Each day, for the next week, I will publish an article as the successor to today's article to give you an overview of

- Part 1) An Introduction the the Current Western Financial System and It's Major Caveats

- Part 2) What Problem Digital Currency Solves and How It Works

- Part 3) How STEEM Works and It's Potential as an Alternative Coin

- Part 4) How to Purchase and Secure Your Digital Currency of Choice

- Part 5) How to Invest in STEEM for the Long-Term and Major Takeaways

IMPORTANT INFORMATION

I am not a financial adviser and you should NOT trust what I am telling you in these articles. Nevertheless, I will share the things I understand. I am not qualified to share this information, but I am for the sake of others becoming more aware of what is going on and what others say, having a new perspective and, most importantly, researching what in the world you are investing in.

It honestly bothers me that people like e.g. Joe Blow, who runs the cash register at the local Walmart, has now overnight become the leading expert and financial adviser on digital currency and people trust him! In other words, people who have no idea what they are talking about and aren't experts are acting like experts and giving financial advice. Again, be aware of what is going on and what others say, have a new perspective and, most importantly, research what in the world you are investing in.

Let's Begin! Definitions and Summary

First things first, in order to understand how STEEM operates, one must be able to understand cryptocurrency. I personally don't like using the term "crypto" because it sounds, by connotation, mysterious and illegal. I would like to get rid of the mysteriousness in these article series and make it clear on how digital currency works. For the sake of these series, I will refer to crypto / digital currency as distributed ledger systems (DLS for short). And in order to understand the reason behind DLS, one must first address the problem they are solving by deconstructing the current, centralized financial system and what its caveats are.

Today's Article: The Errors in Today's Centralized Financial Economy

Theme: Most banks are becoming more and more unstable by the day.

In this part, I will discuss and address 7 main pitfalls of the traditional centralized western banking model. If you know more, please address them in the comments section of this article below. Unless you start your own bank, like a friend of mine is, or have your currency stored off-shore in secure banks in other countries, your financial system is most likely is guilty of the following. (Source: https://www.investopedia.com/university/thefed/fed1.asp)

1) Quantitative Easing and Inflation

The Federal Reserve prints as much money as they need to buy bonds from financial institutions, loan money electronically to other countries and other activities. This can reduce the value of the currency, because more of it exists. (Source: http://www.bbc.com/news/business-15198789) For a stupidly genius example just to prove my point, in a classroom of 30 5-year-olds, there are only 3 of the most amazing candy suckers left. Suddenly, the value of the suckers increases, because there is a limited supply. Kids will trade other sweets and valuables for obtaining one of the amazing suckers. Suddenly, a crazy teacher arrives with a dump truck of suckers and dumps them on the kids. Sure, they will be excited in this example that candy's floating everywhere, but will they trade their valuables for it? Will there be value in 1 sucker? No. The suckers have become worthless and excluding the s***s and giggles arising from the situation, the suckers literally suck. Now expand this concept outside of the classroom to the entire USA and replace the suckers with money.

The lack of worth of the USD began 40 years ago, when President Nixon took the USD off of the Gold Standard. The value of the USD, the world's backing currency, began to loose it's value. The gold standard literally fixed a infinite supply to a finite amount of resources (gold) that would always be wanted to prevent inflation. (Source: https://www.forbes.com/sites/charleskadlec/2011/08/15/nixons-colossal-monetary-error-the-verdict-40-years-later/1/)

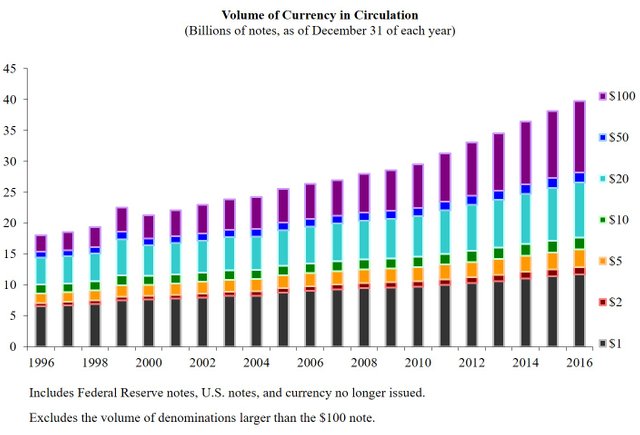

Here is a summary, by year, of printed currency that has been reported and printed since 2013 (Source: https://www.federalreserve.gov/paymentsystems/coin_data.htm)

Summary: The Centralized Financial System can effect the value of currency at will.

2) Hidden Fees

Behind each transaction are fees. And behind each fee is a middle-man or receiver of the fees. Since I am not knowledgeable of the exact middle-men, I quote the information from Amad, a knowledgeable individual found at MerchantMaverick below. The following info is not mine and I accredit all of the information to belong to them with a link back to their website. (Source: https://www.merchantmaverick.com/the-complete-guide-to-credit-card-processing-rates-and-fees/)

Some middle-men transaction fees include, and I quote:

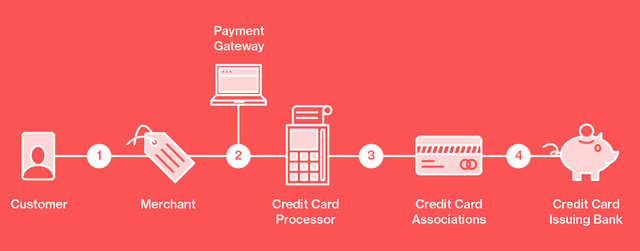

Credit Card Associations: These are obviously the companies that create the credit cards, like Visa, MasterCard, and American Express. These are the guys that set the rules.

Credit Card Issuing Banks: These are the financial institutions that issue the credit cards, like Chase, Citi, and Wells Fargo. Some card associations take on the role of a bank as well, developing and issuing their own cards. Examples include Discover and American Express.

Credit Card Processors: Also known as Acquiring Banks aka Acquirers, these institutions act as messengers between merchants and credit card associations. They pass batch information and authorization requests along so that merchants can complete transactions in their businesses. A merchant may encounter several acquirers for one transaction – one that creates monthly statements, one that handles technical support, and one that issues money to a bank account.

Merchant Account Providers: These are companies that manage credit card processing (e.g. sales, support, etc…), usually through the help of an acquirer. They could be financial institutions, independent sales organizations, or double-duty acquirers, depending on the situation.

Payment Gateways: These are special portals that route transactions to an acquirer, usually in the case of an online shopping cart.

(Here is a graphic to illustrate these charges)

To preserve the length of this article, I will only give the names of the fees associates in a credit card swipe. You can read exactly what they are at MerchantMavericks website. So the next time you purchase a coke, think about the fees associated with your purchase.

Transactional Fee, Flat Fee, Incidental Fee, Wholesale Fee, Markup Fee,Interchange Reimbursement Fees and Assessments, Flat Fee, Terminal Fee, Payment Gateway Fees, PCI Fees, Annual Fees, Monthly Fees, Monthly Minimum Fees, Statement Fees, IRS Report Fees, Online Reporting, Network Fees, Incidental Fees, Address Verification Service (AVS), Voice Authorization Fee (VAF), Retrieval Request Fee, Chargeback Fee, Batch Fee, NSF Fee.

That is 24 Fees in Total.

Summary: Each transaction has hidden fees that you pay to make a transaction.

3) Lack of Control

This one is very simple, your money is not in your hands. It is in your bank's hands and is used for other purposes than simply storing your currency. If the bank is closed, you don't have your money. If the ATM doesn't work or your card breaks, you don't have money. If the bank goes insolvent (bankrupt), you don't have your money.

But wait @millermoo36, what about FDIC?

The FDIC doesn't have enough money to back your security. On their website (https://www.fdic.gov), they claim, "Each depositor insured to at least $250,000 per insured bank." What a bold statement. I found many national surveys, but I wanted to use one on FDIC, so here is a FDIC survey on how many US households do and don't have bank accounts.(https://www.fdic.gov/householdsurvey/)

2015 survey indicate that 7.0 percent of households in the United States were unbanked in 2015. In 2015-2016, the US Census counted roughly 323 million people (https://www.census.gov/quickfacts/fact/table/US/PST045216)

Get Ready for Some Math (All compiled using the data on .gov websites)

323,000,000 x (100%-7% unbanked=93%) x (100%-22.8% under 18= 77.2%)=231,901,080. Now 33% of people are married and we'll assume they half have a joint bank account. That means 16.5% have a joint account. We divide 16.5% by 2 to yield 8.25%. 100%-8.25%= 91.75% have a bank account. Most people are probably going from paycheck to paycheck and don't have a lot of money in their account, but nevertheless, the FDIC claims that each bank account is insured up to $250,000. 231,901,080 * 91.75%= 212,769,241 bank accounts.

212,769,241 * $250,000 = $53,192,310,225,000. That's 53 quadrillion dollars. Again, most people don't have $250,000 in their bank account but my point is quite simply, they don't have the money to deliver on their promise if it was true.

For exact amounts, the FDIC's financial statements stated they have $75 Billion in assets (Source: American Bankers Association https://www.aba.com/Tools/Economic/Documents/DepositInsuranceFund.pdf)

$75 Billion is 0.14% of the total promised. This means in total that each bank account insured is $75B in assets /212M account holders= $352.50 insured per account.

Summary: The government doesn't actually have your money if everyone ran for the banks and you don't have control of it.

This ties into fractional reserve banking.

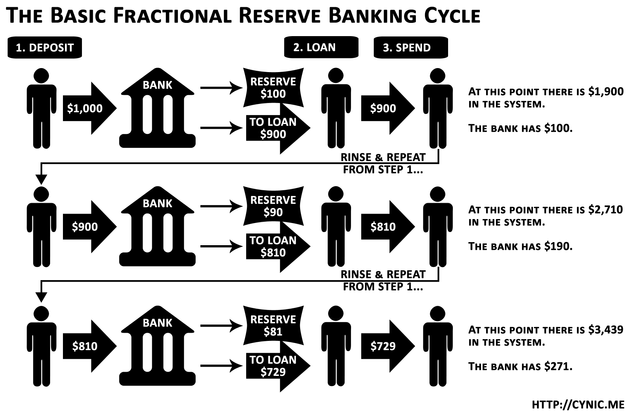

4) Fractional Reserve Banking

Banks are allowed to loan out an exponential amount of money in comparison to how much they actually have. This allows more loans to be made to businesses, mortgages, etc, which means more money to be earned. Here is how much money banks can loan, based upon the Federal Reserve policy ."Reserve requirements are the amount of funds that a depository institution must hold in reserve against specified deposit liabilities."

Loans, Bonds and Mortgages are classified as notes /bond/ mortgage payables under the liabilities section of the balance sheet. A liability is simple something that takes money out of your pocket.

(https://www.federalreserve.gov/monetarypolicy/reservereq.htm)

Here are the amounts (in percent) of how much money banks must hold in accordance to their liabilities.

$0 to $16.0 million 0%!!!! Starting 1-18-18

More than $16.0 million to $122.3 million 3.3% Starting 1-18-18

More than $122.3 million 10% Starting 1-18-18

In other words, if a bank has 100 million dollars in liabilities, this would mean they have 3.3 million dollars in assets. That raises red flags in my mind.

Summary: Banks have a disproportionate percentage of assets versus liabilities.

5) Onymous

The opposite of anonymous. All of your information is collected, stored and shared by the FBI, CIA, NSA, police departments, credit bureau, social security and any other interlinked national and international agencies. They know your whereabouts and what you do with your money every moment. They can freeze your assets at any time and know exactly who you are. I'm not saying this is positive or negative, I am simply stating who has control. All of your financial transactions are stored, allowing the government and companies to know your spending habits for advertising purposes, monitoring, control, data collection, etc.

Summary: Your transactions and records are available to the government and it's partners.

6) Lack of Reporting

Sometimes, the accounting books can be inaccurate. Maybe the accountant "accidentally" left out a number or two, or something goes unreported. This leads to an inaccurate monetary count with somewhat serious reprimands. This can sometimes even go a step further as to money being stolen, swapped or loaned or records are destroyed to ensure people don't see what's really going on. Accounting books and ledgers are counterfeited and money is transferred without knowing where it is. Here's an example of a covert US bail-out of the European banks using a currency swap technique. I'm not going to even go into undisclosed loan amounts. (EU Swap: https://www.wsj.com/articles/SB10001424052970204464404577118682763082876) (Definition of Swap: https://www.investopedia.com/ask/answers/042315/how-do-currency-swaps-work.asp)

My point of this is not to go into the specifics of currency swaps but the overall picture that reporting can sometimes be inaccurate or, furthermore, falsified.

7) Outdated Security

Last but not least, outdated security. Most federal banks use RTGS bank transfer systems, developed in the 1980's. For example, the Federal Reserve uses FedWire, which operates using RTGS. https://en.wikipedia.org/wiki/Real-time_gross_settlement

The security behind RTGS systems have not really been changed since the 80's. Why else does the time to make a ACH Bank Transfer still take 3-5 business days, the same amount it took almost 30 years ago? As stated earlier, I know someone who is starting their own bank and having to go through approval with the Federal Reserve and other companies to start it and is equally shocked by the amount of red tape required to open a bank in direct correlation to the outdated technology in place to operate a bank. Again, you don't have to trust me that I have someone in the industry, so please do your own research.

Summary

Overall, these are seven reasons to show that the current financial system has its own pitfalls. I don't hold an opinion or position of this information, I simply and putting it out there and will let you decide as to what you would like to believe or do more digging into.

In tomorrow's article, I will cover a solution to the problems addressed in this article in the form of digital currency and how it works.

Thank you for reading and I look forward to you tuning in tomorrow.

Until then, take care.

@millermoo36

You have my vote for exposing the Fiat money scam.

Link to Mike Malony THE HIDDEN SECRETS OF MONEY:

My name is Nik Khamsani, from Malaysia. A retired aviator and don't know what to do with the rest of my life. So here I am trying to spend the rest of my life into the Steemit Space.

Feel free to up vote and follow me (that is of course, if you find my post worthy of it) I will gladly do the same. Thanks and have a productive days ahead.

Bt the way,

#nkkb

#teammalaysia Member at Steemit.

#mentormemtee with #zublizainordin and #nkkb

@OriginalWorks #originalworks

https://steemit.com/@originalworks

@t3ran13

Thanking @fisheggs

#fisheggs

https://steemit.com/@fisheggs

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The @OriginalWorks bot has determined this post by @millermoo36 to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Today financial system is not fair but if people do not care enough beyond just speculating on bitcoin and cryptocurrencies the system will use blockchain tomorrow at their expenses https://steemit.com/blockchain/@lepinekong/blockchain-will-be-ethical-or-will-be-not-it-s-up-to-you-entrepreneurs-and-citizens

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow impressive work and thanks for the great lesson!

Hope we can follow each other...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @millermoo36! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cool! I follow you. +vote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Are you considering carrying on with the rest of the 5 part series? I appreciate from personal experience that there is not much money to be made making a detailed post when you don't have many followers yet. You get crickets and few votes. Also although this interests me the most, the world probably reads more cooking blog posts! Now you have to convince them you can be a financial chef too. :)

I look forward to when you publish the rest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit