Have you watched the price of Steem fall and wondered how? Often referred to the "Invisible Hand", market movements usually can be traced back to one incident, one decision in time. We are at such a Steem Black Swan event.

The market is being pushed down by the user @steemit. {I know nothing of this account. I do not know if it is connected to SteemIt.com, but I doubt it. I could be wrong - please correct me} The Uber-Whale of all the whales is selling. I merely present what I see in the various sites that make this fact clear. As to why, there can be speculation. I prefer to think this action is part of a plan to better re-distribute Steem to a wider user base. Be informed.

From the site http://SteemDown.com, you can see that the largest account of Steem currently has 3M Steem and is in power down mode. That will be 600K coins a day of power down (potentially) coming to market.

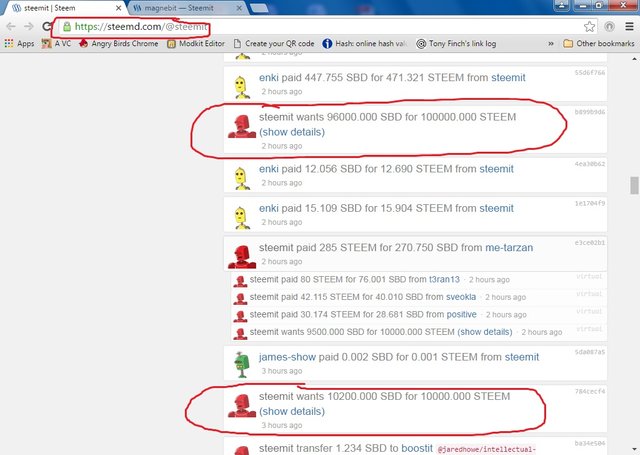

But, how can you be sure they are selling? .......Look at the internal market.

These bids are in the internal market.

As I have stated, @steemit could change direction at any time. If you presume that this is a period of power down, how low can the price go with millions of Steem hitting the market each week? My uneducated guess is pennies a Steem. This would equate to hundreds of thousands of $ per week.

I, for one, am hoping for this as an opportunity to enter the market, though it would be painful in short term for the recent money that has entered. Sorry to say, short term looks bad as only one person can do this havoc.

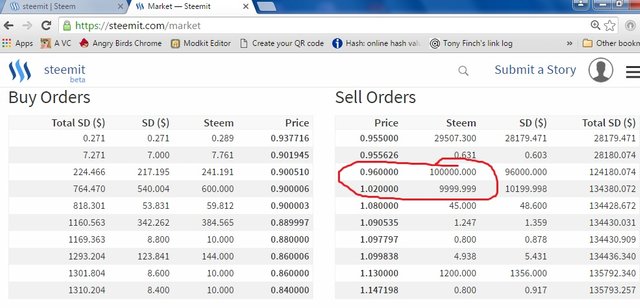

All orders are placed at or above price on coin market cap. These orders are helping to maintain the steem dollar peg.

Proceeds of these sales are kept as steem dollars which keeps value in the platform while helping to distribute steem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It looks pretty sketchy to have downvoted the top post and be the only one who does it. It gave you an opportunity to address everyone's concerns, not that you did a very good job.

The post that you downvoted for no reason that anyone can see besides sketchiness also made the observation that steemit is flooding the market with hundreds of thousands of steem, killing the steem price.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@delicious and the correct answer to that is to buy and hold SBD since that is the literal equivalent of opening a short position on steem. What @dantheman is doing is exactly the correct move, it makes it easier for others to acquire steem and gain a voice and influence while the platform is still nascent.

@dantheman is in the unfortunate position of damned if he does and damned if he doesn't. However the sooner this is over with, the sooner the healing can begin. It's catharsis.

BTW @dantheman I'm a bit pissed I converted $100 USD worth of SBD a week ago and got back about $60 USD worth of steem today. Point of SBD is I'm supposed to be able to get about $1.00 worth of steem and all I need to do is have patience and wait a week. $0.60 does not qualify as "about". I hold SBD so I'm not assuming bagholder risk on steem. Can you please look into fixing it so that we use the current market price or the 24hr avg price? Otherwise the only smart move is to hold something else while we wait out the inflation if there is any chance we will need our money within a few weeks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@delicious isn't complaining about the fact @steemit is selling STEEM, but the fact @dantheman downvoted the post. He is right that this looks really bad. The guy just reported the selling without interpreting it! In one hand Dan explains that it's all good and there is nothing wrong, and on the other hand he downvotes the post to dig the matter under the rug and doesn't even explain his downvote. I had no intention to upvote that post, but given the deliberate attempt to downplay the matter, Streisand it is.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the explanation. For a newbie who hasn't even read a white paper yet it is confusing. Shelled out some $ into steem, because I believe it is going to become a new stronger non hijacked reddit we need so much in order fight against corruption these days.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@williambanks. With conversion you get (about) $1 expected value of STEEM. You do not get literally $1 worth of STEEM, since volatility during the conversion period can work in your favor or against you (I've literally experienced both so I can assure you it works both ways). I think maybe that needs to be communicated better (though mostly my opinion is that the conversion option is unsuitable for most users and should be removed from prominent placement in the UI and left to experts).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think the point is that if it's a 7-day moving average against STEEM like it is now it will be systemically undervalued due to built in STEEM inflation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@nikolai Yes but only by a few percent (will be more like 1% in the future). That can be accounted for by slightly adjusting the feed rate. I have already been aware of this and would be suggesting to witnesses to make that adjustment if I thought it were relevant. At the current time SBD has been -25% and +50% from par, so these small tracker errors aren't that important.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Dan. I have a few questions. I am shocked that an account exist with 50% of the total steem supply. I always believed that the intention of steemit was to be decentralized. Could you help elaborate on these questions?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is essentially the not-yet-distributed coins that are being sold (to raise development funds as well as distribution) as well as given away to new users (for user recruitment and distribution). Steemit will say that they got them from mining, which is technically accurate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Smooth. I really appreciate your response. So technically the owners of the steemit account are the miners? And the decision makers are Ned and Dan + a third person? Or is there no owner of the steemit account and Ned and Dan only uses the account as to serve the development and growth of the whole steemit platform and community?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Steemit Inc. is the business that developed the Steem code, launched the blockchain, and owns and operates the steemit.com web site. Steemit Inc. owns the 'steemit' account, which was created and filled by mining. Dan and Ned are the founders of Steemit Inc. and I don't believe anything else is publicly known about the ownership of Steemit Inc. other than that they had some private investment before the launch.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello smooth. I received several answers fro this question. But your information is by far the best reply. I think that this is important information. It changes the fundamentals for trading steem tokens. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mayneed a hardfork to resolve this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's both really. Supporting SBD while also hurting the price of STEEM. It may be above the current price but a huge sell order slightly above market is still going to weigh on the price. I don't think that is really questionable.

That said, it is and always has been the advertised plan of 'steemit' to sell a large amount (approximately 25% of the total holdings of that account; approximately 20 million USD worth!) of STEEM, which indeed redistributes it to buyers, so no one should be surprised by any of this really. I might disagree about strategy as to how fast or when to sell, but that is not based on anything objective at all. Steemit's strategy here is certainly defensible.

The original post was mostly a reasonable analysis, pretty balanced in pointing out the redistribution effect, and original work on a topic of obvious interest that no one else has published afaik.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

(I deleted my own comment)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The Secrets Steemit's Whales Don't Want You To Know!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

was looking for a way to downvote this, unable to remove upvote after accidentally...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is my biggest problem with the "whales powering down" theory of the price slide.

With so much money in SP, it would be absurdly self destructive of them to not put asks in above the market price.

That is to say, its not like theyre just dumping their steem on the exchanges priced to sell immediately, no matter how far into the order book they have to push.

I think its much more likely for medium and small powerdowns to be doing this. Especially if theyre coming from non-market-savvy traders.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Shouldn't the peg be maintained by the mechanics listed in the white paper?

The conversion function is clearly inadequate, especially when there is heavy sell pressure and limited demand. If the price of STEEM is almost always going to decline, the conversion function is only going to become viable if SBD is heavily undervalued by the market... This is a condition that hasn't been met, since the price of STEEM is dropping at a rate which exceeds the market's discount on SBD.

The other mechanism is the interest rate. The interest rate has literally never changed. I understand that this is up to the witnesses, but they seem to have little interest in increasing the interest rate, despite market conditions demanding it according to the white paper.

"The peg" isn't an actual thing if it requires market transactions like this. Then it's just a target price enforced by the most wealthy and influential actors...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Actually the mechanism in the white paper relies almost entirely on market participants to engage in trading in order to maintain a peg. (Steemit counts as a market participant, in fact currently they are almost by definition the largest market participant.) There is nothing in the white paper or in the software that directly trades on exchanges at all, so the only way exchange prices end up being close to $1 is if market participants trade in a manner to make that so.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, yes... That is true. Ultimately market participants trading SBD at around $1 is how the peg manifests. However, the white paper lays out incentives that are designed to influence the decision making of market participants and encourage them to price SBD near the target.

The most well known of those is the conversion. That provides significant risk of exploitation to traders pricing SBD too low through arbitrage. It influences the supply side, as it should prevent traders from being willing to sell SBD at heavy discounts... Furthermore, if SBD holders are willing to sell well below $1, buyers can confidently purchase it knowing that within a reasonable time frame they can attain nearly a full $1 of value (or even in an unfavorable market, more value than the seller was willing to take). That works on the demand side, by enticing buyers.

The conversion also can function to bolster price by decreasing the supply... Literally by removing the quantity of SBD in existence... but the same effect would be achieved by simply taking them off the market and hoarding them, and that seems like a much better option given the other mechanism designed to persuade traders to price Steem Dollars near $1.

That is the interest rate, which defaults to 10%. That is a very healthy return by almost any standards, given that the risk is essentially limited to catastrophic failure of the economic system. And in that case all this is a moot point, anyway.

Unlike Steem and Steem Power interest, Steem Dollar interest is not intended to debase the currency. It is designed to entice people to hold SBD. If everything is working as planned, it is reasonable to assume that at some point in the future Steem Dollars will be close to par, even if they are not currently... So it becomes much more attractive to wait and collect the passive income than take the loss by selling.

The interest rate should be responsive to market conditions, and it should be raised if the price of SBD remains depressed. That will further encourage holding instead of discounted selling. I'm not sure whether the strategy of raising the interest rate has been consciously abandoned, but I've seen little indication that it will be implemented. I'm not sure whether a 10% discount warrants such action, anyway.

But those are mechanisms designed to influence the decision making of market participants. Those mechanisms are the peg. Directly placing market orders... now that is something entirely different. That's market manipulation, which I can't imagine would be necessary or desirable if the peg as described in the white paper was functioning.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't know if the white paper says so but it is clear to me and Dan has also said that interest rate changes are a long-term factor and don't really have much influence on short term supply and demand. Given that SBD has been between -25% and +50% of par in the relatively recent past I don't think much can said about what the interest rate should be. That's just, like, my opinion of course.

As I said steemit is a market participant. I don't see how that is questionable. If they were push the price away from par, you would have a point about it being "manipulation", but they are doing exactly what rational market participants would do if they find SBD selling at a discount and believe that the pegging mechanism works over time: They are buying it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the response Dan. Can you indicate if this is ongoing feature of the market, or is this for immediate funding needs (temporary)?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am here for long term:

https://steemit.com/steemit/@steempowerwhale/who-is-powering-up-or-am-i-alone-the-steemit-power-up-club

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

But what usually happens with huge sell walls is everyone else tries to sell lower. When everyone is trying to race to sell lower the price crashes fast.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I was under the impression SBD wouldn't be tradeable on the exchanges. Only STEEM.

But its on Bittrex. And I can transfer SBD straight there.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Where did you get that impression? It is a liquid token; any exchange can trade it if they want.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

must've misunderstood the basics when I first signed up

I though you absolutely NEEDED to transfer SBD to STEEM before transferring to an exchange.

I think it came from all the mis info being tossed around in the World Crypto Network's talks with Ton Vays. NOBODY seemed to understand, or want to, anything about the process... just bash it constantly.

Really turned me off.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

so is the whitepaper for steem or steemit?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

But why did you flag it?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Flag = downvote right? Because I found the content offensive.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think @danthenan has given a stroooong hint of this dumping activity earlier last week in his posts. The sooner the clean out begins, the better. For the brave, this is a good buying opportunity.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That move is expected and In my opinion desired for the following reasons:

We are still in beta and everyone knows that the power holders(aka "whales) are few and hold most of the steem, if they "hold" on it, they will continue to be the most powerful ones in the platform so powering down is very nice of them as they are "giving up" on their influence to leave space for others to take the spot, making the system more fair.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How does losing our indigenous whales and replacing them with new outsider whales make the system more fair?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

'steemit' is not really a whale, it is the stash of coins that Steemit Inc. has that is earmarked for selling (just like they are doing) and being given away to new users.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm not implying replacement, I'm implying on distributing the power more evenly, If our current whales don't power down, they will stay the biggest investors forever and scare off any new investor, since he'll have to invest Millions to gain influence. Currently we have, 33 people with very high power, wouldn't it be better if we had say 100? There are 33 people that distribute the most rewards... to a lot of users...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm new here and may be reading this wrong, but it just looks like one phase of a multi-phase plan to me. The short-term downward pressure on token value seems likely to ease off once enough steem has been distributed by this market-supported SD stabilization mechanism. Ideally, the token price will then settle down at whatever level of support it finds, and begin to slowly climb from there. This is what I'm betting on, in any case.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Suppressing the price is by far the most effective way to better re-distribute Steem. No-one will consider investing to become a whale if it costs them half a million dollars. Now if it costs them ten times cheaper, that's a more reasonable deal.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's absolutely the case... and as I have posted, a decreased steem price will lead to higher SP rewards from posting and commenting. People just need to sit back and relax, because everything is going to be ok.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really enjoy the replies to this perspective you presented, loads of very informative delicacies. Namaste :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bring that 1 penny = 1 steem power ill take that thank you! lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You should strongly consider editing this post, since it's based on comprehensive misunderstandings of how Steem works. When STEEM are "sold" on the internal market, it does not put downward pressure on the price of STEEM. It merely adjusts the exchange rate between SBD and STEEM, which at the moment is out of whack. Please do some very careful thinking about how this all works.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I disagree with you there. Markets are interconnected. When you sell STEEM, it doesn't really matter whether you are selling it for SBD, USD, BTC, or bartering it for camel feet. Selling is selling, and it drives the price down. Demand to buy and hold an asset is what drives the price of the asset up.

BTW, pre-July 4, Dan made the argument that people buying STEEM on the internal market in exchange for SBD would drive the price of STEEM up (I partially agreed). You can't have it both ways.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, as I've thought about this more I'm beginning to see that. In fact, those sell walls on the internal market are partially maintaining the dollar peg of SBD. If the sell walls are high enough, then the STEEM price partially becomes an indicator of how many people are trying to get out of SBD.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it's not selling...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post probably caused the removal of that low 100,000 steem sell order. Good job!

Yes, I have seen that account force the price down multiple times too. If you look in your market price image, they chose to push the price down to .96 instead of selling at 1.02. This is a $6000 difference. The actual sell order was placed below that at .95 and was for 50,000, it was slowly bought up overnight. So they threw away at least $3000 on that trade, and could have added .10/on that with no change in sales.

I have seen that account do the same thing for the last 3 weeks at each big price dump, they pick a price .10 to .20 cents lower than market rate and dump 10-20,000. This lowers the prices on the 3 exchanges until the big sell is eaten away. It seems like throwing money away on purpose, when each time the dumper could take an easy .05 -.10 per steem without losing a single sale.

If that wasn't an official account I would swear they are driving the price down on purpose. I would like to hear an explanation for it too, because it has driven the price under a dollar and drawn an awful stock history graph that does not inspire confidence.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't think they are driving the price down "on purpose". They are selling STEEM as always stated they would (both in order to raise funds for development and to redistribute stake to buyers), and in order to actually sell you have to offer at a realistic price where market participants will actually buy it. Offering well above market accomplishes nothing except putting a big wall up "for show".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Did you type that with a straight face?

Look at the order book, they were only 50 shares away from 1.12 and .17 cents more profit on 50,000 shares. The 3 big orders are all steemit sells, and they purposely chose .95, instead of 1.12, wasting $8500 and forcing the price down in the process. This is not profit seeking behavior. If you are right and it wasn't "on purpose", then it should be noted that whoever is controlling that account is wasting thousands of dollars.

These big market actions send messages to investors, just like when a CEO sells stock in the company he is running... When people see an attempted $150,000 dump by the CEO or owners during a 50% drop in price, it does not inspire confidence and makes the situation worse.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your argument is that someone is going to just show up and pay 1.12 for an asset that was trading below 0.95, as a gift so that steemit can make an extra 0.17? I don't buy it. I saw the walls, which were sitting there for quite a while (hours and hours). That observation alone means they were priced above the current (real) market price, not below it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are obviously just going to defend anything that account does, be it manipulative or stupidly wasteful. Have fun with that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"I, for one, am hoping for this as an opportunity to enter the market, though it would be painful in short term for the recent money that has entered. Sorry to say, short term looks bad as only one person can do this havoc."

Be careful, considering most of the whales are powering down steem price could very well go far lower and it could stay there forever. There is competition entering the market and things aren't looking that good for steem right now. As a regular user, I'm not that impressed right now and am feeling a bit fool, let's just hope in few years time I don't feel stupid. Can't blame whales, who wouldn't want to own a yacth or two when given the opportunity. Powering down will continue as long as there is money to pull out and user adoption stays low (profits now feel bigger than possible profits in future).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been linked to from another place on Steem.

Learn more about linkback bot v0.3

Upvote if you want the bot to continue posting linkbacks for your posts. Flag if otherwise. Built by @ontofractal

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for covering my tool #steemdown! Check out the original post for some discussion https://steemit.com/steem/@bitcoiner/steemdown-com-which-whales-are-powering-down

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @magnebit.. account @steemit its not a person (whale), its steemit account for support new users. But if you take look curation rewards of this acc u ill see that he never upvote. when u make new acc this acc steemit ill send for u 3 steem power for free.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You may be correct about the source of the account. https://steemit.com/meta/@steemit/firstpost

Now, what is the liquidation plan that is going on?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, @steemit is not a "user," it's the actual site itself. I dont know how ill be looks steemit in like 1 month, but what i know something bigger its coming in 2-3 weeks..;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I guess its Yours.Network

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No its not my work its project of my friend and team from steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If its not yours, not akasha, and can't be ethereal, I say synereo.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Steem team make synero? I dont think so. What i mean ill be new website on same block chain like steemit. Ill be connect with Steemit together. Article about that ill relise in 7-10 days and website ill be open to public in 14 days.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

akasha ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No its not akasha @djm34.. I cant say what is that now, Sorry

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting analysis...would be great to see how it evolve over time. Yep steemit can go to pennies and it will be great buy buy buy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hmm... if there is a big selling trend from steemit, we know what it means, and it's definitely not buying...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is interesting, but also surprising that one account can make so much difference! That is what alarms me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Satoshi owns a million bitcoins. The problem is transparency of liquidation plan. I hope steemit comes forth and give guidance to the community.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That "one account", last I checked owned more than 50% of all the SP in existence. Given that they have been selling it is slightly smaller now but not a whole lot smaller.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemit is not a "user," it's the actual site itself. This account give free 3SP to every new user.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes I agree. I guess that was not clear enough in my comment, which was trying to make the point that this is not just any "one account" but a special account. You made that point better.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemit is not a "user," it's the actual site itself. This account give free 3SP to every new user.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Steem its not profitable at all, and its worst for minion like me.

Steeemit for minions its a simple social network more.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Defenition of financial pyramid:

"A pyramid scheme is a business model that recruits members via a promise of payments or services for enrolling others into the scheme, rather than supplying investments or sale of products or services. As recruiting multiplies, recruiting becomes quickly impossible, and most members are unable to profit; as such, pyramid schemes are unsustainable and often illegal."

What it reminds me?)))

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

at what point have you been told you need to recruit people in order to earn money here? the site offers investments and a service (in much the same way as you tube does, by the way the vast majority of people posting to you tube are making very little as you need roughly 1000 veiws to make $1 )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

And you can't make even that much if you are in some of the countries. Right now you can't make money on youtube if you are in Russia. Perhaps some day it will change, but that day is yet to come.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So far there is a big difference between youtube and steemit payments: youtube pays from successful sale of advertizing, steemit payments are provided only with sales of steem themselves. It is a pyramid scheme.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

And so is every other crypto-currency out there. If you reach this conclusion regarding Steem, please be consistent and apply it to Bitcoin & Ethereum as well - all of them cover their expenses by "selling themselves".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Such schemes don't involve redistribution schemes that are based on the corporate shareholder model, as it is in Steem. The establishment and process of reaching the release candidate status will take money and time, and so naturally, this is a cost that investors will be bearing as part of their investment. The idea is that after the development phase is complete, from then on, the developers take a lighter touch to the system, and let it develop exactly how the users make it develop. There is nothing stopping individuals or groups forming to fund systems that interact with and add value to Steem, in fact, that's why I wrote this:

https://steemit.com/ascensionteam/@l0k1/steem-is-not-a-blogging-platform-steem-is-an-ad-hoc-public-and-transparent-corporation-let-me-explain

Steem is just the central component of an ecosystem that it aims to foster the development of. It is an accounting system and an investment system and a means for communication and marketing. Once the development phase is complete, this kind of activity will be far more important to the Steemosphere, and Steem itself will fade into the background as an infrastructure, not the core enterprise itself.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ah steemit account, the elephant in the room!

PS: @dantheman it’s really low to downvote this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is yet another example how fucked up the downvoting feature is.

If @dantheman has downvoted it because he thought this post did not deserve a high payout - I fully agree with this. This post belongs to a FAQ category and it just asks a legit question (while other people do the explaining part). Certainly not worth thousands of dollars.

However, if @dantheman has downvoted it because he wanted to hide the post and hurt @magnebit's reputation - I agree, that's highly inappropriate.

But I guess we will never know which one was the case here.

I'm very curious how much time it will take for the devs/founders to realize the damage being done by the current ambiguity of the downvote option.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanx for sharing your thoughts. I was wondering why the market is tumbling further down for reasons we don't know yet and can only speculate. I do hope there is a next explanation on steemit blog soon about what's going on with Steem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The market is tumbling because the bubble is deflating. NOT because @steemit is purchasing SBD on the internal market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This sell off might be for the best. I think the reduced price could be good for redistribution and bringing in smaller investors and has given @dantheman all the funding he needs to bring steemit to the next level.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's on the internal market; hence, it is not a sell-off. They're buying SBD.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Uhh-ohh magnebit...You are on the "Blacklist" now with that downvote! Lol:)

https://steemit.com/blacklist/@steemit-life/do-steemit-whales-keep-a-blacklist

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Its going more down .

https://steemit.com/steem/@peace9/steem-going-down-any-way-to-safe-number-7-its-scary

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/steemit/@anxiouspublic/steemit-inc-should-explain-what-they-are-doing-with-the-money-on-the-accounts-belonging-to-them

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"STEEM is constantly increasing in supply by 100% per year due to non-SMD incentives. Someone who holds STEEM without converting it to SP is diluted by approximately 0.19%

per day." (Page 8)

"Because Steem wants to encourage long-term growth, it is hardwired to allocate 9 STEEM to Steem Power (SP) stakeholders for every 1 STEEM it creates to fund growth through contribution incentives." (Page 9)

"There are two items a community can offer to attract capital: debt and ownership. Those who buy ownership profit when the community grows but lose if the community shrinks.

Those who buy debt are guaranteed a certain amount of interest but do not get to participate in any profits realized by the growth of the community." (Page 8)

The platform literally doubles the STEEM supply every year out of thin air and which forces people to either dive into SP which is rewarded with STEEM (air) in a 9:1 ratio vs STEEM holders or cash out.

They are basically admitting in the whitepaper that the system is designed to lock people into rampant asset speculation. "community grows" implies a future revenue stream where as the only revenue stream anyone can think about is their own into SP. Right now all I see is market decap ever since hype train after generous donation aka ponzi seed. Dan and Ned's pre-mined pre-allocated pre-(what ever the fuck you want) stake (@steemit) is powering down at a princely sum of $359,002.77 per week. :P

http://steemdown.com/

I'm just going to go ahead and lock it in Eddie, option a) Ponzi scheme and hats off to you Ned and Dan, it's not a bad one.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit