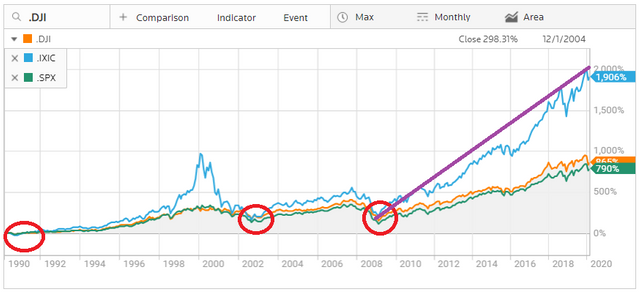

Based on the charts, since 2008 the stock market only direction worldwide is higher-high over and over again. As the old saying goes “what goes up must come down” the only question is when. Timing the market is not an easy task but if you have tested-of-time strategies, times like these are the great opportunity to gain. Big winners go on big runs for three primary reasons. One, the market is jamming. Two, their fundamentals are humming. Three, institutional investors — mutual funds, large investment advisors, banks, pension funds — bet heavily on true industry leaders.

Investing in the equity market means confronting a constant barrage of economic, political, and financial information – with most of it tilting to the negative. Then there are times when prominent commentators up the ante and start to talk of “Financial havoc” scenarios, forecasting economic ruin and using phrases like “the death of equities.” Many investors, understandably, get shaken up by such predictions, and scurrying to the perceived safety of bonds or stay liquid until the market stabilized.

But sudden decisions to ‘run for the exits’ at the first mention of financial turbulence is almost always wrong. That has consistently been my opinion on the matter, but now there is actually research showing that heeding financial tumult predictions can lead to poor, negative performance. A recent study looked at financial turmoil predictions made by over 15 prominent financial thought leaders – from asset managers, to journalists, to the heads of major banks and hedge funds. These prognosticators and managers made financial armageddon predictions at various times over the last 10 years. We know that when the stock market is near all-time highs, it’s evident each prediction was wrong. But the study takes matters a step further, and examines the actual financial impact of moving from stock market class to safe-haven investments like physical assets classes (gold, silver, land, etc.) at the time of doomsday prediction.

The stock market crash could become a great buying opportunity for long-term investors. I heavily invested during the stock market price depression in 1990-1991, 2001-2002, 2008-2009 and liquidated in 2014-2017. Then positioned my cash into physical assets. Today, I reaped and enjoyed the fruits of this investment.

Now, you may be asked why quit in the stock market in 2014-2017, when the fact market goes to the ceiling mostly in 2018-2020? My reasons are simple, I believed in an 8-10 year market cycle yet to come, don’t be greedy, and the market can never go up and up endlessly.

Things are likely to get worse before they get better, so it’s hard to time the bottom. Stock market doyens always remind “Don’t catch a falling knife” was a more popular refrain in recent months as analysts questioned whether the stock market crash would persist longer than expected.

While no indicator is a magic bullet for identifying a market bottom, monitoring a few broad economic indicators can give you a good idea of how healthy the global economy and the stock market are. After all, stocks go up when the companies represented by those stocks do well, and companies tend to do well when the global economy is healthy and functioning correctly.

Conclusion:

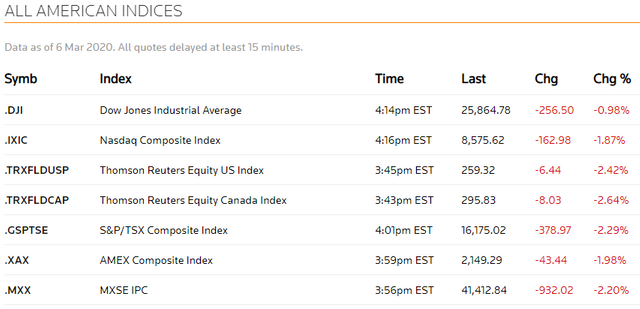

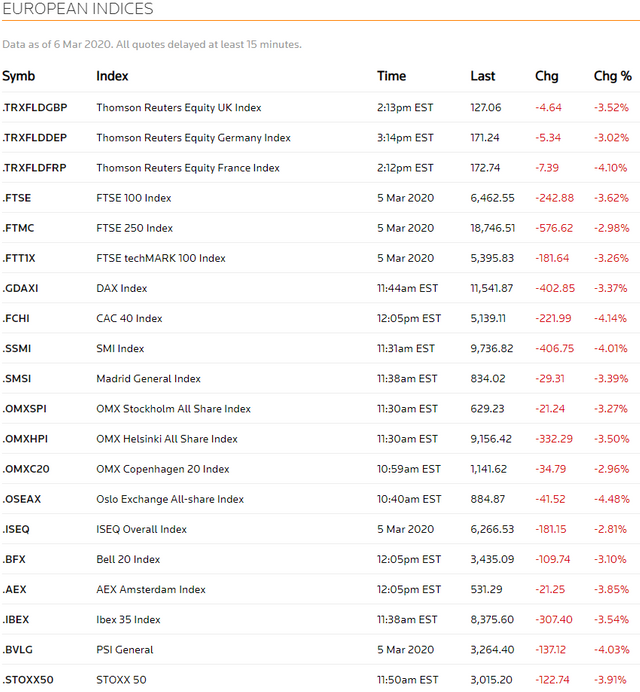

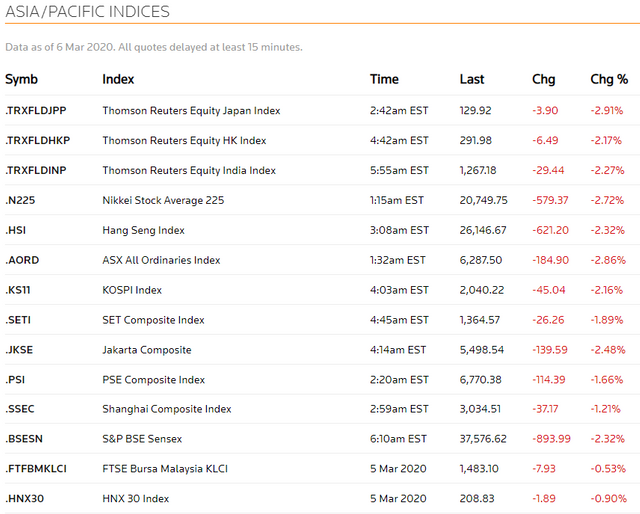

Just a few weeks ago, the Dow Jones Industrials shed more than 4,000 points and the S&P 500 fell for the eleventh time in the past 12 recent sessions as the looming recession prompted a sharp cut to global economic growth forecasts for 2020.

In the case of the Philippine Index (PSEi), my first support level, the low points on 25-Oct-2018 at 6,941.10 has just broken. Then the next support level, the low on 23-Dec-2016 at 6,499.90 will be rolled off the edge. If hits, the next support level, the low on 26-Sep-2011 at 3,715.01 may soon be the brim of certainty, and before you knew it, the so-called financial havoc points, the low on 17-Mar-2009 at 1,775.44 is not a far-fetched reality.

As I always said, the guiding principle in stock investing is “buy low, sell high”. No one can predict the direction of the market. Spotting the top or bottom of a market isn’t easy. Prediction is a tricky game, and like any game, one thing is sure, there is always a loser and the winner takes it all!

And now, am I dreaming? Oh well… only time will tell!

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of any securities.

Related Topic:

https://steemit.com/steemph/@php-ph/is-ecomonic-collapse-looming

Please upvote and follow me on https://steemit.com/@php-ph.