Zcash

Zcash is a cryptocurrency that grew out of the Zerocoin project, aimed at improving anonymity for Bitcoin users. The Zerocoin protocol was initially improved and transformed into Zerocash, which thus yielded the Zcash cryptocurrency in 2016.

founders and CEO

CEO of Zcash is Zooko Wilcox-O'Hearn.

cryptographer Matthew D. Green from Johns Hopkins University.

investors

Roger Ver was one of Zcash's initial investors..

technology

Bitcoin is the first digital currency to see widespread adoption. While payments are conducted between pseudonyms, Bitcoin cannot offer strong privacy guarantees: payment transactions are recorded in a public decentralized ledger, from which much information can be deduced. Zerocoin tackles some of these privacy issues by unlinking transactions from the payment's origin. Yet, it still reveals payments' destinations and amounts, and is limited in functionality

Zcash can be described as an encrypted open, permissionless, replicated ledger. A cryptographic protocol for putting private data on a public blockchain. Zcash can be thought of as an extension of the bitcoin protocol. Basically Zcash added some fields to the bitcoin transaction format to support encrypted transactions.

Zcash uses SNARKs or (Zero Knowledge Proof) to encrypt all of the data and only gives decryption keys to authorized parties to see that data.

This could not be done on a public blockchain in the past, because if you encrypted everything in the past it would prevent miners from checking to see if transactions are valid. ZKPs have made this possible by allowing the creator of a transaction to make a proof that the transaction is true without revealing the sender's address, the receiver's address and the transaction amount.

You could say Bitcoin has 3 columns, which are the three mentioned above (sender address, receiver address, transaction amount) and Zcash has 4.

The 4th column proof doesn’t know the sender address, the receiver address and amount transferred, but it does know that nobody could have created the proof that comes with the encrypted values unless they have a secret key which has sufficient value to cover the amount amount being transacted. This is a proof that the data inside the encryption correctly satisfies the validity constructs. This allows the prevention of double spendsand transactions of less than zero.

Zcash is mostly the same as bitcoin. The miners and full nodes are transaction validators. Zcash uses Proof of Work that has miners checking Zero Knowledge Proof attached to each transaction and getting a reward for validating those transactions.

Full nodes are the same except that if you have the private keys you can detect if some transactions have money that is there for you. SNARKs make it so that miners can reject a transaction from someone if their private key doesn’t have enough money for that transaction.

By keeping all data private except for the 4th column it omits information from leaking onto a private blockchain which allows for everyone to view information about transactions. zCash has selective transparency while bitcoin has mandatory transparency. This means that Zcash can reveal specific things to specific people by permissioning. It reveals specific transactions that anyone looking at them can verify in the blockchain.

Decentralised anonymous payments

A DAP scheme enables users to directly pay each other privately: the corresponding transaction hides the payment's origin, destination, and transferred amount. We provide formal definitions and proofs of the construction's security.

Privacy achieved

In Zcash, transactions are less than 1 kB and take under 6 ms to verify — orders of magnitude more efficient than the less-anonymous Zerocoin and competitive with bitcoin. However the privacy achieved is significantly greater than with bitcoin. De-anonymizing bitcoin has become much easier through services that track and monitor bitcoin movements and the data associated with it. Mixer services

allow for coins to be changed as they move through the system via a central party but this still is not sufficient enough.

risk-averse and mixer services

"[M]ixes suffer from three limitations: (i) the delay to reclaim coins must be large to allow enough coins to be mixed in; (ii) the mix can trace coins; and (iii) the mix may steal coins. For users with “something to hide,” these risks may be acceptable. But typical legitimate users (1) wish to keep their spending habits private from their peers, (2) are risk-averse and do not wish to expend continual effort in protecting their privacy, and (3) are often not sufficiently aware of their compromised privacy."

However, ZCash’s use of cutting edge cryptographic techniques comes with substantial risks. A cryptographic attack that permits the forging of zero knowledge proofs would allow an attacker to invisibly create unlimited currency and debase the value of Zcash. Attacks of this kind have been found and fixed in the recent past. Fortunately, the metadata hiding techniques used in Zcash tread are more production-hardened and can be considered less risky.[This part will need more looking into as it might be outdated.]

the importance of privacy and fungibility for a currency

The major motivations for Zero Knowledge Proofand the Zcash protocol are privacy and fungibility.

Fungibility is being able to substitute individual units of something like a commodity or money for an equal amount. This can be a real problem when some units of value are deemed less because they are considered "dirty".

Hiding the metadata history doesn't allow for a coin with a bad history to be rejected by a merchant or exchange.

Insufficient privacy can also result in a loss of fungibility, where some coins are treated as more acceptable than others, which would further undermine Bitcoin's utility as money.

I review the other top 15 marketcap coins in part 10.0 the post got to big. Read part 9 to understand what the post is about.

Zcash

Zcash is a cryptocurrency that grew out of the Zerocoin project, aimed at improving anonymity for Bitcoin users. The Zerocoin protocol was initially improved and transformed into Zerocash, which thus yielded the Zcash cryptocurrency in 2016.

founders and CEO

CEO of Zcash is Zooko Wilcox-O'Hearn.

cryptographer Matthew D. Green from Johns Hopkins University.

investors

Roger Ver was one of Zcash's initial investors..

technology

Bitcoin is the first digital currency to see widespread adoption. While payments are conducted between pseudonyms, Bitcoin cannot offer strong privacy guarantees: payment transactions are recorded in a public decentralized ledger, from which much information can be deduced. Zerocoin tackles some of these privacy issues by unlinking transactions from the payment's origin. Yet, it still reveals payments' destinations and amounts, and is limited in functionality

Zcash can be described as an encrypted open, permissionless, replicated ledger. A cryptographic protocol for putting private data on a public blockchain. Zcash can be thought of as an extension of the bitcoin protocol. Basically Zcash added some fields to the bitcoin transaction format to support encrypted transactions.

Zcash uses SNARKs or (Zero Knowledge Proof) to encrypt all of the data and only gives decryption keys to authorized parties to see that data.

This could not be done on a public blockchain in the past, because if you encrypted everything in the past it would prevent miners from checking to see if transactions are valid. ZKPs have made this possible by allowing the creator of a transaction to make a proof that the transaction is true without revealing the sender's address, the receiver's address and the transaction amount.

You could say Bitcoin has 3 columns, which are the three mentioned above (sender address, receiver address, transaction amount) and Zcash has 4.

The 4th column proof doesn’t know the sender address, the receiver address and amount transferred, but it does know that nobody could have created the proof that comes with the encrypted values unless they have a secret key which has sufficient value to cover the amount amount being transacted. This is a proof that the data inside the encryption correctly satisfies the validity constructs. This allows the prevention of double spendsand transactions of less than zero.

Zcash is mostly the same as bitcoin. The miners and full nodes are transaction validators. Zcash uses Proof of Work that has miners checking Zero Knowledge Proof attached to each transaction and getting a reward for validating those transactions.

Full nodes are the same except that if you have the private keys you can detect if some transactions have money that is there for you. SNARKs make it so that miners can reject a transaction from someone if their private key doesn’t have enough money for that transaction.

By keeping all data private except for the 4th column it omits information from leaking onto a private blockchain which allows for everyone to view information about transactions. zCash has selective transparency while bitcoin has mandatory transparency. This means that Zcash can reveal specific things to specific people by permissioning. It reveals specific transactions that anyone looking at them can verify in the blockchain.

Decentralised anonymous payments

A DAP scheme enables users to directly pay each other privately: the corresponding transaction hides the payment's origin, destination, and transferred amount. We provide formal definitions and proofs of the construction's security.

Privacy achieved

In Zcash, transactions are less than 1 kB and take under 6 ms to verify — orders of magnitude more efficient than the less-anonymous Zerocoin and competitive with bitcoin. However the privacy achieved is significantly greater than with bitcoin. De-anonymizing bitcoin has become much easier through services that track and monitor bitcoin movements and the data associated with it. Mixer services

allow for coins to be changed as they move through the system via a central party but this still is not sufficient enough.

risk-averse and mixer services

"[M]ixes suffer from three limitations: (i) the delay to reclaim coins must be large to allow enough coins to be mixed in; (ii) the mix can trace coins; and (iii) the mix may steal coins. For users with “something to hide,” these risks may be acceptable. But typical legitimate users (1) wish to keep their spending habits private from their peers, (2) are risk-averse and do not wish to expend continual effort in protecting their privacy, and (3) are often not sufficiently aware of their compromised privacy."

However, ZCash’s use of cutting edge cryptographic techniques comes with substantial risks. A cryptographic attack that permits the forging of zero knowledge proofs would allow an attacker to invisibly create unlimited currency and debase the value of Zcash. Attacks of this kind have been found and fixed in the recent past. Fortunately, the metadata hiding techniques used in Zcash tread are more production-hardened and can be considered less risky.[This part will need more looking into as it might be outdated.]

the importance of privacy and fungibility for a currency

The major motivations for Zero Knowledge Proofand the Zcash protocol are privacy and fungibility.

Fungibility is being able to substitute individual units of something like a commodity or money for an equal amount. This can be a real problem when some units of value are deemed less because they are considered "dirty".

Hiding the metadata history doesn't allow for a coin with a bad history to be rejected by a merchant or exchange.

Insufficient privacy can also result in a loss of fungibility, where some coins are treated as more acceptable than others, which would further undermine Bitcoin's utility as money.

transaction speed

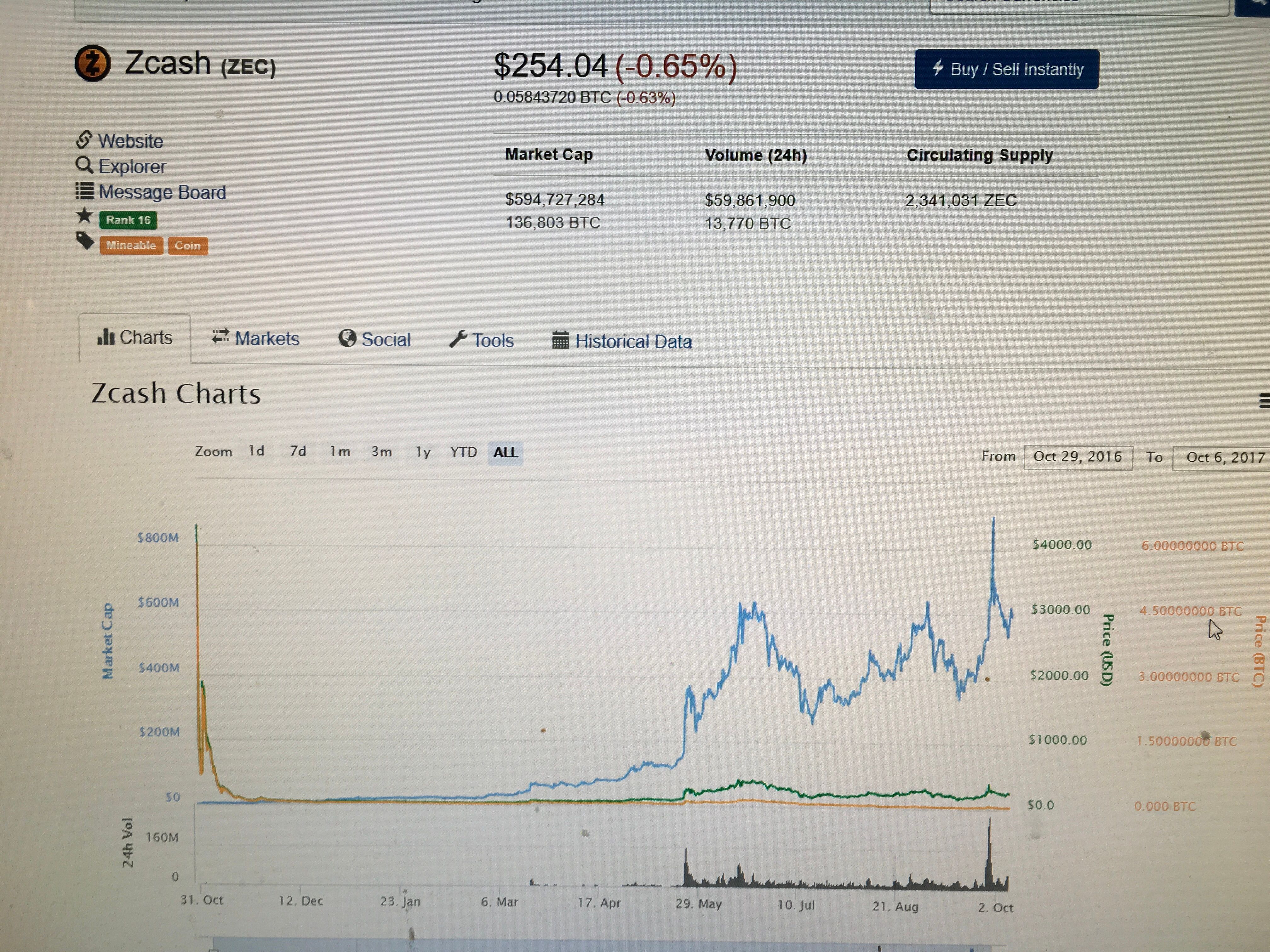

Transactions per second: Between 6.67 and 26.67 transactions per second.

Transaction fee Between 0.0015 $ and 0.00005$. (very cheap)

The project was founded in November 2015. It has two tokens USDT and EURT, which were made as analogues of USD and EUR in a Blockchain world. These cryptocurrencies are closely connected with the exchange Bitfinex. At first, Tether was based on the Bitcoin Blockchain system, but in June 2017, the transition to Litecoin was declared.

stable currency

Tether converts cash into digital currency, to anchor or tether the value to the price of national currencies like the US dollar, the Euro, and the Yen.

100% Backed

Every tether is always backed 1-to-1, by traditional currency held in our reserves. So 1 USD₮ is always equivalent to 1 USD.

Transparent

Our reserve holdings are published daily and subject to frequent professional audits. All tethers in circulation always match our reserves.

Blockchain technology

The Tether platform is built on top of open blockchain technologies, leveraging the security and transparency that they provide.

Widespread Integration

Tether is the most widely integrated digital-to- fiat currency today. Buy, sell, and use tethers at Bitfinex, Shapeshift, GoCoin, and other exchanges.

Secure

Tether’s blockchain-enabled technology delivers world-class security while meeting international compliance standards and regulations.

Banks

Bitfinex and Tether have experienced some issues with the banking system.

In April 2017, Tether underwent a cut to wire transfer services from Taiwanese banking partners. Later that month it was international customers who found their wire deposits frozen.

Liquidity and emission

Despite some big issues described in the source, the Tether capitalization was growing. It has been growing rapidly, so it means investment flow.

As the official site says reserve holdings are subject to professional audits. However, Tether does not give any names of auditors or companies.

If everyone wanted to sell their usdt tokens will their be enough liquidity to cope with that demand, or will there be new issues, whereby your account withdrawal is being put on hold.

unanswered questions

Tether cannot use bank facilities, so where does the company hold its money? Why is the information not known for token holders?

What is the real circulation of tokens?

The Blockchain community has more questions than answers.

Emission can be excessive, which means unbacked tokens.

Below “hidden” in the legal section of tether is a surprise statement, that is

“Once you have Tethers, you can trade them, keep them, or use them to pay persons that will accept your Tethers. However, Tethers are not money and are not monetary instruments. They are also not stored value or currency. There is no contractual right or other right or legal claim against us to redeem or exchange your Tethers for money. We do not guarantee any right of redemption or exchange of Tethers by us for money. There is no guarantee against losses when you buy, trade, sell, or redeem Tethers.”

There, tether tokens are touted as “Money built for the internet.” Potential users are told that these tokens are a “stable currency,” “100% backed,” “transparent” and “secure.”

One might be forgiven for wondering if the marketing department and legal team work for two entirely different companies. The message could hardly be more conflicted.

Bitfinex

It has long been thouht that Bitfinex and Tether are associated with each other. For instance, when Bitfinex’s banking at Wells Fargo was cut off, Tether joined Bitfinex’s lawsuit against the bank. A Bitfinex employee posted to one of several reddit threads today, under the handle “bfx_drew,” saying:

“I'd like to correct two common misapprehensions:

Bitfinex does not own Tether. It is a sister company with a minority percentage of overlap in shareholders.

Audit

According to Tether they are undergoing a balance sheet audit.”

One user made a skeptical comment about the audit, asking if the Tether audit would remain in “coming soon” status indefinitely, like Bitfinex’s own audit. In reply, bfx_drew offered a bet of 5 BTC that Tether’s audit will in fact be completed this year.

The pair USDT/USD is presented on only two exchanges: Kraken and Bitfinex. Bitfinex fixed the price of one USDT at a rate of one USD.

Volume

The volume of these transactions is tiny, so the question about the liquidity is open.

Transparancy

They mention every Tether is backed up by 1 USD, the site however gives no information about its auditor and does not make any audit reports available. Also, one wonders why bfx_drew boasts that Tether is currently undergoing an audit when, in the company’s own words, they are regularly audited. If in fact such audits are routine, why call special attention to this one?

How does it work?

Supposedly every tether token in existence - at present, over 300 million of them - is backed by US dollars in Tether’s bank account. When a Tether business partner deposits US dollars in Tether’s bank account, Tether creates a matching amount of tokens and transfers them to that partner.

However, without published audit results, there is no way to know whether these tokens are fully backed. Tether insists that they are not operating a fractional reserve system, but they either cannot or will not prove it.

Questionable

When Tether and Bitfinex had their banking ties cut, there were around 66,000,000 tether tokens in existence. Today, there are 319,501,508 - nearly five times as many. It seems totally irrational that deep-pocketed entities would deposit nearly $250,000,000 with a company that currently has limited banking connections.

I will do more research over time, two articles showing that Tether has a lot of questions to be answered, whilst transparancy does not seem part of their portfolio.

I try to not be negative in reviews and most of the above is directly taken from the source, over time I am sure people will chime in and hopefully back the answers up with proof.

I do however think that some crypto’s are surrounded by more mist then others which generally means something could be off.

For now Tether still seems to be holding strong at 1$ and is being tradd everyday by many!

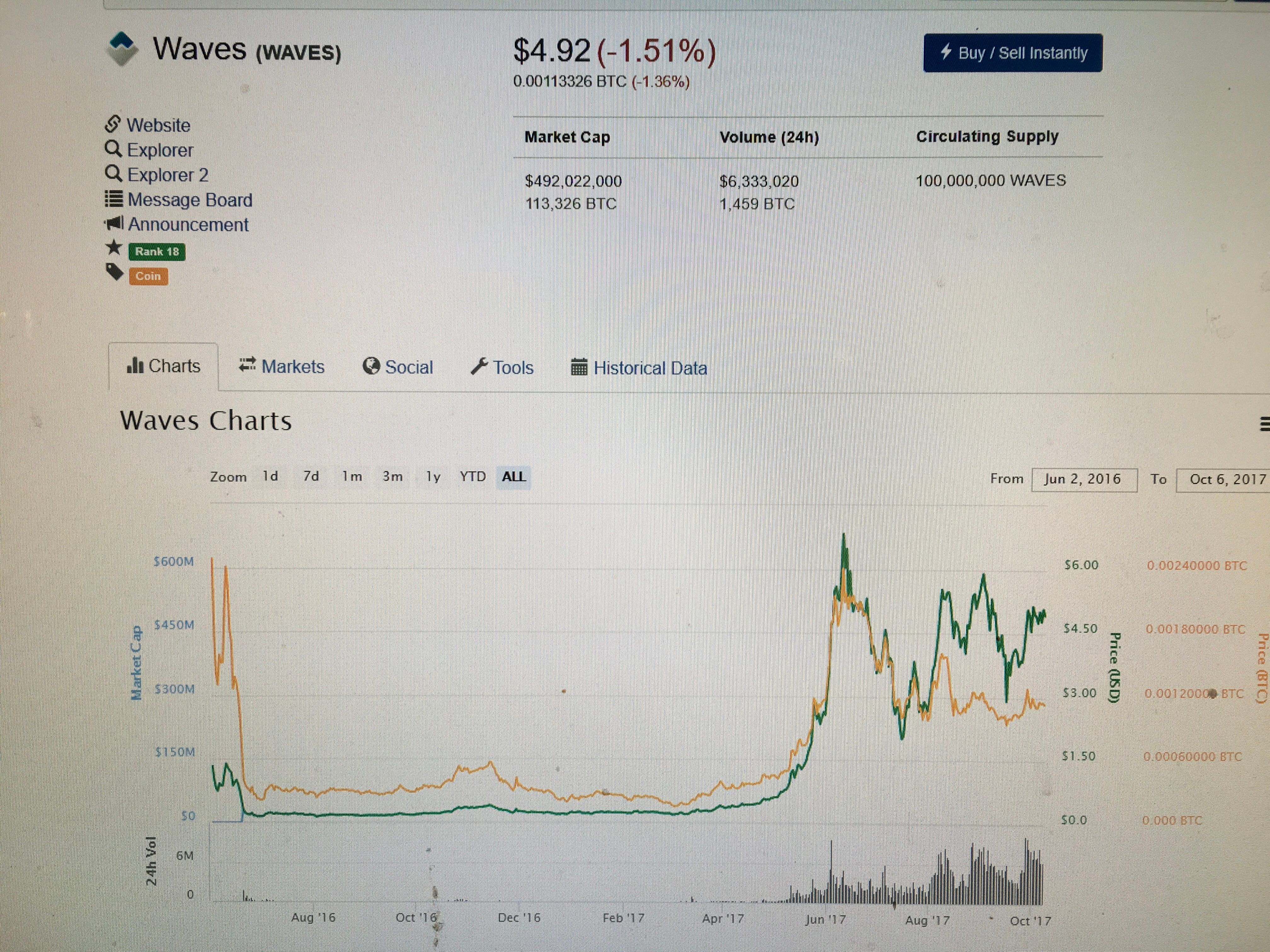

Waves is a platform.

Waves will enable you to make custom tokens, which means you can launch your own cryptocurrencies. You can also decentralize trading and crowdfunding, as it will come with integrated fiat currency gateways like USD/EUR/CNY right in your wallet.

You will be able to launch ICOs to fund your projects from around the world in a matter of minutes, without going through intensive cryptocurrency coding. This will make life easier for startups and open up a new era of community-backed projects.

The Waves cryptocurrency (WAVES) has real world tradable value on various exchanges.

Team

CEO Sasha Ivanov

Sasha is a physicist by education and has been involved in payment systems software development. With blockchain technology, he launched the first instant cryptocurrency exchange coinomat.com.

Use cases

Use Cases and the Future of Waves

Some of the use cases which are being built or are already in production:

Tokenomica – A transparent venture capital organization.

Upcoin – A political engagement initiative.

ZrCoin – A green manufacturing technology business.

MobileGo – A marketing drive for a mobile gaming platform.

EncryptoTel – A secure telecommunications infrastructure company.

Incent – A blockchain loyalty scheme.

Waves Dex (Decentralised exchange)

WavesDex is a decentralized exchanged built on the Waves blockchain. It allows users to trade their BTC/ETH/etc. in exchange for Waves (or any other asset token issued on the Waves platform).

Smart Contracts

In Waves, smart contracts are not as complex as they are in Ethereum. They are Non-Turing complete, but powerful and secure.

Governance

Waves has implemented a consensus system called Leased Proof of Stake (LPoS).

The network is secured by active nodes, which require a balance of at least 10,000 WAVES to generate blocks. Whilst anyone can run a mining node if they have this amount, it is possible for users to lease their balance to a node, giving them additional ‘weight’ in the network. The extra rewards earned by the node are then shared with those who have leased balances to them, and nodes will naturally compete to offer leasers the best deal. Leased WAVES remain in the full control of the account holder, and can be transferred or exchanged at any point.

Revenue streams

There are two main revenue streams for nodes and leasers. The first is the transaction fees that are paid for any operation on the Waves platform. ‘As our platform and ecosystem grows, we will see hundreds of thousands of transactions per day on Waves,’ explains CEO Sasha Ivanov. ‘With many new major businesses coming on board, mining will become more and more profitable.’ The second is the Miners Reward Token (MRT), which is distributed to miners with every block created. This can be used to vote on certain network issues that affect miners. It will also be used as a means for new token issuers to reward nodes for processing transactions, using their own token as a fee. As a Waves token, MRT can be transferred and traded freely on Waves’ decentralised exchange (DEX).

The rates of return for mining are currently around 1% per month on WAVES balances, and the cost of entry at 10,000 WAVES is just a few BTC. As the price of WAVES rises, so too will both returns and the price of becoming a new miner. ‘Those who get on board early, while WAVES is still below $1, will likely see quite remarkable returns in the future — aside from the increase in the value of their capital.’

Tokenization

You can make your own custom tokens or cryptocurrencies in one minute on the Waves platform. You will require at least 1 WAVES token to do so.

You can decide what name to give the token, how many to be issued, and how many decimal fractions you want to keep.

This is ideal for crowd funding and ICOs.

Fiat Gateways

Fiat Gateways such as USD/EUR/CNY will allow you to exchange any token issued on the Waves platform (or any other cryptocurrency like BTC/ETH) for “real” money, which can be deposited in a bank.

Best of both worlds

All transactions between cryptocurrency to fiat or fiat to cryptocurrency will be recorded on the Waves blockchain. This is like mixing the best of both worlds (i.e. centralized systems and decentralized systems).

KYC/AML Know your customer and Anti Money Laundering

KYC/AML is needed to deposit and withdraw fiat money. However, KYC is not necessary for cryptocurrency transactions.

Transaction fees: low (0.001 waves) around 004 $

Transaction speed: Up to 1,000 txs/second

March 2017 total transactions per day were: 10000

Transactions by comparison

Bitcoin is 7tps and Ethereum 15tps. Litecoin has a maximum capacity of 56tx per second.

Be aware this data is probably old, after for instance Segwit implementation the Bitcoin tps increased a bit. Yet in terms of world wide adoption we must really be hoping for a coin to do limitless transaction per second.

Otherwise the monetary system becomes to slow.

Lightning Network

It is a network that is being build to allow scalibility of decentralised coins like Bitcoin, to allow for Billions of transactions per day. One could argue it is a workaround to make a slow system quicker by building a layer to it.

However there are many issues surrounding the implementation of this network one of which is that it will be unlikely that the solution is decentralised potentially making Bitcoin even more centralised then it already is. read more about potential Lightning Network issues

http://www.investopedia.com/news/bitcoin-lightning-network/

Coins to be followed and added to this message in the future:

stratis

ark

steem

bytecoin

maidsafecoin

tenx

BAT

golem

eos

augur

decred

stellar lumens

Crypto coins have Memory

No, don’t worry, I am not one of [Dr. Emoto’s] (http://highexistence.com/water-experiment/) crazy labstudents.

But I can’t help but think, that those who hold crypto, remember in what coins they invested in, in the past.

That means for me that potentially BitShares could explode back to it’s original glory once people understand BitShares and it gains renewed visibiliy.

It will take time and I am pleading for help from fellow investigators to come to an overall conclusion to what would be the true best longterm act to invest in right now and in the future.

As investors we want to make the decision that has best calculated equity to that decision.

So why not help each other gaining info and discuss latest news and additions to our favourite coins and reevaluate what the best option is here. Based on facts! Proof me that BitShares is not the best investment and by doing so convince yourself you are making the right decision.

This is all informational and hopefully over time factual, so don’t hold anyone responsible but yourself for making an investment decision that popped your balloon.

Check the Benchmark out between Bitshares and BTC.

Why I think a paradigm shift will happen that involves BitShares.

Hi @oudekaas, Once again, you have provided an information rich article. I like the sound of Waves, and reading this encourages me to buy in. Be nice to be part of a collective that focused on putting these ideas into practice, not as lone wolves, separated by borders, but as part of an investment group that met up regularly, to invest in crypto in real time, instead of only virtual time :) Thank you for the effort you have unselfishly put into this and shared. Much appreciated :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ok, you've convinced me. But I cant get a wallet. Now I have over a dozen differet coin/ token types and as many different wallets. Ive also tried and rejected a few more. So Im more used to them than many of us un-nerdy buyers.... But nearest Ive got is having one on my android which gives me the option to sign in, but not create. I therefore have nothing to sign in to.

I cant understand how or what I'm missing here. And just to add salt to the wound you say bitshares does more transactions than the top three coins together? This suggests that it must be possible to own and use a wallet... But how?

Best way for you to promote your precious baby bitshares is to walk us zero-techie woüld-be bitshare owners h through the process of buying and stabling them. Oh, and oodles....pretend we are five, pretty please. :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well its seems there was a bug preventing sign up. Ive downloaded the update and finally got a wallet. No recovery phrase or private key though... Exchange is included but as yet ive not been able to buy through it - buy orders simply dont confirm. All in all I'm not confident , but have found some links on youtube to try.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit