Given all of the most important, probablymarket-moving events and conditions we're expecting within the month ahead, here area unit the key charts and worthlevels that investors ought to be look in March 2019. Markets move supported a large kind of political economy and political factors.

Among the foremost necessary and heavily anticipated of those factors slated for March can be: the monthly U.S. jobs report, the Federal Reserve's next FOMC call, Brexit Day, and a possible U.S.-China trade summit at President Trump's Mar-a-Lago club. In a way or another, the 5 charts featured below are wedged by one oradditional of those factors.

GBP/USD

This is a lucid one. just in case you haven't been following developments commencingof Europe, Brexit Day is quick approaching.this is often the date - March twenty nine -once the U.K. is meant to depart the euUnion. Of course, there is been largepolitical chaos within the run-up to the present date, and that we still do not knowwhether or not Brexit can endure as planned, are delayed, or can simply fail altogether. What ultimately happens is sort of bound to build an outsized impact onBrits pound, similar to the first Brexit votein mid-2016 did.

Recently, the pound rallied against eachthe monetary unit and also the dollar onceUK Prime Minister Mother Theresa couldsecure Members of Parliament the chanceof delaying Brexit till a deal are oftenapproved between the united kingdom and EU. Generally, the pound has fallen on fears of a tough (or "no-deal") Brexit,whereas the currency has rallied on the prospects of a Brexit delay or another public vote.

From a technical perspective, the chart on top of shows the GBP/USD (British pound vs U.S. dollar) typically on a rebound from its December and January double-bottom lows. Since those lows, GBP/USD has upwell on top of each its 50-day and 200-day moving averages, and has climbed up to hit key resistance round the one.3300 level. The weeks ahead leading up to the regularBrexit Day are vital in determinant the direction of the pound. Any sign of a Brexit deal or a delay ought to be positive for GBP/USD. A escape on top of the notedone.3300 resistance level would beconsiderably optimistic, probably leading the means towards one.3700.

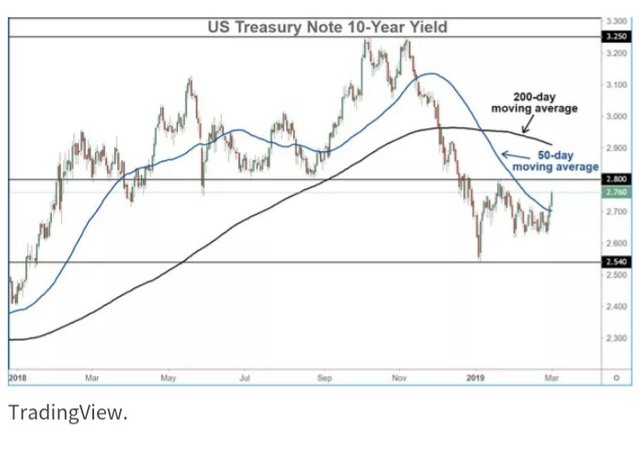

U.S. Treasury note 10-Year Yield

The 10-year yield has been falling since it double-topped around three.250% in Octand Gregorian calendar month. This drop has occurred because the Federal Reservehas become more and more involvedregarding economic process. throughoutnow, the Fed's language and selectionsbecame {progressively|increasingly|more and additional} more pacifist and hesitant in raising interest rates any. The expectedcharge per unit flight has thus becomeabundant less steep than it had been last year.

In March, each subsequent major FOMCcall on March twenty and also the monthly U.S. non-farm payrolls jobs report on March eight may play a significant rolewithin the direction of the 10-year yield. As of the start of March, the futures marketsarea unit overpoweringly pricing-in no rate hike from the Fed (more than 98%). Clearly, within the exceptionally unlikely event that we have a tendency to do get a rate hike then, the 10-year yield may surge sharply. within the absence of that occuring, the yield can seemingly continue its downtrend given the increasingconsiderations over the economy andinternational growth.

In March, if the yield remains below the two.800% resistance level, lower charge per unit expectations may pressure the 10-year yield towards the two.500% level and below.

Gold

At the terribly starting of March, the worthof gold fell sharply, however abundant of that was thanks to a stronger U.S. dollar.before this drop, gold had been on a pointyrally since its period of time lows around $1160. there have been many factorsserving to to spice up the worth of goldthroughout that point. one in every of these factors, already mentioned, was falling interest rates as shown within the U.S. Treasury 10-year yield since Gregorian calendar month. once interest rates fall, non-interest-bearing gold has less competition from fixed cost instruments.thus gold costs and demand for gold tend to rise.

Also, gold is taken into account a safe-haven investment, which implies investorsobtain gold once considerations or fearsregarding international political and economic conditions increase. As noted, there area unit several potential risk factors in March and on the horizon.considerations regarding U.S.-China trade negotiations, Brexit, and retardationinternational economic process may stillboost the worth of gold.

As of the primary day of March, the come by gold has tentatively pressured worthbelow its 50-day moving average for the primary time since Gregorian calendar month. however with charge per unitexpectations falling and key risk factors looming, gold is probably going to recover. With any climb back on top of the $1300 level, subsequent major upper side target is around $1360, that represents last year's highs.

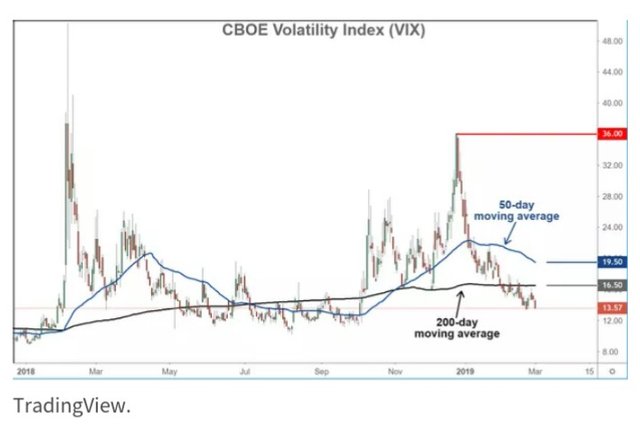

VIX

As equity markets have created a dramatic rebound and recovery from late Decemberlows, the Volatility Index, or VIX, has come back down sharply from its highs. The VIX,conjointly called the "fear gauge," could be a primary live of concern and volatilitywithin the markets as measured by S&Pfive hundred index choices volatility. As shown on the VIX chart, the largeDecember spike in volatility mirrors the large December come by stock costs.

But the VIX is standard for falling back rather chop-chop once such overdoneconcern spikes, and December was no exception. By January, the VIX had fallen below its 50-day moving average, that ispresently round the nineteen.50 level. And by Feb, below its 200-day moving average,that is presently around sixteen.50. As ofthe start of March, the VIX concisely bustright down to a brand new low not seen since Oct.

While this shows a high level ofsatisfaction within the markets at this time,the danger factors on the horizon stay.significantly in March, U.S.-China trade, Brexit, the Fed call, and retardationeconomic process may all play a task in boosting the VIX yet again.

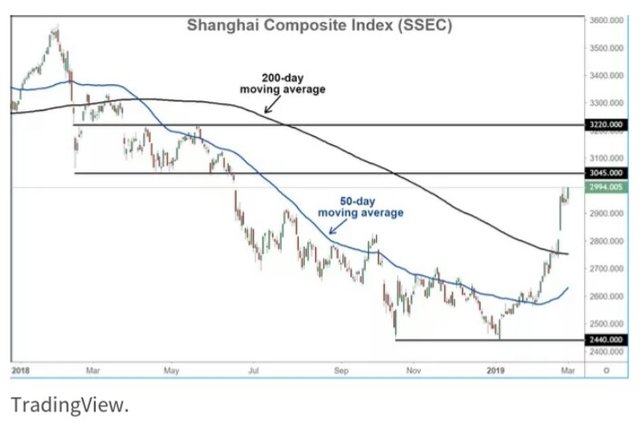

Shanghai Composite

We've mentioned U.S.-China trade multiple times, and permanently reason. It's on the minds of investors. Not solely have recently positive developments in trade negotiations between President Trump and Chinese President Xi helped boost U.S. markets, however they've conjointly done wonders for the Chinese markets. The Shanghai Composite is associate degreeindex of all stocks listed on the Shanghaisecurities market, that is that the largestsecurities market in China.

From its early January double-bottom low, the Shanghai Composite has up a fulltwenty second (as of the 3/1/2019 market close) - not atiny low achievement forassociate degree index. This even beats the performance of the S&P five hundredwithin the same fundamental quantity.within the method, the Shanghai index has climbed sharply on top of each its 50-day and 200-day moving averages.

Again, March are vital for the SSEC, with the planned summit between Trump and Xi slated for late March at Trump's Mar-a-Lago. With from now on positive developments between the 2 Presidents in March, the Shanghai Composite is probably going to any its rally. subsequent major resistance level to the upper side is round the three,045 level. With any escape on top of that level, subsequent majoroptimistic target is around three,220.