Dear option traders community,

it happens very often, that I see people posting trade ideas on Twitter which are virtually risk free at the first look.

These trades are usually made in smoking hot stocks like Beyond Meat (BYND) or Tilray (TLRY).

Usually these "risk free trades" turn out to be very big losers and even blow up accounts.

Let's have a look at an actual example:

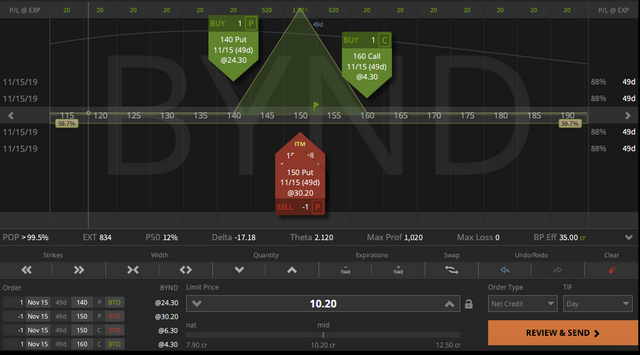

Iron Fly in BYND

A $10 wide iron fly, where you collect a credit of $10.20 looks like a risk free trade, since the most you can lose in an iron fly is the strike width minus the credit received.

So if you get filled at $10.20, you lock in a profit of 20 cents ($20 per one lot).

Since we live in efficient markets this shouldn't be possible, since there is no free lunch.

Something smells fishy here, right?

Hard to Borrow Fee

If you are shorting stock, your broker lends you shares of stock, which you sell in the hope of buying them back at a lower price later.

Usually this is no problem in very liquid underlyings like SPY, QQQ, IWM, AAPL, FB, but if there are not much shares of stock available to borrow in an underlying, the borrowing fees shoot up (supply and demand).

In BYND you will get charged 268% of the stock price per year at the moment.

In hard to borrow stock like BYND it pays for the buyer of a call to exercise it and then lend out the stock.

If you have a short call on, like in an iron fly, there is almost a 100% chance, that your short call gets exercised and you get assigned a short stock position. Even if you close it immediately, you will be charged the hard to borrow fee for several days, since it usually takes about 3 days until settlement.

Let's do the math:

BYND is trading at 152 at the moment.

152 * 2.68 = $407.36 per share of stock per year.

Since one option contract consists of 100 shares of stock, your annualized fee would be $40,736.

If you close your position right after assignment and the settlement takes 3 days, you would have pay ($40,736/365)*3 = $335 per 100 short shares of stock.

It happens very often, that novice traders see those type of trades, think there is no risk and do up to 100 contracts and blow up their accounts.

Please stay away from these trades!!!!

If something looks too good to be true, stay away from it!

If you are interested in learning everything you need to know about options trading, please check out my books.

Books

With the completion of my latest book, I have now a trilogy.

The first book is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My third book is available on Amazon, Google and iTunes.

Have a great weekend,

Stephan Haller

Legal disclaimer: These are not trade recommendations. Options involve risk and are not suitable for all investors. The trades shown above are for educational purpose only.

So schön kann das Leben als Steemit Rentner sein ;-) Ein !BEER und Trendotoken für Dich !trdo vom rentenbot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @steemrentetoken, you are successfuly trended the post that shared by @stehaller!

@stehaller got 0.22473000 TRDO & @steemrentetoken got 0.14982000 TRDO!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

View or trade

BEERat steem-engine.Hey @stehaller, here is a bit

BEERfor you. Enjoy it!Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for posting from the https://steemleo.com interface 🦁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit