Have you ever notice that evertime you go out shopping, the first thing the casier ask you is, "WOULD YOU LIKE TO APPLY FOR A CREDIT CARD TODAY". They use the sales pitch "IF YOU GET APPROVED YOU CAN TAKE 20% OFF OF YOUR PURCHASE TODAY". But wait 20% off once for a trade of 12 months at, well lets say 12% intrest. Not really a good deal.

Total debt in america has risen to a all time high, how high you ask? Well its ten times the amount of currency that is currently in circulation.

12.73 trillion to be exact. This number will only get bigger.

Now lets take into consideration that there are only 321.4 million citizens in the United states.

That means that each citizens of the united states owes $39,607, yes that includes the children as well.

Now we all now that our children do not have debt, so lets dig a little deeper into the true number.

According to the census Bureau 74.2 million americans are under the age of 18.

So that puts our new debt per person to,, $51,496 per Us Citizen that is over the age of 18.

So we have 12.73 trillion dollars worth of debt with only 1.2 trillion US dollars in circulation.

This is a problem, a huge problem. At the rate we are borrowing we will not be able to pay this debt back as a total.

My point behind this soft rant is...... when that cashier ask you would you like to apply for a credit card today, just say NO THANK YOU. dont get tricked into the sales pitch, trust me you are not really getting the 20% off.

Now the next thing that I see wrong with this debt crisis is automobile loans.

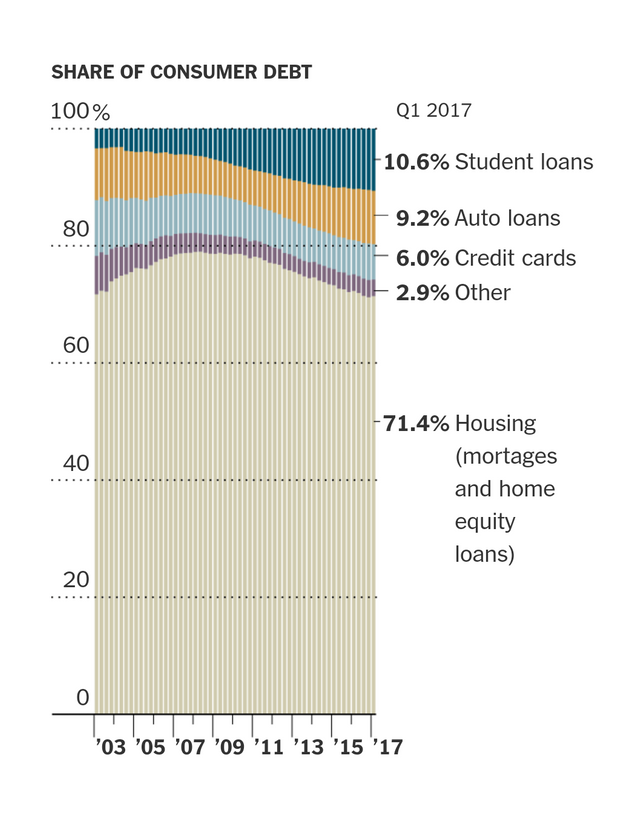

Graph by NY times.

Auto loans make up 9.2 % of American debt. Now I understand that most people in our country needs a automobile. But have you really done your homework before you go out and purchase one. I mean it is very difficult to find a brand new car for less than $25,000, and thats just the basics, no upgrades. I looked at a new pickup a few months back and I could not find one on the car lot for less than $35.000 and some all the way up to $70,000. I just do not see the value in this.

Automobile loans are to easy to obtain. We have dealerships helping us citizens live beyond there means and this is very dangers. I see this aumobile bubble popping and it will be bad when it does.

Prices are so high on automobiles in America, I dont ever see my self buying a brand new one again, I will buy a good used before new.

So I will end this with this, not all debt is bad, not all debt is unavoidable, but if we could only stop the avoidable debt we would be in a better place.

Follow me @raybrockman

Upvotes and comments are appreciated

You make a good point about automobile loans... I once had a teacher say that he would never take out a loan for a car, since it wasn't worth going into debt for something that loses value so quickly. His view was a little extreme, but he was avoiding what debt he could.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That man is 100% right after you bought a brand NEW car the value of it drops more than 20% to moment you own it.

Second hand with 50.000km - 70.000km on the clock is perfect andway cheaper. In the end a car only transport us from point A to point B

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

True. Plus, the value of your car and how well it works depends on how you take care of it more than how new it is. My car has almost 230,000 miles on it, and though I've had to get it worked on here and there, it still runs fine.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I just own a bike, I'm from Holland ;)

Also good point and a lot of people don't take good care of their car.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

this made me lol 😂

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hahahaha thats the dutch way of going where you want :P

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's much better for the environment!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

and healthy :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

True. I would probably use a bike for everyday transportation... but the other day I had to drive 46 miles across town to a job and 46 back. I don't think I could make it on a bike lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep, i do not see myself ever buying another brand new car, atleast untill they get the prices back in line. Thanks for the comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed, no problem!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good post man, freaking incredible that amount of money that basically is thin air XD.

keep it printing.....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep, its kinda shocking once you put it on paper. Thanks for the visit and comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good that I follow you really interested in posts like this :), its kinda seeing the collapse coming XD

if you want check out my post you might be interested:

https://steemit.com/steemit/@smappy/your-new-fair-randowhale-the-fair-whale

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Debt is like gravity... It always brings you down!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well said my friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm with you. Some of those cashiers can be real persistent, too. I wonder if they get a commission? I've noticed that lately we're receiving an explosion of credit card offers and loan offers in the mail. More than usual. It's strange.

I will never have a car loan. The minute you drive that heap of metal off the lot it drops its value. It's a huge liability when you take into consideration insurance, taxes, registration, maintenance, etc....

My husband and I drive high quality vehicles that we bought used and paid cash for. Toyota Lexus SUV year 2001 and a 1996 Toyota Land Cruiser. They never break and hubby does the maintenance. Only carry liability insurance.

We're teaching our kids to incur no debt. We learned the hard way that debt sucks the life out of you. My motto is " I'd rather go to bed hungry than wake up in debt."

Up voted and resteemed. Great topic.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well first thanks for the resteem, and what an awesome thing to teach your children. Debt is nothing more than modern day slavery. Thanks forbthe visit and comment my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nicely said @raybrockman, I 'm not a lover of being in debt. Being more conscious of your budget and spending habits will go a long way.

I read a good Steemit post [HERE] (https://steemit.com/money/@ipopular/5-tips-to-save-more-money)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks my firend, agree tou have to have a conscious plan. Thanks for the visit and comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Here is another perspective for a conscious solution. https://steemit.com/money/@calaber24p/different-ways-to-think-about-your-time-and-money-to-lead-to-better-financial-security

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If all currency was used to pay off debt there would still be debt and the economy would crash. If debt isn't paid off then eventually it will be too large to service and the economy will crash. My advice is take their credit card and rinse it to the max on storable food, precious metals and guns 🤣

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

And then just wait for a crash? I with you somewhat. But unfortunately that is not what they are buying. Thanks for the visit @gamma-rat

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Radical times, calls for radical strategy! We will see how it pans out. Kudos for the post , good info!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Because the dollar is debt, they need you to continually borrow more of them to keep the system liquid, and the Ponzi scheme that is the dollar intact. It's failure is a mathematical certainty. I'm just watching the race between subprime auto loans, student loans, and the bond market to see which implodes first.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think you are a winner with those 3 pics. I personally think it will be auto loans first. Thanka for the visit and comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cars are not a rational buying, but essentially emotional. It represents confort and status.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agree, the loss alone as soon asbyou drive off of the lot, should be enoufh to make everyone reconsider that purchase. Thanks for the comment and visit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh so right! I work as a cashier for a living, if you can call it a living lol, and we are hounded...yes, hounded to ask for credit apps. It is a practice I refuse to do lol. By golly, I think you just gave me an idea for a post :D Getting rid of the avoidable debt is critical!! Great post :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey thanks, I am also in the dreaded retail industry, so I feel you pain, kinda feels like you are taking advantage of the volitile situation when you pressure them into applying. Thanks for the visit and comment my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post with great advice

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post received a 1.4% upvote from @randowhale thanks to @raybrockman! For more information, click here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@raybrockman got you a 33.94% @minnowbooster upvote, nice!

Want a boost? Click here to read more!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 13.36 % upvote from @booster thanks to: @raybrockman.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit