Let’s get started…..

The Best Bitcoin Trading Strategy –

(Rules for a Buy Trade)

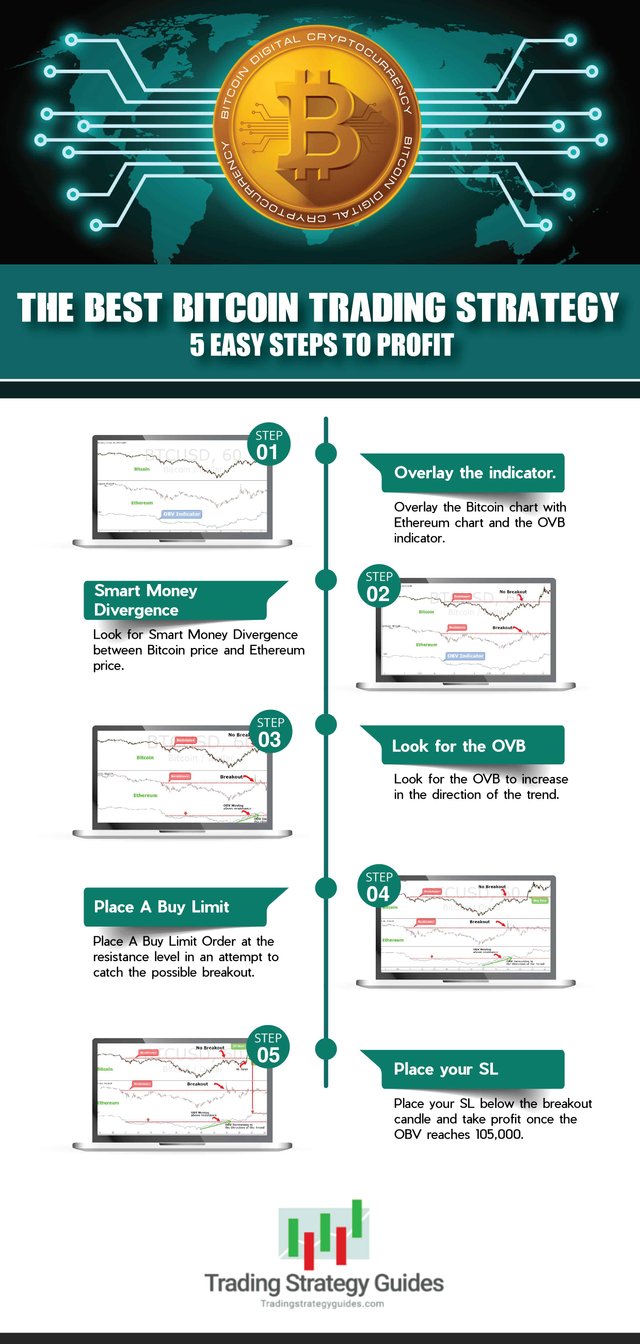

Step #1: Overlay the Bitcoin chart with Ethereum chart and the OVB indicator.

Your chart setup should basically have 3 windows, one for the Bitcoin chart, the second one for the Ethereum chart and the last but not least one window for the OVB indicator.

If you followed our cryptocurrency trading strategy guidelines your chart should look the same as in the figure above. For now, all should be good, so it’s time to move forward to the next step of our best Bitcoin trading strategy.

Step #2: Look for Smart Money Divergence between Bitcoin price and Ethereum price.

What do we mean by this?

Simply put it, we are going to look after price divergence between Bitcoin price and Ethereum. Smart money divergence happens when one cryptocurrency fails to confirm the action of the other cryptocurrency.

For example, if Ethereum price breaks above an important resistance or a swing high and Bitcoin fails to do the same, we have smart money divergence. It means that one of the two cryptocurrencies is “lying.” This is the main reason why we have called this cryptocurrency trading strategy and Ethereum trading strategy as well.

If you’re still struggling to identify support and resistance we’ve got your back, simply read our guide on this topic here: Support and Resistance Zones – Road to Successful Trading.

In the above figure, we can notice that Bitcoin price fails to break above resistance while Ethereum price broke above and made a new high which is the first sign that the best Bitcoin trading strategy is about to signal a trade.

The reason why the smart money divergence concept works are that the cryptocurrency market as a whole should move in the same direction when we’re in a trend. The same principles have been true for all the other major asset classes for decades and it’s true for the cryptocurrency trading strategy as well.

Before buying we need confirmation from the OBV indicator, which brings us to the next step of the best Bitcoin trading strategy.

Step #3: Look for the OVB to increase in the direction of the trend.

If Bitcoin is lagging behind Ethereum price it means that sooner or later the Bitcoin should follow Ethereum and break above resistance.

But, how do we know that?

Simply, the OBV is a remarkable technical indicator that can show us if the real money is really buying Bitcoin or quite the contrary they are selling. What we want to see when Bitcoin is failing to break above a resistance level or a swing high and the Ethereum already broke is for the OBV to not only increase in the direction of the trend but to also move beyond the level it was when Bitcoin was trading previously at this resistance level (see figure below). Here is how to identify the right swing to boost your profit.

Now, all it remains for us to do is to place our buy limit order, which brings us to the next step of the best Bitcoin trading strategy.

Step #4: Place A Buy Limit Order at the resistance level in an attempt to catch the possible breakout.

Once the OBV indicator gives us the green signal all we have to do is to place a buy limit order at the resistance level in anticipation of the possible breakout.

It’s no surprise to see this trade getting triggered and for the Bitcoin price to break higher as expected after all we told you the OBV is an amazing indicator.

Now, all we need to establish is where to place our protective stop loss and when to take profits for the best Bitcoin trading strategy.

Step #5: Place your SL below the breakout candle and take profit once the OBV reaches 105,000.

Placing the stop loss below the breakout candle is a smart way to trade. We’ve written more about the reasons for hiding your SL above/below the breakout candle in our most recent article here: Breakout Trading Strategy Used by Professional Traders.

When it comes to our take profit usually an OBV reading above 105,000 is an extreme reading that signals at least a pause in the trend which is why we want to take profits.

Note** The above was an example of a buy trade… Use the same rules – but in reverse – for a sell trade. In the figure below, you can see an actual SELL trade example, using the best Bitcoin trading strategy.

Conclusion

Maybe one day our fiat money system will go under and be completely replaced by cryptocurrencies. We’re living in a digitalized world and the possibility of Bitcoin or any other major cryptocurrencies to replace the way we pay for the goods and services is not beyond the realms of possibility. However, as long as there are still profits to be made from Forex currency trading we encourage you to read our receipt for Forex trading success: How to Make Money Trading – 2 Keys to Success.

We hope that The Best Bitcoin Trading Strategy – has shed some light on how you can use the same technical analysis tools that you use for trading the Forex currency market to now trade the cryptocurrencies.

this content source - https://tradingstrategyguides.com/best-bitcoin-trading-strategy/

thank for steemit.com

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://tradingstrategyguides.com/best-bitcoin-trading-strategy/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sir, I have already given a link to something similar

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

reply me plz

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

reply

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit