Dear trading community,

Here is a look at my sample portfolio for Friday September 20th 2019.

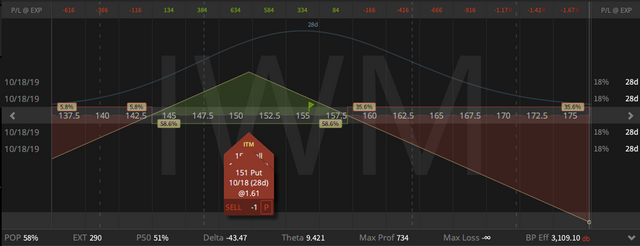

IWM Straddle

On Wednesday, September 4th 2019, I sold an 30 delta strangle in IWM. On Monday, September 9th 2019, I had to roll up my put to defend the position.

My overall credit for this position is $7.03.

My profit target for this position is $2.01, so I'm going to close this position when it trades for $5.02 or at 21 DTE.

At the moment this position is down 31 cents ($31 per one lot).

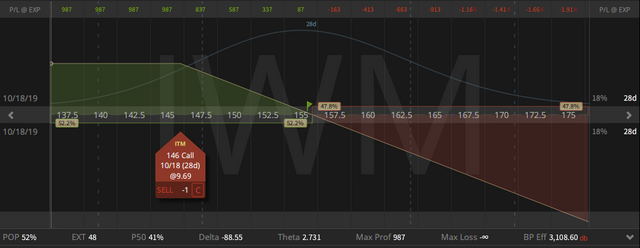

October IWM Short Call

On Friday, August 23rd 2019, I sold this call for a credit of $4.53.

Since this is a very small position and because of my traveling I missed defending this position.

Next week I will have to sell a put against it to defend this position.

At the moment this position is down $5.16 ($516 per one lot).

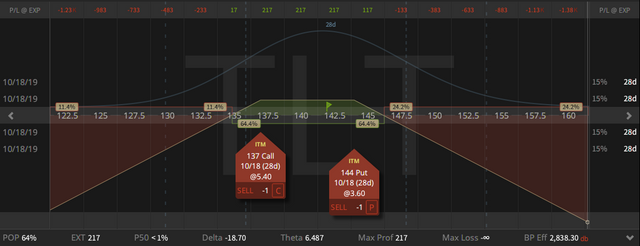

TLT October Inverted Short Straddle

On Wednesday, September 4th 2019, I sold an 30 delta strangle in IWM.

On Monday, September 9th 2019, I had to roll up my put to defend the position.

On Friday, September 13th 2019, I had to roll down my call and go inverted.

My overall credit for this position is now $7.29.

Since the most I can make on this position is 29 cents, I'm looking for a scratch, so I'm going to close this position when it trades for $7.00 or at 21 DTE.

At the moment this position is down $1.88 ($188 per one lot).

Rolled October SPY Aggressive Short Delta Strangle into a Straddle

On Friday, August 23rd 2019, I sold the aggressive short delta strangle for a credit of $10.03.

On Monday, September 16th 2019, I rolled up my put into a straddle for a credit of $1.43.

My overall credit for this position is now $11.46.

My profit target for this position is $3.56, so I'm going to close this straddle when it trades for $7.90 or at 21 DTE.

At the moment this position is down $3.34 ($334 per one lot).

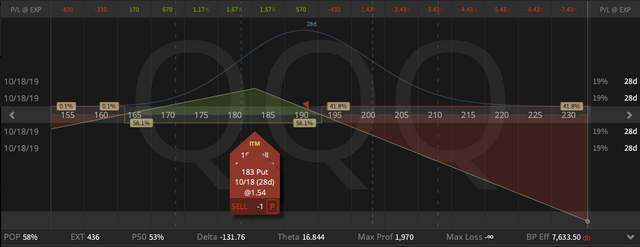

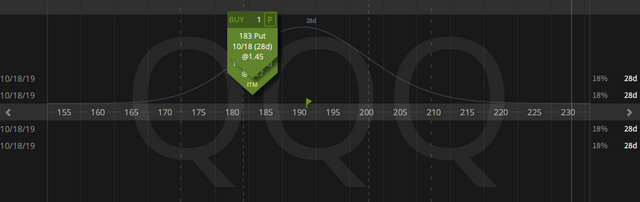

QQQ Synthetic Covered Put

I also had to roll up my put in this position for a credit of $1.

My synthetic basis on the covered put is now $179.97, so I have to collect $1.91 more in credit on this position, until I can break even.

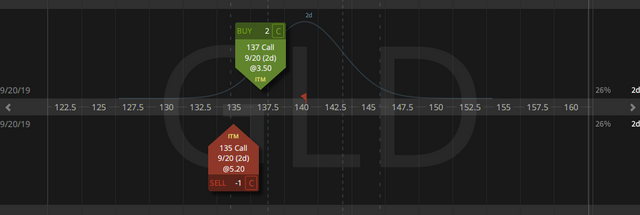

Closing QQQ October Short Straddle

The overall credit on this position was $11.54.

On Friday, September 20th 2019, I closed it for a profit of 89 cents ($89 per one lot).

Closing GLD September Call Ratio Spread

I sold this one for a net credit of $1.26 on Thursday, August 1st 2019.

On Wednesday, September 18th 2019, I closed it for a loss of 23 cents ($23 per one lot).

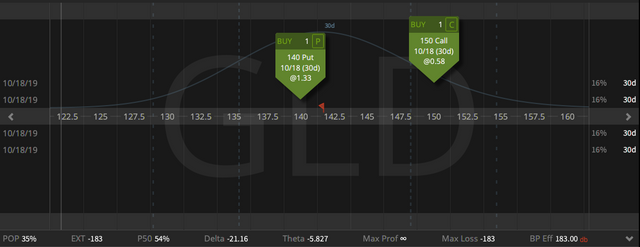

Closing October GLD 30 Delta Strangle

On Friday, August 23rd 2019, I sold this position for a credit of $3.33.

On Wednesday, September 18th 2019, I closed it for a profit of $1.50 ($150 per one lot).

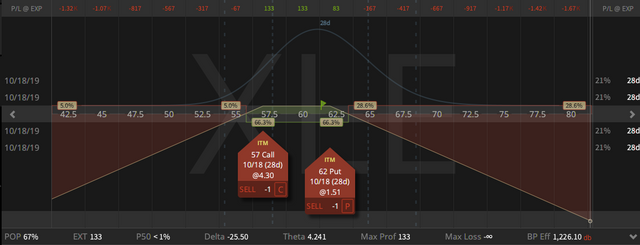

XLE Inverted Strangle

This position started out as an October 57 short straddle.

The price of XLE kept going up, so I had to go inverted.

The overall credit on this position is $5.25.

At the moment this position is down $1.08 ($108 per one lot).

Books Update

With the completion of my latest book, I have now a trilogy.

The first book is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My third book is available on Amazon, Google and iTunes.

Have a great weekend,

Stephan Haller

P.S. Probably no update for the next two weeks.

Legal disclaimer: These are not trade recommendations. Options involve risk and are not suitable for all investors. The trades shown above are for educational purpose only.

wow, you seem to be very very good at doing this! How many positions do you have open at a time? And congrats on the new book!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

I have always 5-10 different positions on.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So schön kann das Leben als Steemit Rentner sein ;-) Ein !BEER und 6 Trendotoken für Dich !trdo vom rentenbot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @rentenbot, you are successfuly trended the post that shared by @stehaller!

@stehaller got 6 TRDO & @rentenbot got 4 TRDO!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for posting from https://steemleo.com 🦁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit