What is Forex?

What is forex? Why trade forex?

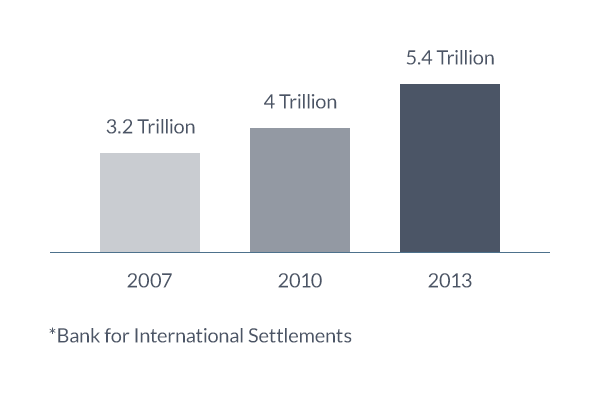

The foreign exchange market – or forex for short – is the buying and selling of currencies, and it’s one of the fastest growing markets in the world. From 2007 to 2010, forex market activity increased by 20%, with average daily turnover reaching nearly $4 trillion in April of 2010.

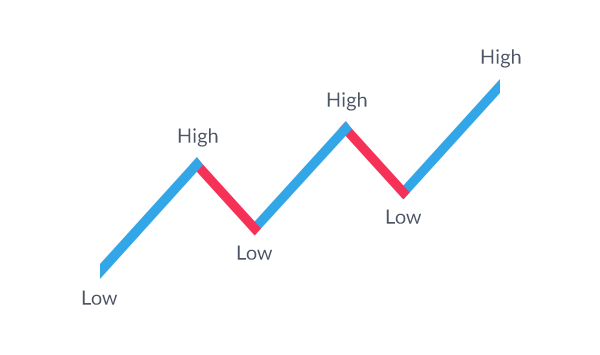

Forex trading works much like it does with stocks, you buy low and you sell high. The benefit of trading forex is that you don’t have to choose from thousands of companies or sectors. Plus, you can make things even simpler than choosing which company to buy.

For example, most people, even those that are new to forex, have an opinion on the US dollar and the US economy. They can easily take their opinions and translate them into a forex trade. Buying or selling US Dollars as simple as they buying or selling a company’s stock.

Also, another advantage of the FX market is that it doesn’t begin at 9AM and end at 4PM. Trading takes place 24 hours a day, 5 days a week. For most people 24 hour trading means they can trade before or after work. Plus, you have the flexibility to make your trades online.

Plus, you can buy and sell at any time, in up trends (also called bull markets) and in down trends (also called bear markets).

Each day, more and more traders find the ever expanding Forex market; making the shift from other asset classes for a variety of reasons.

Around-the-clock trading availability, wide geographical dispersion, and pure unbridled opportunity have contributed to the growth in this market, as average daily volume in the FX Market nears $4 trillion dollars ($3.98 Trillion per the Bank of International Settlements).

That’s nearly $4 Trillion, in one day.

The goal of this article is to explain the nuances of the Forex market, highlighting key similarities and differences from other popular trading vehicles.

The FX Quote

The first thing that most new traders will notice is the FX quote. When trading stocks or futures, quotes can generally be read easily, as they are one-sided; meaning when you read a quote on Google, you are looking at the price at which traders can buy or sell Google. However when you want to trade a currency, such as the Euro, you have quite a few options. If you want to trade the Euro, you can pick a variety of different ways of doing so.

You can choose to pair the Euro with the US Dollar. This would be the EUR/USD currency pair, which is the most common, liquid currency pair in the world.

Or perhaps you wanted to make a different type of play and choose to marry the Euro with another currency, such as the Australian Dollar (abbreviated AUD), or the Japanese Yen (abbreviated JPY).

Traders can choose to trade the Euro in a wide variety of ways, based on their goals and prevailing opportunities in the market.

This really isn’t all that different than stocks.

Let’s go back to our quote on Google. If GOOG is trading at $650.00, we can think of this in currency terms as GOOG/USD at $650 (Google quoted in terms of US Dollars is trading at $650).

We can also quote Google in terms of Euros.

Let’s say that the spot quote on EUR/USD was $1.50, meaning that each Euro was worth One Dollar and Fifty Cents. We can then divide our $650.00 price on Google with the exchange rate of 1.5 Dollars for every Euro (remember 1.50 is euro’s quoted in terms of dollars) to get the equation ($650/1.5 = $433.33). So Google, quoted in terms of Euros with the above information would look like:

GOOG/EUR = $433.33

Just like any other asset class, as the trader I want to look to buy low and sell high. Or sell high, and buy back to cover at a lower price for short positions.

When we sell a currency pair, we are selling it relative to another currency. Let’s take our EUR/USD example from above. If I were to sell the EUR/USD currency pair, I would be selling Euro’s. I would also be buying dollars. My goal in this trade would be for Euros to weaken, the Dollar to strengthen, and price to go lower so that I could cover my short position at a lower price.

Five Digit Pricing

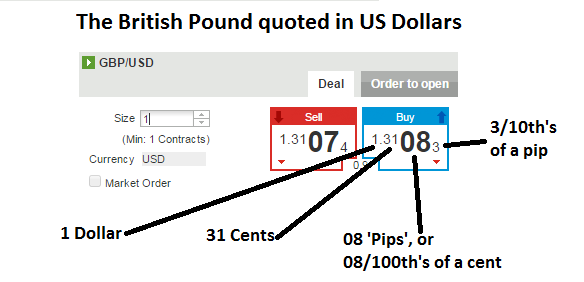

Another key difference in the quote of an FX pair is the fact that prices are offered, in many cases, to five digits. Most markets are denominated in a much more common sense manner, using prices that resemble those which we see in our everyday lives, quoted to 2 decimal places. When I want to buy some flour at the store, the price will be quoted 2 digits beyond the decimal place; like $4.56. If I want to buy a car, once again, prices are quoted 2 places past the decimal with a price such as $54,367.31.

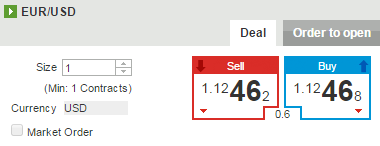

But in the FX Market, more precision is needed, and prices are quoted up to 5 digits beyond the decimal. Let’s look at a quote on EUR/USD for further examination.

Let’s assume that the bid on EUR/USD is 1.27218.

The first three digits of this number are just like any other price that we will see. In this case the Euro is worth One dollar, and 27 cents. The digits after help further define this quote.

The next 2 digits in this quote are called ‘pips,’ which is short for ‘percentage in point.’ In this quote, the Euro is trading at 1 dollar, 27 cents, and 21 pips, or 21/100ths of a cent. Another way of saying this same quote would be One dollar, 27 cents, and 21 pips.

The fifth digit of this quote is called a ‘fractional pip,’ and some forex brokers do not offer this fifth digit. The fifth digit further helps define price, and represents ‘tenths of a pip.’ In the case of the above quote, it can be read One dollar, 27 cents, 21 pips, and 8/10th of a pip.

Below is an example of another quote, with full annotation.

Many traders first entering FX wonder why such precision is needed with prices. That leads us into the next unique aspect of the FX Market.

Leverage

The current average daily range (over the past 14 days) of the EUR/USD currency pair is approximately 115 pips. Using the EUR/USD current market price of (1.2726 as of this writing), the average range is approximately .9%, or less than 1%.

This is much less volatility than many traders, including myself, are looking for.

In the FX market, leverage is available so that I can make these smaller moves work in the way that I want. For most traders in the United States, up to 50X leverage is available. Meaning, I could lever up a .9% daily move 50 times on my portfolio, theoretically allowing me to turn a .9% gain into a 45% gain at 50:1 leverage.

The thing that traders entering the FX Market have to keep in mind is that these excessive levels of leverage can be counter-productive.

Most professional traders keep their leverage inside of 10:1. Meaning, if they have $10,000 on deposit with their broker, they will keep their position sizes under $100,000. Or if they have $2,000 on deposit, they will keep their positions under $20,000.

To find leverage, we can simply multiply the account deposit times the leverage factor (such as 10X or 5X) to find the desired position size to stay inside of their desired leverage level.

Let’s walk through a full example together.

Let’s assume that our trader has $10,000 on deposit, and wanted to use a 2x leverage factor. This would allow them to open a trade of up to $20,000.

Let’s assume they wanted to speculate on the EUR/USD currency pair.

They could purchase (or sell) 2 standard lots (each standard lot is $10,000 of the base currency, or the second currency in the quote), to arrive at a position size of $20K.

Trader’s deposit: $10,000

Leverage Factor: 2X

Position Size: $20,000 (or 2 standard lots, as each standard lot is $10,000 USD)

What Are We Trading?

“…When money flows into a currency, it strengthens, and when money flows out of a currency, it weakens.”

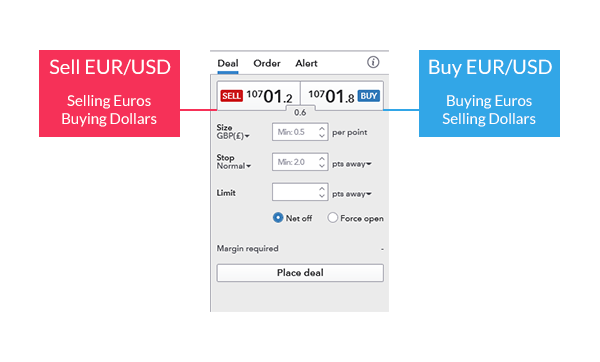

When we place a trade in the forex market, we are buying one currency and selling the other. This is why forex is traded in currency “pairs.” As a visual example, we can reference the image below.

If we buy a currency pair, like the EUR/USD, we are buying euros and selling dollars. We place this trade when we believe the EUR/USD exchange rate will rise and allow us to sell back our euros for a larger amount of dollars at some point in the future.

But in the forex market, we can trade the other direction as well. So we could sell the EUR/USD, effectively selling euros and buying dollars. With that trade, we would want the EUR/USD exchange rate to fall so we can buy back the euros for less dollars than we originally sold them for.

So not only do we have a goal of buying low and later selling high, we have the option to sell high first, and then buy low later. There are no restrictions on short selling and we do not need to own any euros prior to selling the EUR/USD. This is what people refer to as a “two-way market.”

What is a Pip?

“PIP” stands for Point In Percentage. More simply though, a pip is what we in the FX would consider a “point” for calculating profits and losses.

When trading a mini lot (10k units of currency), each pip is worth roughly one unit of the currency in which your account is denominated. If your account is denominated in USD, for example, each pip (depending on the currency pair) is worth about $1.

In all pairs involving the Japanese Yen (JPY), a pip is the 1/100th place -- 2 places to the right of the decimal. In all other currency pairs, a pip is the 1/10,000 the place -- 4 places to the right of the decimal.

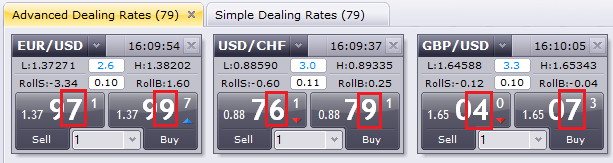

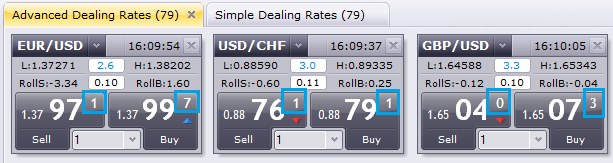

You’ll see that the digits for pips are in a larger font. This makes them easier to see.

Additional transparency is provided through most electronic platforms as each currency pair is quoted with precision to 1/10th of a pip. This fraction of a pip allows price providers to bring spreads down even further as they are not restricted to quoting in full pip increments. This is beneficial to you, the trader, because the spread is a component of your transaction cost.

You’ll notice that earlier in this post, we mentioned that the value of a pip for a 10,000 unit trade is roughly equal to 1 unit of your denominated currency (or $1 if you have a USD account).

Now, let’s identify what the actual value per pip is.

For those who wish to determine the calculation by hand, follow this method below (if you are not interested in the mathematics involved, then proceed to the next article).

First you start with the size of your trade. If you want the value of a pip for a mini lot, you start with 10,000. You then multiply your trade size by one pip for the pair that you are trading.

In this example we are going to calculate the value of a pip for one 10k lot of EUR/USD.

So since I am using 10k mini-lot, I’m starting with 10,000. I multiply 10,000 by .0001 since 1/10,000th is a pip for all pairs (except JPY pairs).

That gets me a value of 1. That will be valued in the “counter currency” (second currency) of the pair that I am trading. In this example, I am trading EUR/USD, so USD is the counter currency of the pair. One pip is worth 1 USD dollar for one 10k lot of EUR/USD.

If my trading account is based in US Dollars, then I will see $1 of profit or loss on my account for every 1 pip move that the EUR/USD makes in the market.

Now, if my trading account is based in Euros (EUR), I would have to convert that $1 USD into Euros. To do so, I just divide by the current EUR/USD exchange rate which at the time of writing is 1.3797. I’m dividing here because a Euro is worth more than a USD, so I know my answer should be less than 1. 1 divided by 1.3797 is 0.7248 Euros. So now I know that if I have a Euro based account, and profit or lose one pip on 1 10k lot of EUR/USD, I will earn or lose 0.7248 Euros.

Let’s do another example of GBP/JPY.

Again we’ll go with a one 10k lot trade.

This time a pip is .01 because it is a JPY pair.

10,000 times .01 is 100. Again, that “100” is in terms of the counter currency, so it is 100 Japanese Yen (JPY).

Now we need to convert that 100 Yen to the denomination of your account. If you have a USD based account, then you take the 100 Yen and divide it by the USD/JPY spot rate, which at the time of this writing was 105.11. That gets you an answer of $0.95 per pip.

The Basics of How Money is Made Trading Forex

Trading currency in the Forex market centers around the basic concepts of buying and selling.

Let's take the idea of buying first. What if you bought something (it could literally be almost anything...a house, a piece of jewelry or a stock) and it went up in value. If you sold it at that point, you would have made a profit...the difference between what you paid originally and the greater value that the item is worth now.

Currency trading is the same way...

Let's say you want to buy the AUDUSD currency pair. If the AUD goes up in value relative to the USD and then you sell it, you will have made a profit. A trader in this example would be buying the AUD and selling the USD at the same time.

For example if the AUDUSD pair was bought at 0.74975 and the pair moved up to 0.76466 at the time that the trade was closed/exited, the profit on the trade would have been 149 pips. (See the chart below…)

Had the pair moved down to 0.74805 before the trade was closed, the loss on the trade would have been 17 pips.

Also, it makes no difference which currency pair you are trading. If the price of the currency you are buying goes up from the time you bought it, you will have made a profit.

Here is another example using the AUD. In this case we still want to buy the AUD but let’s do this with the EURAUD currency pair. In this instance we would sell the pair. We would be selling the EUR and buying the AUD simultaneously. Should the AUD go up relative to the EUR we would profit as we bought the AUD.

In this example if we sold the EURAUD pair at 1.2320 and the price moved down to 1.2250 when we closed the position, we would have made a profit of 70 pips. Had the pair moved up instead and we closed out the position at 1.2360 we would have had a loss of 40 pips on the trade.

Remember, we are always buying or selling the currency on the left side of the pair. If we buy the currency on the left side, which is called the base currency, we are selling the one on the right side which is called the cross or counter currency. The opposite would be true if we were selling the currency on the left side.

Now let's take a look at how a trader can make a profit by selling a currency pair. This concept is a little trickier to understand than buying. It is based on the idea of selling something that you borrowed as opposed to selling something that you own.

In the case of currency trading, when taking a sell position you would borrow the currency in the pair that you were selling from your broker (this all takes place seamlessly within the trading station when the trade is executed) and if the price went down, you would then sell it back to the broker at the lower price. The difference between the price at which you borrowed it (the higher price) and the price at which you sold it back to them (the lower price) would be your profit.

For example, let’s say a trader believes that the USD will go down relative to the JPY. In this case the trader would want to sell the USDJPY pair. They would be selling the USD and buying the JPY at the same time. The trader would be borrowing the USD from their broker when they execute the trade. If the trade moved in their favor the JPY would increase in value and the USD would decrease. At the point where they closed out the trade, their profits from the JPY increasing in value would be used to pay back the broker for the borrowed USD at the now lower price. After paying back the broker, the remainder would be their profit on the trade.

For example, let’s say the trader shorted the USDJPY pair at 122.761. If the pair did in fact move down and the trader closed/exited the position at 121.401, the profit on the trade would be 136 pips.

On the other hand, if the pair was shorted at 122.761 and the pair did not move down but rather it moved up to 122.951 when the position was closed, there would be a loss on the trade of 19 pips.

In a nutshell, this how you can make a profit from selling something that you do not own.

In wrapping up, if you buy a currency pair and it moves up, that trade would show a profit. If you sell a currency pair and it moves down, that trade would show a profit.

Events That Have Affected Forex Throughout History

Among the many things that make Forex so interesting are the underlying themes that drive the market itself. When looking at it from a fundamental viewpoint, there are geopolitics, governments, societies, macroeconomics, and the behavior of numerous participants who vary greatly in objectives and approach. Throughout history, we have seen major events born from these themes that have greatly influenced the Forex trading environment. Here are some highlights from five impactful events.

The Bretton Woods Accord

The first major transformation, the Bretton Woods Accord, occurred toward the end of World War II. The United States, Great Britain, and France met at the United Nations Monetary and Financial Conference in Bretton Woods, NH to design a new global economic order. The location was chosen because at the time, the U.S. was the only country unscathed by war. Most of the major European countries were in shambles. In fact, WWII vaulted the U.S. dollar from a failed currency after the stock market crash of 1929 to benchmark currency by which most other international currencies were compared. The Bretton Woods Accord was established to create a stable environment by which global economies could restore themselves. It also established the pegging of currencies and the International Monetary Fund (IMF) in hopes of stabilizing the global economic situation.Though the Bretton Woods Accord lasted until 1971, it ultimately failed but did accomplish what its charter set out to do – to re-establish economic stability in Europe and Japan.

The Beginning of the Free-floating System

After the Bretton Woods Accord came the Smithsonian Agreement in December of 1971, which was similar but allowed for a greater fluctuation band for the currencies. In 1972, the European community tried to move away from its dependency on the dollar. The European Joint Float was then established by West Germany, France, Italy, the Netherlands, Belgium, and Luxemburg. Both agreements made mistakes similar to the Bretton Woods Accord and in 1973 collapsed. These failures resulted in an official switch to the free-floating system.

The Plaza Accord

It did not take long for traders to realize the potential for profit in this new world of currency trading. Even with government intervention, there still were strong degrees of fluctuation and where there is fluctuation, there is profit. This became clear a little over a decade after the collapse of Bretton Woods. The U.S. economy was booming but the dollar had risen too far, too fast. The weight of the U.S. dollar was crushing third-world nations under debt and closing American factories because they could not compete with foreign competitors. In 1985, the G-5, the most powerful economies in the world – U.S., Great Britain, France, West Germany, and Japan – sent representatives to what was supposed to be a secret meeting at the Plaza Hotel in New York City. News of the meeting leaked, forcing the G-5 to make a statement encouraging the appreciation of non-dollar currencies. This became known as the “Plaza Accord” and its reverberations caused a precipitous fall in the dollar.

Establishment of the Euro

After WWII, Europe forged many treaties designed to bring countries of the region closer together. None were more prolific than the 1992 treaty referred to as the Maastricht Treaty, named for the Dutch city where the conference was held. The treaty established the European Union (EU), the creation of the Euro currency, and put together a cohesive whole that included initiatives on foreign policy and security. The treaty has been amended several times but the formation of the Euro gave European banks and businesses the distinct benefit of removing exchange risk in an ever-globalized economy.

Internet Trading

In the 1990s, the currency markets grew more sophisticated and faster than ever because money – and how people viewed and used it – was changing. A person sitting alone at home could find, with the click of a button, an accurate price that only a few years prior would have required an army of traders, brokers, and telephones. These advances in communication came during a time when former divisions gave way to capitalism and globalization (the fall of the Berlin Wall and the Soviet Union). For Forex, everything changed. Currencies that were previously shut off in totalitarian political systems could be traded. Emerging markets, such as those in Southeast Asia, flourished, attracting capital and currency speculation.

The history of Forex markets since 1944 presents a classic example of a free market in action. Competitive forces have created a marketplace with unparalleled liquidity. Spreads have fallen dramatically with increased online competition among trustworthy participants. Individuals trading large amounts now have access to the same electronic communications networks used by international banks and merchants.

Interest Rate Expectations: The Driver of Forex Rates

Talking Points

• Future interest rate expectations take precedence over the headline rate

• If a country has a high interest rate, but no further increases are expected, the currency can still fall.

• If a country has a low interest rate but is expected to raise interest rates over time, its currency can still rise

While it is easy for Forex traders to understand the logic of why investors move money from lower yielding currencies and assets to higher yielding assets and currencies. They may also believe that the simple mechanism of supply and demand is responsible for currency movement. However, this is only part of the story. The expectation of future interest rate increases or rate cuts is even more important than just the actual rates themselves.

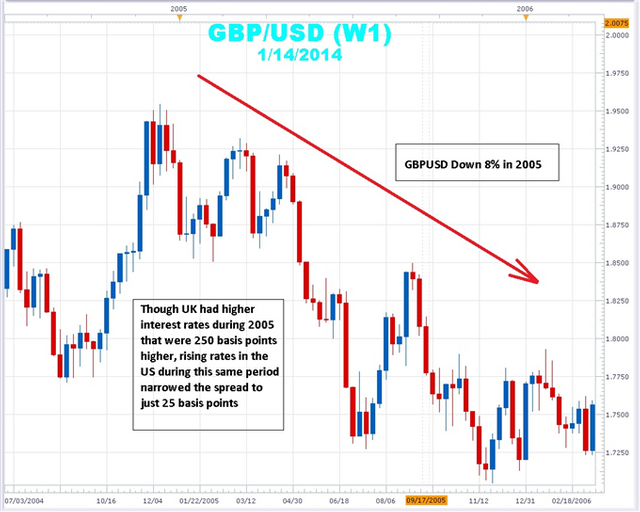

Learn Forex: Rate Expectations Sinking GBPUSD

For example, the United Kingdom had interest rates that hovered between 4.5 and 4.75% which was much higher than the 3.25% in the United States. Conventional wisdom would dictate that GBPUSD should have went up during this time period. However, as seen in the chart above, this was clearly not the case as GBPUSD headed lower. The reason for this was the expectations that the US Federal Reserve would begin a rate tightening cycle. The 250 basis point premium enjoyed in the UK at the beginning of 2005 narrowed to just 25 basis point difference. The Fed raised the interest rate from 3.25% in December 2004 to 6.00% by May of 2006.

If a central bank decides to one day, hike rates and then say that they are through raising rates for the foreseeable future, then a currency can still sell off though the interest rate was raised.

On the other hand, if a central bank begins to aggressively raise interest rates to curb inflation and inflation remains stubbornly high, investors around the world realize that there is nowhere for rates to go but up. The currency of that nation may continue to rise as expectations for more rate hikes become widely anticipated.

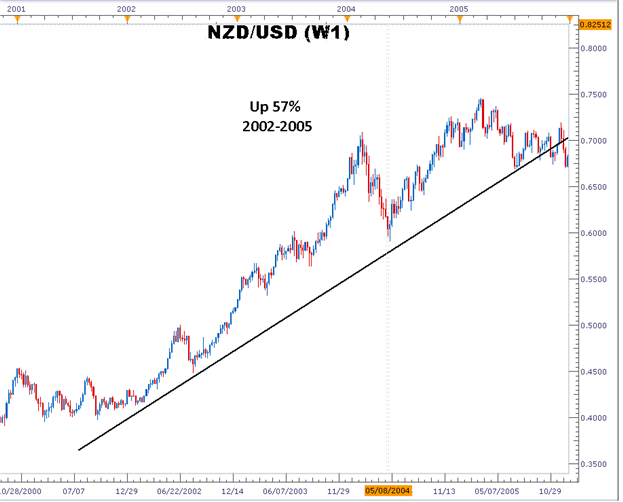

Learn Forex: NZD/USD Uptrend with Interest Rate Increases

In the example above, NZDUSD rose 57% as the Reserve Bank of New Zealand continued to raise rates. From 2002 to 2005 the RBNZ raise interest rates from 4.75% to 7.25% while the Fed increased rates from 1.73% to 4.16% over the same period. Investors in search of higher yields trade the low yielding dollar for the higher yielding NZD. The result was NZDUSD rallying 57%.

If the chances that interest rates can be raised in the future is near zero, investors will want to look elsewhere for a country whose rates are rising. The market is a discounting mechanism which means favorable news, like interest rate hikes are already built into the price. To continue to offer value, there must be an indication that rates will continue to rise to justify the inflated price in the currency. Without any expectations of a rate rise, there is little incentive for new investors to enter or for past investors to remain.

On the other hand, extreme levels of interest rates can shift and move interest rate expectations in the opposite direction because investors believe that interest rates may revert back to the mean. Much like a rubber band stretching to extremes and snaps back, interest rates behave in a similar manner. The extreme interest rates of the 1980’s in the U.S. that topped out at 20% saw a snap back toward 3% in the 1990’s. The extreme low interest rates around the world following the Global Financial Crisis of 2008 may revert back to the mean which is much higher than current 3%. The bottom line is that Forex traders have to not only watch the headline currency rate, but they also have to monitor interest rate expectations in order to keep themselves on the right side of the trade.

Forex Market Size: A Traders Advantage

Talking Points

• The Forex market is the largest and most liquid market in the world.

• The US dollar makes up the majority of Forex transactions

• The Forex market’s deep liquidity is advantageous to traders by allowing them to enter and exit the market instantaneously

According to the Bank for International Settlements, foreign-exchange trading increased to an average of $5.3 trillion a day. To put this into perspective, this averages out to be $220 billion per hour. The foreign exchange market is largely made up of institutional investors, corporations, governments, banks, as well as currency speculators. Roughly 90% of this volume is generated by currency speculators capitalizing on intraday price movements.

Unlike the stock and futures market that are housed in central physical exchanges, the Foreign exchange market is an over-the-counter market, decentralized market completely housed electronically. Banks from Hong Kong to Zurich and from London to New York. Though most investors are familiar with the stock market, they are unaware how small in volume it is in relation to the Forex market.

In the diagram above, it can be easily seen how the FX market’s $5.3 trillion per day in trading volume dwarfs the equities and futures markets. In fact, it would take thirty days of trading on the New York stock exchange to equal one day of Forex trading!

Traders from other markets are attracted to the Forex because of this extremely high levels of liquidity. Liquidity is important as it allows traders to get in and out of a position at with ease 24 hours a day 5 ½ days a week. It allows large trading volumes to enter and exit the market without the large fluctuations in price that would happen in less liquid market. This means that if you will never get in a position because of the lack of a buyer. This liquidity can vary from one trading session to another and one currency pair to another as well.

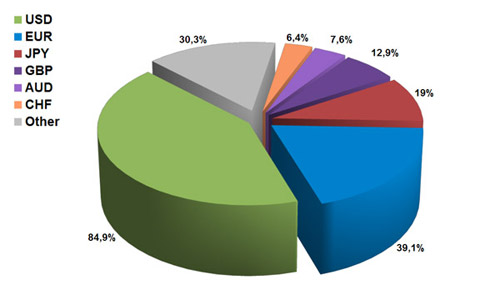

As the most traded currency, the US dollar makes up 85% of Forex trading volume. At nearly 40% of trading volume, the euro is ahead of the third place Japanese yen that takes almost 20%. With volume concentrated mainly in the US Dollar, Euro and Yen, Forex traders can focus their attention on just a handful of major pairs. In addition, the greater liquidity found in the Forex market is conducive to long, well-defined trends that respond well to technical analysis and charting methods.

In sum, the Forex market size and depth make it the ideal trading market. This liquidity makes it easy for traders to sell and buy currencies. This is why traders from all different asset classes are turning to the Forex market.

Advantages of Trading the FX Market

Talking Points:

-High-Leverage & Low-Cost of FX

-Intermarket Moves Keep FX Always Relevant

-24-Hour/5 Access To an Active Market

This article will give you a 10,000 ft. view of why retail or individual traders come to the Forex Market. Since the Forex Market became available to non-bank traders in 1999, the popularity relative to other markets have exploded. Even though there are too many reasons in all to list here, you will come to a better understanding to see if this market is for you.

Before we get our hands dirty and our minds working about the benefits of FX, you should keep one thing in mind. All markets, whether it is private equity, real estate, stocks, options, or FX are really about one thing. Markets are about seeking a satisfactory return of capital relative to the level of risk you’re taking on at any one time.

High-Leverage & Low-Cost of FX

The Forex Market allows you to trade with large amounts of leverage. Leverage allows to control a position or trade that is larger than your capital base. Therefore, with a $5,000 account, you could open up a trade of $10,000, $50,000, or $100,000, if you so desire.

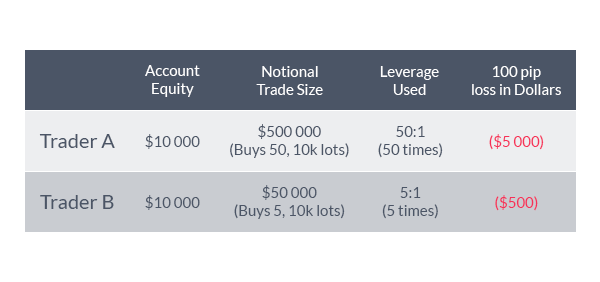

Learn Forex: A Simple Look at How Leverage Can Affect You

Of course, there is always a trade off in any market and Forex is no different. Your profit or loss on any trade is dependent on the trade size open. Therefore, if you open a trade that is too large relative to your account balance and that trade goes against you, the effect can be more than you bargained for.

The other side of the coin to the Forex Market is the low cost to start an account. The brokerage that you decide to trade with will set the required start-up account balance. However, as a trader, less isn’t more as we found it is far better to find an appropriate balance over the lowest possible balance.

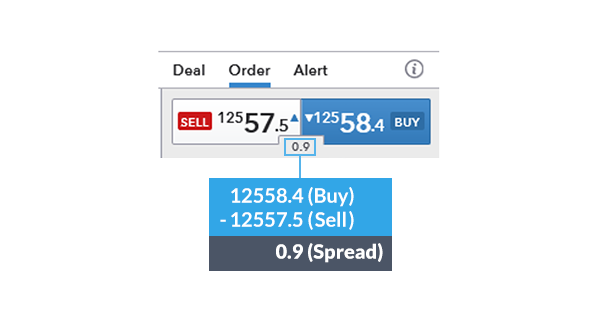

The other aspect of low costs is displayed in the transaction costs. The transaction costs in Forex is known as the spread and is found by taking the different of the bid and ask measured in pips. All things being considered, the lower the spread, the quicker you will realize a profit should the market move in the direction of your analysis.

Intermarket Moves Keep FX Relevant

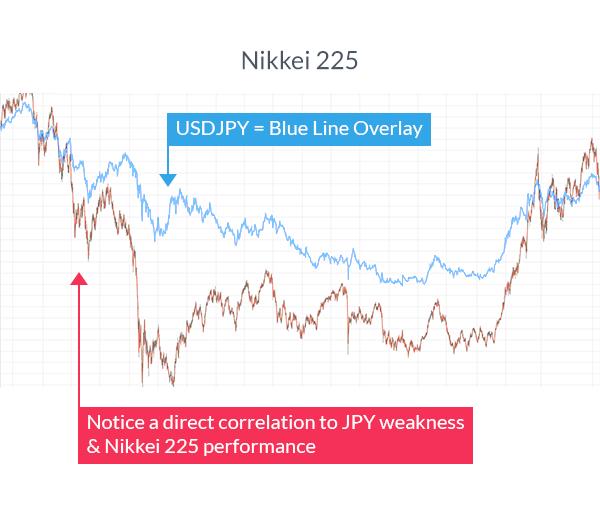

In 2013, the hottest stock market in the world was the Nikkei 225. The Nikkei 225 is Japan’s stock market which was boosted by an aggressive monetary policy via the Prime Minister of Japan and the Bank of Japan. As the world becomes more and more interrelated, it shouldn’t surprise you that the JPY was similarly one of the biggest performers in 2013 which assisted in the Nikkei 225’s 57% return in 2013.

Learn Forex: FX Is Correlated To Many Markets

As you can easily imagine, because every other financial market is priced in global currencies, a shift of global capital flow into a new market in a different country would could massive buying or selling of currencies. This type of thinking or analysis is known as Intermarket analysis or Intermarket correlations. The reason that this natural occurrence is seen as a major benefit of trading this market is because it can add rocket fuel to your trade idea. Excellent trends can develop in the Forex Market for a myriad of reasons but if a global capital flow shift begins to develop, you may find the trend your trading moving faster and further than you imagined which makes this a great market to trade.

24-Hour/5 Access to an Active Market

Trading stocks isn’t kind to those who work for a living and want to actively trade. The New York Stock Exchange opens after most start their work day and almost certainly end before their day ends. Stock trading hours in the US are open from Monday through Friday 9:30 a.m. to 4:00 p.m. ET. This means that if you want to have an active trading style, you’ll likely need to pay someone else to do the trading for you.

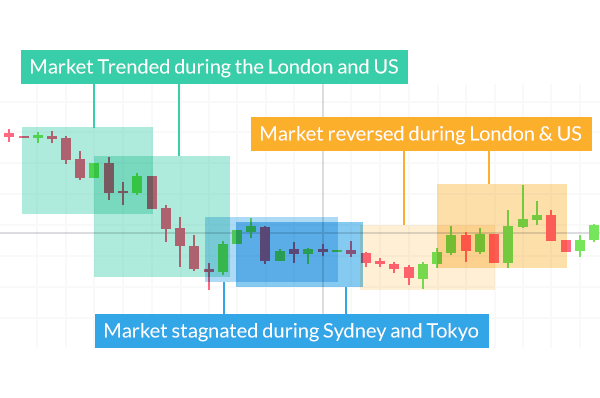

This dilemma doesn’t exist in the Forex Market. Living in the Western Hemisphere, you can easily trade the Japanese Consumer Price Index or Reserve Bank of Australia Rate announcement in the evening. What’s more, there are three distinct zones in any given trading day with distinct trading opportunities so that regardless of your preference on how to trade, there’s likely a few opportunities a day for you to try and capitalize on.

Forex Vs Other Markets

Talking Points:

• Forex provides many advantages over traditional markets

• The Forex market estimates over $4 Trillion in daily volume

• Costs and market access make Forex accessible virtually around the clock

The foreign exchange market, also known as Forex, has unique characteristics that set it apart from traditional equities and futures markets. The good news is these differences provide many advantages that traders can benefit from on a day to day basis.

So today we are going to look at how Forex stands apart from other markets

Volume

The first difference between Forex and other markets is the sheer size of the Forex market. Forex is estimated to be a $4 trillion a day market, with most trading concentrated on a few major pairs. This dwarfs the dollar per dollar volume of all of the world’s stock markets combined average only about $84 billion per day.

Having such a large daily trading volume can bring many advantages to traders. Primarily added volume allows traders to receive execution. While all markets are prone to gaps, having more liquidity at each pricing point better equips traders to enter and exit the market rapidly when it counts!

24 Hour Markets

Forex is an over the counter market meaning that it is not transacted over a traditional exchange. Trading is facilitated through the interbank market. This means trading can go on all around the world during different countries business hours and trading sessions. Therefore the Forex trader has access to trading virtually 24 hours a day 5 1/2 days a week!

The Forex market also has no restrictions on trading. This means you can enter, exit, or modify a trade at your convenience. This is vastly different from trading a futures or equities contract on a regional exchange where markets only have limited availability for a small portion of the day. In short, Forex trading allows you to trade the strategy that you want, when you want!

Costs

Most Forex accounts trade without commission, and there are no expensive fees or data licenses. The cost of trading is the spread between the buy and sell price, which is always clearly displayed on your screen. This is quite different than trading other markets. When trading equities or a futures contract, you often have to pay the spread along with a commission to a broker while not including a data charge for a price stream and charting!

While you may not see the costs of trading other contracts, Forex spreads are always transparent. Below you will see the spread of the EURUSD highlighted inside of the executable dealing rates. This way you can calculate the cost for your position size upfront prior to execution!

Trading Decisions

Lastly it is worth mentioning that Forex trading revolves around 8 major currencies. This keeps the time of analysis low when you are looking for a trade! This is one area where more is not necessarily better. Consider that there are over 1867 companies listed on the NYSE (New York Stock Exchange). Even if you have a fundamental opinion of the market, this can complicate the task of honing in on just one stock to trade.

Reading a Forex Quote

Quoting Convention

Quotes in the currency market can be a bit confusing because any position you take in the market is actually two different positions.

In FX you’ll see currencies listed in Pairs. This permits you more options in FX then you get in other markets. For example, you may be bullish on Euro and will therefore buy want to buy the Euro. In FX, you can chose what you want to buy those Euros with. You can buy them with USD, or you can buy them with JPY if you prefer. You can buy Euros with a long list of other currencies that we offer.

So a currency pair will be displayed in this manner.

EUR/USD

The first currency listed is referred to as the “base currency”. The second currency listed is considered the “counter currency”. So for EUR/USD, the Euro is the base currency and the US Dollar is the counter currency. If the pair is trading at 1.4700, that quote tells us how much of the Counter currency it would cost to buy one unit of the base currency. So it would cost $1.47 US to buy one Euro.

When it comes to placing a trade, keep in mind that any time you take a position you are doing so in terms of the base currency. So if you buy a pair, you are buying the base currency. If you sell a pair, you are selling the base currency. Then it’s easy to keep in mind that you are always doing the opposite with the counter currency. So, if you buy EUR/USD, you are buying Euros and selling US Dollars.

If that is still a bit too confusing, you can think of it simply this way. Buy if you expect the rate to go up. Sell if you think the rate will go down. Simple as that!

You will always see a two-sided quote in FX. In your account you will always be shown a Buy price and a Sell price. They can also be referred to as the “bid” and “ask” respectively. The Buy price is the rate that you can buy that pair at, and the Sell price is the rate at which you can sell that pair. The difference between the two prices is called the “spread”. The spread is determined by the price providers and liquidity in the markets at that precise moment.

A spread exists for all tradable instruments, stocks, bonds, futures, options, etc, it just isn’t always visible to the trader.

So now you hopefully understand how currency pairs are quoted and what you are buy and what you are selling when you place a trade.

See You in Part 2. Happy Trading!