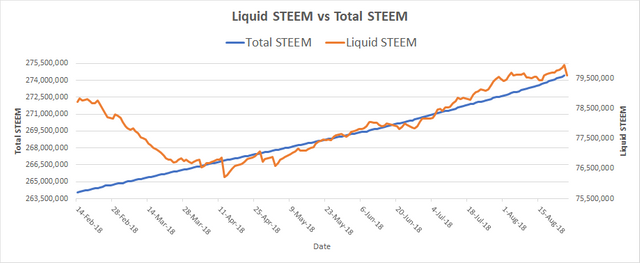

This is a historical graph of both Total STEEM and Liquid STEEM supply

(Note) There are two different scales on this graph. For full scale, see graph below.

Liquid STEEM is the remaining STEEM that has not been converted into Steem Power. (Orange Line)

- When STEEM is liquid, it can be readily sold and purchased.

- When STEEM is locked away in SP, it is not liquid, It takes a significant amount of time to convert it back to a liquid form.

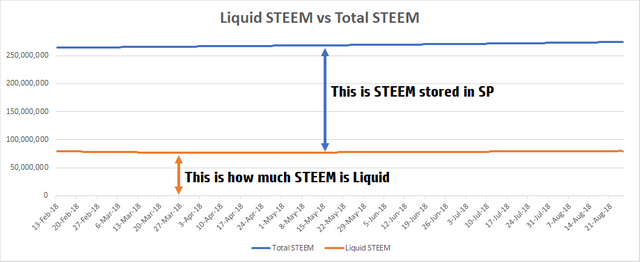

This is a graph of the same data. The data of this graph was plotted on the same scale to show the massive difference between Liquid STEEM and STEEM stored in SP

I created these charts with data that I collected over the last few months.

Why are these graphs important?

STEEM is created at a high rate. Currently 8.77% per year. Many Steemians have a concern about STEEM inflation with the high rate of new currency creation. These graphs show that there is a limited supply of STEEM. Inflation is being offset by the rate of STEEM converted to Non-Liquid STEEM.

I hope you enjoyed reading my Blog. Please remember to Upvote, Resteem, and Follow. Thank you.

---------------------------------------

For a breakdown of how Steemit Rewards system works:

For a breakdown of Steemit Keys:

https://steemit.com/life/@socky/do-you-understand-your-steemit-key

For a breakdown of why Steem Power is Important:

https://steemit.com/steemit/@socky/why-is-steem-power-important-beginners-read

I do not understand this very well, however, does this mean that SP mitigates the effect of inflation?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No. Only a 8.77+% interest rate in savings would mitigate the inflation rate. Currently, we have no way to gain interest off of our steem/steem power.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The amount of STEEM being stored into SP (a long term contract) which is non-liquid is far larger than the liquid supply of STEEM. I don't agree that inflation is an issue. If you want returns of your STEEM, then convert it to SP and blog. Don't hang your hat on getting interest gains on that SP even when the market is great and the liquid supply is low.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Same, i dont understand. But no problem it's oke aja lah

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This doesn't mitigate steem inflation. We can see this with how much our steemit power yields. 4 months ago, when I joined, about 75-125 steem power gave a .01 upvote with 100%. Now, according to steemworld, around 200 steem power is a .01 upvote. we've had our voting power decimated by the inflation rate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Actually, it was decimated by the price of STEEM. You are getting paid in the US dollar equivalent price in STEEM. That is why there is a dollar sign next to the reward value. The entire cryptocurrency market is down and not just STEEM, so hang in there. Hopefully it will bounce back soon. The inflation is actually a good thing and makes STEEM function as a currency and not like a storage of value like gold or silver. Eventually usable currencies will win out and cryptocurrenies with extremely limited supply will loose.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit