Elon Musk led, Tesla, is burning cash at an exponential rate. Musk raves about his company, Tesla, being a lean manufacturing operation, but do the numbers add up? No, is the simple answer.

When you google search Tesla images, most of them that come up show very little to no employees at all, on the manufacturing floor along side robotic machinery. Apparently, this is not the case in day-to-day operations. Furthermore, taking a look at Tesla's history, we can have some opinions in comparison to previous generations of manufacturing automobiles.

Tesla's current operational facility, which was purchased after a joint venture between Toyota and General Motors decided to dump 350,000 cars there, and Musk picked up right where they left off. Not really.

In 1984, the same 5.3 million square feet of commercial real estate that Tesla now occupies, was occupied and run by Toyota and GM. During this period, with roughly 2,500 employees the joint effort manufactured 65,000 cars a year. 65,000 cars a year, with 2,500 employees equals about 26 cars per year on the back of one employee. In 1997, the same facility, the same space, but by this time with 5,000 employees and 360,000 total cars made that year, Toyota and GM managed to get 74 cars per person. This is efficiency.

Now, fast forward twenty years and all the technological advances since then, and we have Tesla producing a measly 83,000 cars with roughly 8,000 employees. This adds up to 10 cars a year, that are manufactured at this incredibly large and "lean," facility.

I am either missing something, or Elon does not know about efficiency in manufacturing cars. Anyone have a block-chain for that? LOL

Elon is burning through Tesla's cash, and at an insane rate. .png)

$600,000,000 per quarter are being burned, that is $30,000 dollars for each and every car that is produced.

To add on top of this big joke of a manufacturing facility, they are expecting to increase production to 500,000 vehicles a year. This is with the announcement of the Model 3 being taken into account. From personal experience in manufacturing, there is no way in hell this is going to happen, and if it is, investors should be wary of how much cash Elon is willing to burn through.

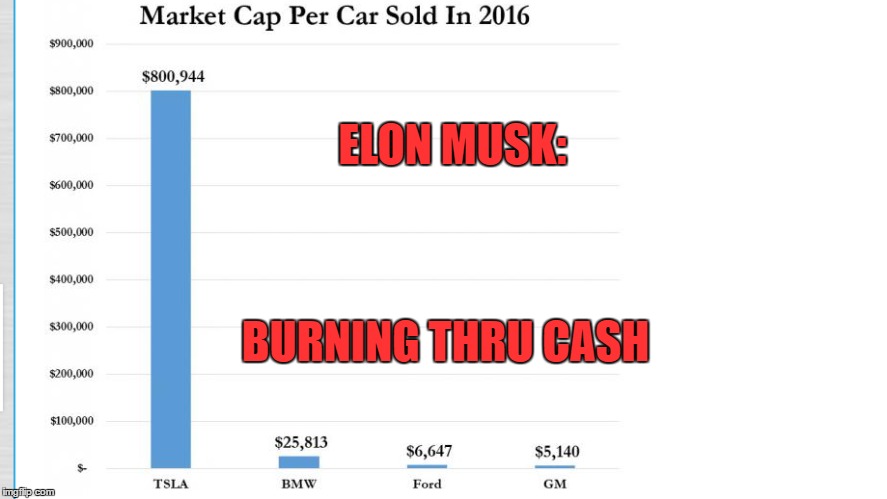

Currently standing, the market cap per Tesla automobile is $800,944, looking at the chart in comparison to BMW, Ford, and GM we can see how unreasonable this data is. If we assume that shareholders in Tesla are okay with the current financial ecosystem within Tesla, they should be bullish on their stock price in the following year. Ramping production to 500,000 cars a year should totally raise their valuation to $400,000,000,000 dollars with ease.

I would blame this on Amber Heard, but she didn't come along until recently. LOL.

In all seriousness, Tesla investors should be weary of their assets. In volatile financial times, it's in peoples best interest to invest wisely. There is nothing wise about investing in a company that is mismanaging the use of 5.3 million square feet of space, 8,000 employees, and billions of investor dollars.

I love the technology, I love the ambitious character of Mr. Musk, but this is ridiculous.