Most credit cards have rewards programs for purchases that give you points in your own stores or for use in shops or services, miles to exchange for trips and even cash.

Next, we explain what is the difference between cashback and reward points on credit cards. Although they seem the same thing and even the banks use these names interchangeably, they are not the same.

Compare the rewards of more than 180 credit cards for free. What is cashback on credit cards? The cashback or return of cash on your credit cards is when the financial institution "deposits" money in your credit card or on your rewards card, which you can withdraw and use in whatever you want, even to lower the amount of your debt

What are the reward points on credit cards? The reward points systems on credit cards return a certain percentage of your purchases in the form of points or kilometers, in the case of airline credit cards, for use in affiliated stores, catalogs of the same institutions financial or airlines.

How to choose a credit card per rewards program?

The rewards of credit cards are really useful when: Your purchases with the card are "natural". This means that you do not spend only to get points or to take advantage of promotions, but because you acquire goods or services that you really need. One way to generate more reward points in a "natural" way is to direct your payments.

The key is to pay on time, as if you were covering it with cash or depositing your credit card with the money before the charges, so you do not spend your limit and do not get used to 'must' services. The card offers you more rewards for purchases in places that go with your lifestyle. If you are going to choose the credit card according to the rewards, we recommend you check your shopping habits and how many points each plastic gives you for it; For example, if you are used to traveling, look for a miles card; If you spend a lot on entertainment, look for a card that gives you 2 × 1 at the cinema or offers discounts for events. Before choosing a credit card,

Please compare your options!!!.

A young man of twenty-five named Thomas Harrison has decided to build a credit card called Blockrize, which offers a line of credit and pays users 1% in cryptocurrency rewards for each purchase. Harrison was once the chief operating officer of the now-defunct Whatsgoodly application that offered different types of online surveys. According to Harrison in an interview with the financial news outlet Market Watch, the card already has more than 2,000 people on the waiting list.

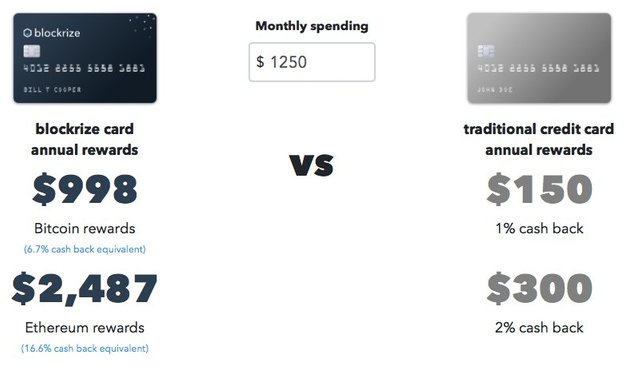

The Blockrize website details that traditional rewards cards with an average spend of $ 1,250 USD per month can earn $ 150-300 'cash back'. If someone spent the same amount in 2017 with the crypto rewards card, they would have earned $ 998 in BTC or $ 2,487 in ETH.