Mondo Bank, Simply Cook, Witt Energy, Hybrid Air Vehicle, Rise Art, go Henry, Opun, Zap and Go, Axol Bio Science, NowWeComply, Syndicate Room, GrowthDeck, Dabbl (Stock Broker)..

I have certainly made mistakes on the way, and would pass on some of the investments I have made, if I were offered them today. Following will be some rules that I have developed to filter out the 'bad apples', in an attempt to give myself the best possible shot of success. I believe these rules can be applied boardly to your investment strategy, and give you a quick and easy filter that will leave you with a less overwhelming choice of investments.

Only Invest what you can Afford to Lose

Seems obvious, but many investor don’t realise the level of risk involved in startup investing. I would suggest you never exceed an investment sum you can't afford to totally lose. From research and experience, I would suggest that 7 out of 10 startups will fail in spectacular fashion, and then out of the other 3, who knows... This ties in nicely with the next step.

Steem(it): Without getting Philosophical, time is something Everyone can afford.

Diversification - Don't put all your Eggs in one basket..

I believe this to be key. In order to get the odds of success in your favour, I believe building up a portfolio to minimum of 10 investments is important. This ties in nicely to the $ sum you should be investing in any given investment. Make sure you can carry on investing that sum 10 times over. Spreading your risk like this gives you more of a chance to hit a 'hero' some point..

Steem(it): I spend 1-2hrs per day on Steemit, that leaves me with 22 hours to work with elsewhere. Seems like a reasonably diversified portfolio...

Invest in what you know!

First things first, would you be a customer, or do you know someone who would be? This concept has been coined many times by illustrious investors like Warren Buffet and Peter Lynch. This is an important consideration as, how can you assess a company in great detail if you don’t know anyone that would use their products or services. If your not excited about their offering (or don't know anyone who would be), then your not the right person to invest. Also, many prospective companies offer investor rewards in the form of free product. If you were to be a customer of this company, this is a great way to de-risk an investment (The Brewery investments have given me on average 50% of my investment back in product rewards...).

Steem(it): The more you use it, the more you will know. This is a unique investment because you can pull out at anytime, and you actually gain (in time) from pulling out.

Industry Activity

- Is the industry growing? (Craft Beer)

- Is their larger player buying up smaller players? (Technology - Google - Nest)

- Is the industry ripe for disruption? (Banking)

- Is the regulatory environment good for new players? (Crowdfunding)

Steem(it)

a. Is the industry growing? Yes

b. Is their larger player buying up smaller players? Yes, but doesn't apply

c. Is the industry ripe for disruption? Yes

d. Is the regulatory environment good for new players? Decentralised Blockchain Application are not under any regulation, nor will they ever be...

Could it be a 10 bagger...

This is a very risk form of investment, and thus the potential returns need to be high. I work on the premise that, if I pick my investments well, and go through the process, 1 in 10 will hit their projection and succeed (maybe 2-3 will give me a good return, and the rest will fail for total loss. In turn, I look for a viable case that I can get a 10x return on capital with every company I invest in. Then, If 1 in 10 hit their projections, I have the other 9 for free, and some of these should give me returns..

This company raised at a £10m valuation with a revolutionary product that had only been launched a year earlier into small retail outlets. With a forecast of £8m Net Profit in 3 Year, such a company could sell for 10-15x Net Profit if they were to hit their numbers over the following 3 years. This would be a sale price of £80m-£120m. If you believe this company to have a reasonable chance of hitting it's projects, it passes this test.

Steem(it): More than enough room. Steem currently has around a $300m market cap. Facebook is 1000x larger, and that's before we even talk about the further value Steem will unlock through potentially being a stable currency.

Strong Management is Key!

I would rather invest in good management with a good idea, than bad management with an AMAZING idea. Bad management kill anything in their wake, but great management can make the most average idea succeed. Almost all of the greatest companies in the world were not first to market, they just executed better than everyone else..

Steem(it): @dan and @ned have been very impressive

How big is the market opportunity

Try your utmost to visualise how big the market opportunity is. Products with broad appeal and strong use case will generally have to spend less to reach their potential customers. Talk to friends and family to gauge for who would be a customer, and what critiques they have of the concept.

Steem(it): MASSIVE!!

Look for companies with strong corporate values

Apple success has not been down to innovation or being first, it's been down to the strong corporate values they hold, mostly based around simplicity and access. This is summed up nicely in a TED talk by Simon Sinek which I recommend is worth a view.

http://www.ted.com/talks/simon_sinek_how_great_leaders_inspire_action

Steem(it): Steemit's Blockchain backbone fulfils this and some..

Growth is key

Try to find companies that can demonstrate high levels of growth, with minimal capital investment. Theory being, when they complete a large fundraising round, that money will put 'fuel on the fire'..

Steem(it): User numbers for 4700 to 18,300 in 4 weeks... Yes!!

Cash burn and Runway

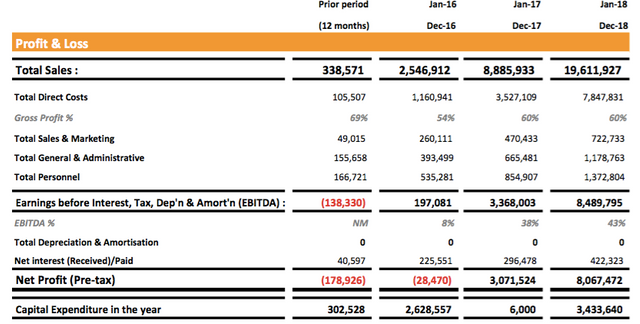

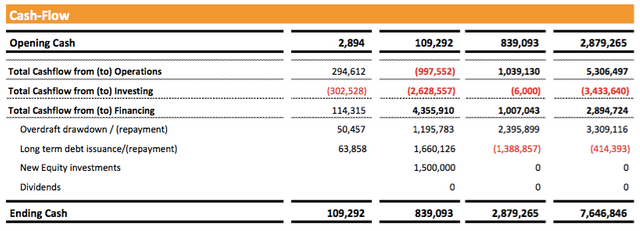

How much Cash is the company currently 'Burning' and how much 'Runway' does the current raise give the company (time between this fundraising and the next). The example I have above shows the last year in the left hand column, moving forward a year into the future as you move to the right. We can see here that the company Cash Burn next year is forecast to be £997,552 from operational activities, and £2,628,557 from investment activity (plant, machinery, assets etc). It also shows that the company will require further financing to the tune of £4,355,910 (which is broken down below) in order to carry on operating at the same level. There is no hard and fast rule here, just judgement as to whether you believe this to be a likely achievement for this company next year...

Steem(it): @ned and @dan have a war chest filled with Steem, The runway looks very long right now...

Don’t worry about the one’s you miss. Don't get EMOTIONAL!!!

FOMO (Fear of missing out) is one of the worst character traits an investor (I certainly have FOMO, but I'm trying my best to combat it). Get comfortable passing on successful companies. If the risk reward doesn't add up, then in the long run you will not make money, however successful a few companies you pass on become.

Steem(it): It's ok to have a bit of FOMO when the investment is free is risk

Summary

I look to satisfy all of these key terms before investing. Although much of this is subjective, it has worked nicely for me to filter down a larger amount of investments on offer, to a more manageable few to delve more deeply into. This also allows me to take emotion of out the equation, which is an important thing to do. If you have any question, I would be happy to chat to anyone interested..

Steem(it) represents a risk free investment with massive upside potential. It's a no brainer. Get involved!! This pictures sums it up just nicely...

As a crypto investor in many projects that came to life I think that the most important thing is diversification, never put your eggs in one basket.

Can I ask you what type of niches you invested most and why ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I invest in crypto like you (currently hold around 10 different currencies). Fin-tech is the niche where I like to invest the most (around 25% of my investments have strong links to this sector). This is because Banks are still using antiquated 1980's system that really hold the whole sector back from development. Anyone building a fin-tech solution from the ground up gets my attention.

Also, I am a Oil Trader by day and really interested in finance, so I feel I have a better grasp of what's going on in Fin-Tech over other sectors..

These 2 are some of my favourites...

https://getmondo.co.uk

https://tandem.co.uk

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Fin-tech does sound like the best niche in this day and age.

Also, as an Oil trader do you think water as a commodity investment might be the next frontier ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, there is definitely something there. The optimist inside me thinks that one of the high profile billionaire philanthropists is going to solve this problem for us... Have you seen this...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haven't, 2 minutes in and it looks promising I will watch.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting video, the guy is a genius.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

great stuff!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good post.. nice pictures and well written..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @quickfingersluc for your kind words.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Based on what you've seen, what would you say is a reasonable growth pattern to expect in the coming year from Steem?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@wanderer Interesting question. One which I have been grappling with myself.

With no advertising budget, much of the marketing will be down to @ned and @dan running the PR side of. So far we we have seen user numbers grow from 4,700 to 18,300 in 4 weeks. We have started to see some pain attached to the hack with the website going off line for periods, which explains the peaks and troughs here

www.steemle.com/charts.php

There is a lot of variables here, but I would expect to slowly make our way towards 50,000 users over the coming 2-3 months.

Hopefully somewhere between hitting 50,000 users and growing towards 100,000 users, we could see some locational critical mass begin to be hit which could really propel the platform forward.

This is all predicated on the price of Steem maintain at lease 50% of it's current price

Also very subjective and complete opinion..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your exclamation in the first paragraph is a sign that your emotions are at play in your analysis. I'm not agreeing or disagreeing with your result.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@vam I don't worry so much about emotions when they don't cost me anything ;) But fair point..

I'm advocating spending time and earning Steem, not buying it...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article! I'm going to make a video about the upward potential of Steemit!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit