Dear trading community,

today I want to show you what can happen to a well diversified short straddle portfolio, when you start it, before a real big move happens.

Going back in history September 19 2008 was probably one of the worst days to start out a short premium portfolio.

First let's have a look what happened back then:

1. VIX:

2. IWM:

3. FXE:

4. TLT:

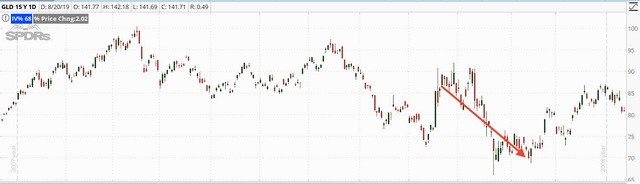

5. GLD:

6. XLE:

As described in my books, IWM, FXE, TLT, GLD, XLE are the most uncorrelated underlyings, but in times when IV pops, usually all of these make a big move.

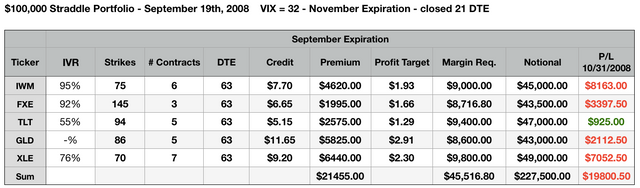

Now let's have a look what would have happened to a $100k portfolio, where you sold straddles in these five underlyings, starting September 19 2019.

Rules:

- IWM, FXE, TLT, GLD, XLE short straddles

- $100k portfolio

- starting September 19 2008

- end October 31 2008 (21 DTE)

- Closing at 25% of max or 21 DTE

- November expiration 63 DTE (October had only 28 DTE, so I was going farther out)

- equal buying power among all underlyings

- IV was really high at the starting day, so I went up to 45% of buying power reduction on the overall portfolio or 3x notional whichever was lower

Results:

All in all a 19.8% loss.

Almost 20% down is still a pretty big loss, but definitely not the end of the world.

Had you defended the positions by going inverted, when the break evens got hit, your losses would have been probably $3,000 - 5,000 lower.

During the same time the S&P 500 Index lost 22%, so despite having a 2.28x leverage, you still outperformed the SPY.

Whatever style or strategy you trade, it is crucial, that you never over leverage.

It is not strategy which kills, but leverage.

I learned this truth the hard way....

If you want to learn more about options trading, please check out my books:

The first book is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My third book is available on Amazon, Google and iTunes.

Have a great trading day,

Stephan Haller

Legal disclaimer: These are not trade recommendations. Options involve risk and are not suitable for all investors. The trades shown above are for educational purpose only.