Coins Augur reputation (REP) is now traded on the Gatecoin at a price of about 0.02 btc, or about $8 per coin. While the network is operating in the test mode, trade in fact is receipts, and are not real tokens, and the guarantor in this case is the exchange Gatecoin.

Before the start of the network and the auction will become liquid, it would be nice to have on hand an adequate evaluation model for the REP tokens. This article presents such a model.

Please note that all models are only attempts to come closer to reality, and when it comes to cryptocurrency markets where the flourishing of manipulation, no one can predict the actual outcome of events. However, models can be mathematically clear view of things, providing a firm basis for reflection on the feasibility of the investment. Overall, our analysis here serves as an example of how the blockchain investments may greatly exceed the investment in common stocks, which greatly contributes to the openness of data and measurability, which allows to build more accurate models.

ЯндексПереводчик

Dollar turnover platform Augur

During krautsalat Augur, 11 000 000 REP tokens were distributed among the participants. Each REP token gives its owner one vote when confirming the outcome of an event in the prediction market Augur. Possession of the token also allows you to claim half the market fees. Thus, it is possible to simulate the return on investment on the token, considered an indicator called dollar turnover. Dollar turnover shows how many dollars were involved in transactional turnover of the platform, Augur.

If the Augur platform turnover amounted to $1 billion for the year, and the average size of commissions for trading transactions amounted to 1%, the REP token holders will receive all dividends in the amount of $1 billion x 0.01 x 0.5 = $ 5 million. Each coin will be applied to the payment of $5 million / 11 000 000 = 0,45$. Therefore, if today I will give you 1 REP token, then in a year you can expect to receive $0,45 in compliance with the above input data.

Now the question is: what is the value of owning a privilege to $0,45 per year?

The real value of REP tokens

Of course, getting the money in a year not nearly as attractive as getting them right now: for example, you could invest somewhere else (say in government bonds), and also to get some income. Thus, the current value of our REP token needs to be slightly reduced in size without risk of the interest rate (which in the U.S. is about a 2.35%) and will be then $0,435.

Next you need to consider that dividend payments will be repeated. Current valuation should include the turnover of the platform and in the more distant future. In other words, we can simulate the possession of tokens REP as the ownership of securities from which we receive annual dividends. This is called a perpetuity.

On this basis, the price of the REP token (P) can be considered as the current value perpetuities of paper, on which the dividends are paid (D). This current value is considered according to the following formula, where ‘r’ is, without the risk rate:

Since the size of dividend payments D every year the same, this model corresponds to the simplest case where, under our assumption, the growth of the platform Augur does not occur. However, it is easy to see that D is a monotonically increasing function, which describes the growth, which will raise the price D. the perpetuity Model thus reveals the lower bound of the price the REP tokens, suggesting that Augur will be able to maintain a minimum level of annual turnover.

Then we can ask the question: is the $8 token is a reasonable estimate of the lower boundary of the average annual turnover of Augur in the future?

What can come on the basis of current assumptions about price

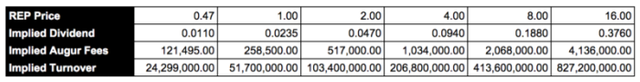

If you fix r and know P, we can calculate the expected dividend payment D. Knowing D, we can calculate the estimated turnover of the platform, Augur.

If the current price of REP token is 0.02 btc (about$ 8), and we assume that r = 0,0235, the estimated size of the annual dividend payment D = 8 x 0.0235 = $0,0188. This, in turn, suggests that the size of the total annual payments to all holders REP will make $2 068 000; If it is 1% of the total turnover of the platform, then the turnover should be $413 600 000 per year, which roughly corresponds to half of the current market cap of Ethereum.

We can do similar analysis for different levels of the REP tokens, starting from $0,47 (approximate price of the tokens during their initial sales).

Whether the annual turnover of the platform Augur is $413,6 million is justified?

Check for sanity

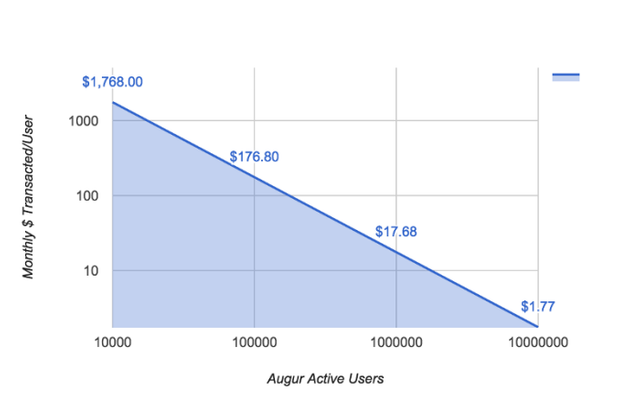

Given our initial data for constructing the model, the following chart shows the tradeoff between number of users and their average monthly spending on Augur to the extent that it might justify the price of a REP token of $8.

For example, from 1 million active users each life needs to spend $17,68 per month (or $212,16 annually) Augur; in this case the buyers REP can really count on the price of $8 for the token.

How justified are the expectations of the user base Augur 1 million people in the near future?

The user base Augur in comparison with the dynamics of its growth in other startups

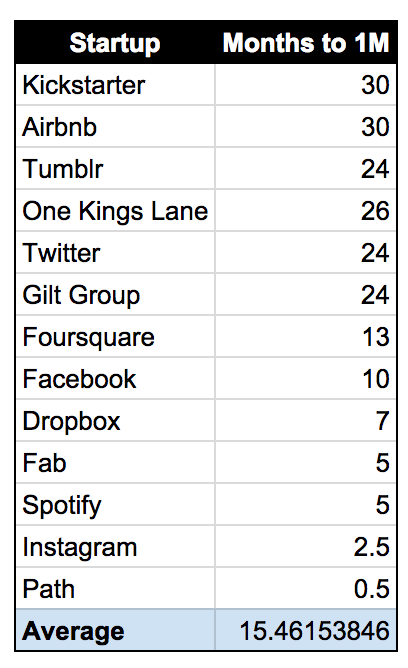

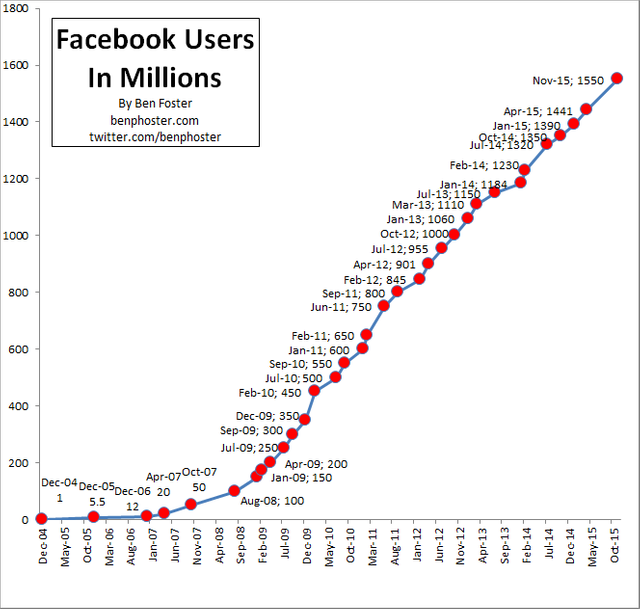

Let us approach the problem from the point of view of attracting users. As a starting point we can measure the speed of attracting the users of other successful startups. On the one hand, some startups can grow and take market million users in 2.5 years. In other cases, the development of a startup can take viral in nature and lead it to success literally overnight.

The following table shows the number of months it took thirteen successful companies to reach 1 million users:

You need to understand one important thing: we are not taking into account 95% of startups failed in the early stages of its development. However, the table above shows that even for well-funded companies with experienced management teams, the benchmark of a million users is not trivial to achieve and requires a lot of time.

Simulation of growth of user base Augur and the 10-year yield

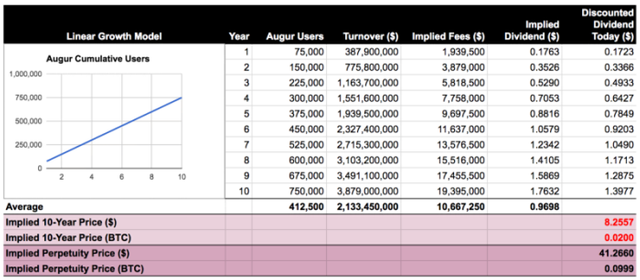

Let's shift our perspective and try to understand what should be the growth of the user base Augur for the reasonableness of price of $8 per token REP. For this purpose we simulate the dynamics of annual growth of the user base Augur in the next ten years, and then will calculate a reasonable current value of the token on the basis of the ten-year yield REP tokens. Let's call it the assumed 10-year price REP tokens.

Today, the official Twitter of the project Augur has about 7,000 subscribers, and the thread on Reddit about 1,800 subscribers. Many of those who read the thread Reddit ETH (of which more than 10 000), also monitor the project. Optimistically assuming that those who are now watching the project Augur later become users of the platform and will attract another 5 friends each, we get the approximate number of users for the first year about 50-100 thousand people.

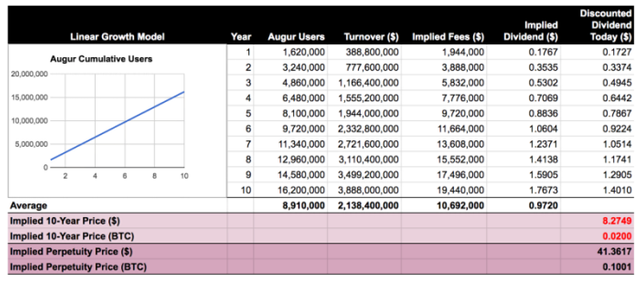

Applying the linear growth model, we see from the table below how to grow the user base Augur. According to the model, to justify the price of a token in the amount of 0.02 btc, the average annual turnover should be equal to $2.1 billion over the next ten years. This, in turn, assumes monthly expenses of $215,5 each user that seems realistic not an inflated figure.

On the other hand, we can ask the question: how many users of the first year will be required to maintain that price in accordance with the conservative estimate of the monthly cost of say $10 per user?

Answer: of 1.62 million users in the first year of the launch of the platform. Growth to 1 million users for 7.4 months puts the project in a row with such a record for rapid growth as Dropbox, Spotify or Instagram. Too optimistic.

10-year income according to exponential growth model

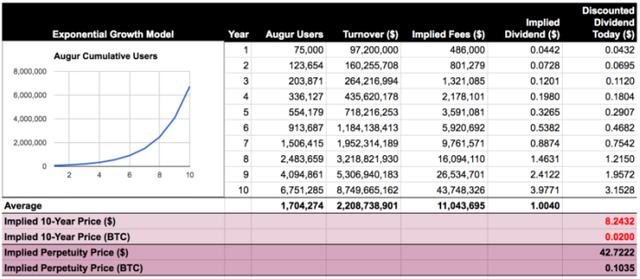

For many successful projects tend to increase its user base due to the multiplier network effects, and because of the exponential growth model may be more appropriate to describe this case. The exponential model also helps to see a more adequate monthly indicators of user costs.

The following table shows the development of the user base Augur with 75 thousand users in the first year and an annual increment in their number by 50%. The result of the analysis are the monthly costs per user that are equal to a much more reasonable value at $54 per person per month.

With these inputs the user base grows over time more conservatively compared to the previous linear model. Augur will attract one million users only in the seventh year, but at the same time, the current price level for REP tokens would be justified.

The opportunity to ‘play’ with the above model of the turnover of Augur and the price of REP tokens

Want to try to simulate the price the REP on your own with the settings to your taste? Copy the model into their own Google spreadsheets and share with us the results.

Summary and conclusions

The price of REP tokens Augur theoretically can be modeled as a perpetuity of the current values or current values with 10-year yields, based on the growth model of the project Augur. We can use the real annual interest profitability of existing products to determine the size without risk bets for the purposes of our simulations.

If you use the model of linear growth of the user base, it is impossible to achieve a model with reasonable outcomes: if you apply a conservative growth of the user base, each user will have to spend thousands of dollars on Augur annually. On the other hand, conservative spending lead us to the need of the incredibly rapid growth of this user base.

Assuming exponential growth of the user base, using our model, we received an aggressive growth of the project, which cannot be considered completely unreasonable for a successful product. The monthly user spending on Augur also began to look more real. However, the required turnover is still measured in the billions, which implies the speed of growth Augur that he will have to stay ahead of its parent platform Ethereum.

Based on these findings, we are inclined to believe that the REP tokens at the moment overvalued. Lower price will allow us to bring and linear and exponential models in a more realistic region. At the same time, we wish the team and the Augur project success. As the appearance of the actual operation of the platform, we can adjust the parameters of the model.

https://translate.google.com/translate?hl=en&sl=ru&tl=en&u=https%3A%2F%2Fbitnovosti.com%2F2016%2F09%2F28%2Fpricing-rep%2F

All of your posts are copy pastes and you've been warned before. !cheetah ban

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay, I have banned @tolyn.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@pfunk

This user have seeking for my help.

Please read. I don't think , this was intended.

Just because someone missed using any reference , we have to total banned the user.

I am sure by now, you know who I am. Anything please shoot me a message.

Cheers @bullionstackers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Source- https://bitnovosti.com/2016/09/28/pricing-rep/

It looks like this is just a translated copy of the above source.

Copying/Pasting full texts is frowned upon by the community. Sharing content by itself adds no original content and no value.

Share content and add value by:

Repeated copy/paste posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

If you are actually the original author, please do reply to let us know!

Thank You!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit