Market Analysis

Bitcoin retraced from its 2019 high of $13,970 last week, with the price testing the strong support level of $10,600. On the higher side, immediate resistance is seen around $11,350. A lot of technical indicators signalled price correction in Bitcoin after the run-up. 14 period RSI was in the overbought zone and price moved sharply above the Bollinger Band. Profit booking in the token came on higher volume compared to the volume during price acceleration. With the sharp decline in price, the chatter of further correction has accelerated in the community.

However, from a fundamental point of view, the asset remains strong. Further, the injection of new Tether units in the market has been positively correlated with Bitcoin price, a factor that could have played some role in last week’s rally. Followed by Thursday’s price crash, Tether supply has been increasing since Friday which further hints that bulls might be taking the control this week. Although the phenomena are unique and not entirely decoded, investors should keep an eye on Tether market cap to take a decision.

While there was a gradual decline in the Bitcoin Long contracts, a sharp decline in the Shorts on 30 June 2019 indicates that the short sellers are not expecting a further decline in the near term. On the fundamental side, there has been a significant increase in the hashrate with the mining power reaching 69 exo hash per second. As Bitcoin dominance raises to 61%, altcoin performance has been muted throughout the last week with maximum money flowing in Bitcoin. Overall, Bitcoin remains in a strong area with pullback and consolidation presenting a good opportunity for entering a trade.

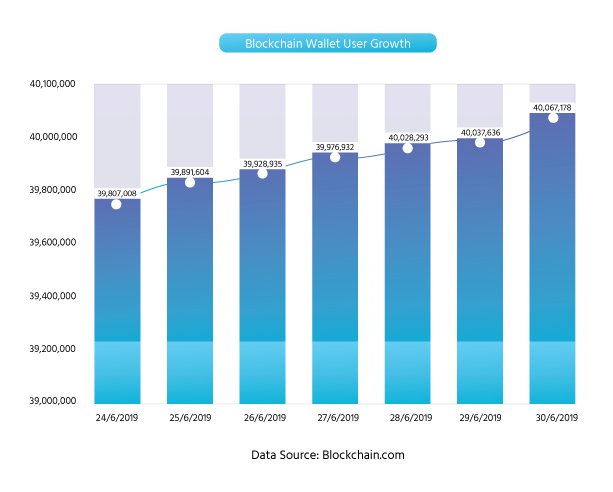

Weekly Growth Blockchain Wallet Users

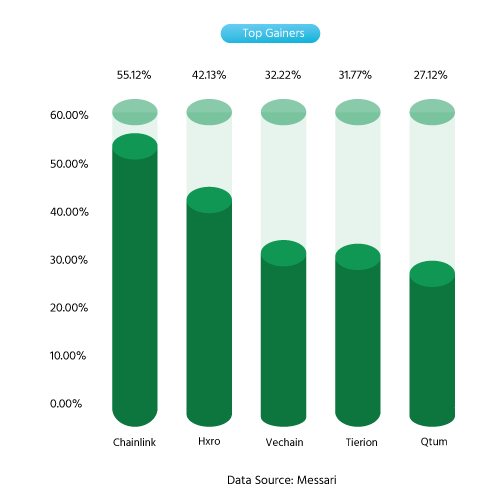

Weekly Gainers & Losers

Major Developments this Week

-> Bitcoin — Inflation hit Venezuela is seeing record volume in Bitcoin at 45 billion in recent weeks reaffirming the tokens safe-haven status in the country.

-> Ethereum — Transaction volume has surged significantly from the February low of 3,80,000 to 1,000,000 last week signalling improving fundamental attributes of the asset. All-time high transactions in Ethereum was clocked in January 2018 at 1,300,000.

-> Ripple — Ripple has signed a deal with Coinfirm, a startup which might make XRP FATF regulation compliant.

-> Litecoin — All eyes are on Litecoin with the halving event roughly a month away. Halving event has been big for the token with the price accelerating almost 400% before the last such event in 2015.

-> Ethereum Classic — No major update was reported in the token last week.

-> Bitcoin Cash — Bitcoin Cash has registered more than 10,000 installs on Google Play. Further, Twitch also reinstated BCH payment on its platform. In another development, BCH would be added as the additional funding option in the Brave browser 0.68 version of the app.

-> EOS — EOS founding company Block.one has announced the launch of its social media platform Voice on EOS platform

-> TUSD — No major update was reported in the token last week.

Wider Market Update: Weekly News Analysis

-> Report from NakedSecurity concluded that phishers and scammers are now using more sophisticated English with perfect grammar to lure crypto investors.

-> Crypto Industry in Switzerland has urged the authorities to enable seamless financial services to the start-ups, citing the hurdles they are facing due to non-cooperation of banks and other financial entities.

-> Government of Malta has announced that all the rental contracts will be registered on a decentralised ledger.

-> Iran has blamed Bitcoin miners for the surge in electricity consumption in the country. The Energy minister of the country claimed that each miner consumer electricity equivalent to 24 houses consumption.

-> In India, the country’s largest cryptocurrency exchange, Koinex shuts down due to the unpredictable regulatory environment.

-> Latest Coinbase data suggests that in the United States, California holds the maximum Bitcoin.

-> VeChain foundation has announced 25 million dollar buyback giving way to the speculations on price rise. A bigger development for the company was when Walmart China entered in partnership with VChain to launch blockchain based food safety platform.

-> Data collected by app tracker, App Annie suggested that crypto app growth has remained stagnant in 2019 despite Bitcoin price surge.

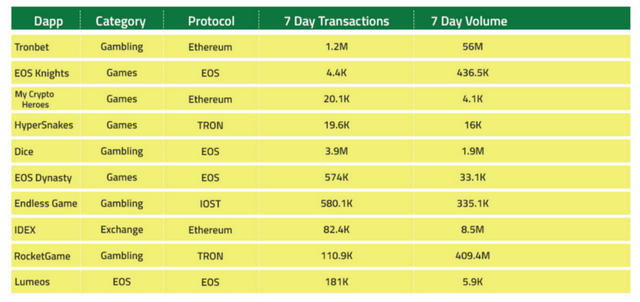

Weekly Dapp Statistics

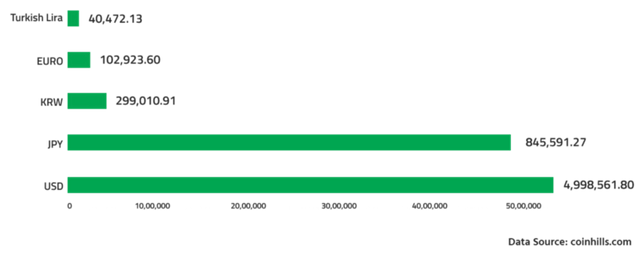

Fiat to Crypto Trade