Most people think money is that paper fiat currency you’re carrying around in your wallet. It is what we have grown accustomed to and it is a commonly accepted societal norm that we rely on this paper because our government says it’s ok.

Source

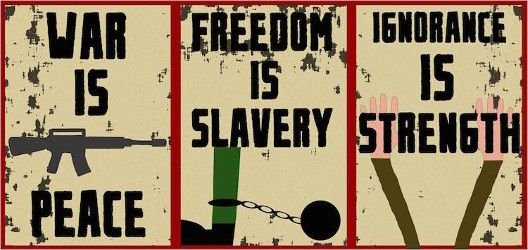

As you go down the rabbit hole and investigate the history of money it becomes pretty clear that this paper stuff isn’t really worth holding. The smart and rich people put their wealth into assets and they only use currency for transactions and cash flow. But the majority of people are clueless about the way the financial system and central banks are working and in many cases they don’t want to know. For the Sheeple “Ignorance is Bliss” and many people of my generation are just too busy with their heads-down-bums-up just trying to make ends meet so they can make their mortgage payments. They don’t have time to look into this stuff themselves. They just want to trust that the governments and banks will do the right thing….and we know where that leaves us…..

Source

So when I figured some of this money stuff out, the first thing I wanted to do was share some of the knowledge I had gained. At first I was just blurting and ranting about things and my arguments might have seemed barely coherent as it can be such a complex subject. Trying to explain it and doing a bad job usually just results in the “Thousand yard stare” and you can see your audiences eye’s glaze over – you’ve lost them.

Source

I’ve come to appreciate that getting past the mainstream brainwashing about money is actually a bit of an art form. Now I am no expert as I’m still struggling to convince even my own parents about this subject. They want to just trust their mainstream financial adviser, who has them chasing yield in the typical crowded trades that will continue to pay them 5-6% a year until we hit the next financial crisis and it takes a big dump. They already lost something like 50% of their retirement savings in the last GFC and they still haven’t got it back. But that’s the thing with old people – they have a bad short term memory.

Source

So I’ve come around to thinking that the best way to teach family about money is to actually get someone else to do it. You can focus on facts as there are a lot of good documentaries about the history of money, which was in fact Gold and Silver for centuries. Since I’ve changed tact I am very close to making a breakthrough. I actually got my father to watch this recent video “Bitcoin : Beyond the Bubble” which runs for only 35 mins but it has an excellent opening 10 minutes or so where it summarises the history of money. My dad actually shared the video with his Probus group, and believe me – That is a big deal!

Source

Mike Maloney appears in that video and while I have followed him for a couple of years now it’s only recently that I have come to appreciate that he is very focused on Investor Education. He speaks very well and explains complicated subjects in easy to understand language. He has also done an excellent series called “Hidden Secrets of Money” and I am confident that if I can get my parents to sit through that then I’ll be half way there.

Source

My realisation is that it is quite difficult to explain the Cryptocurrency phenomenon without a basic understanding of money and currency because it is important to understand what problem Cryptocurrency is actually trying to solve. I think it is wise to start by looking back through history and understanding the important role Gold and Silver has played (and still plays) in our financial systems before looking forward to Cryptos. In Part 2 I will talk about that next step.

http://educateinspirechange.org

http://themillenniumreport.com

https://www.pixoto.com

https://au.finance.yahoo.com

https://vimeo.com

https://goldsilver.com

checking some of your posts and ya got my full vote, interesting post. I would say gold and real estate are the best things to hold to create some wealth.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. I broaden that a bit and put both gold and real estate into a category of "tangible assets", but I can't bring myself to buy real estate at these lofty valuations, so it's gold for me right now :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yaa I guess gold is easier to sell. I heard silver is going to be a hot commodity in the near future because is going to be used for many things involving tech. gadgets

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The "system" is purposely obfuscated to ensure a level of confusion and complexity to the common person. That's why not many people understand it and many many people are bored by it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree. It's a shame as it doesn't need to be so complicated a subject.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Trying to explain it and doing a bad job usually just results in the “Thousand yard stare” and you can see your audience's eyes glaze over – you’ve lost them.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't understand your comment. You have just copy-pasted my own words and then self-voted yourself. You haven't even upvoted the original post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So I’ve come around to thinking that the best way to teach family about money is to actually get someone else to do it

I don't really get when you said those words, does it mean that the family couldn't have an expert who could educate his family on the issue of money.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I feel like it's meant that because @buggedout is a close family member they are more likely to dismiss what he is saying as unofficial biased information rather than that of a 'trained' professional or documentarian.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. You've pretty much nailed it there @bogglemcgee

I seem unable to convince them, whether it's because I am a family member who they discount, or it's because my presentation skills aren't good enough. I have come around to thinking I need to find good professional material from other sources to help make my case.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Gold and Silver cryptos are already here.

Check out Unity Ingot (UNY) and the whitepapers on Cryptobontix.com.

Unity Ingot currently has the highest 7 day return on Coinmarketcap.

Thanks for post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, @buggedout for the nice article.

I have a similar problem with my family. Especially smart and successful people are difficult to convince that they've been fooled.

I have found a good way, though. I ask them about fiat currencies. Questions like those:

I totally agree. The problem is that we all take the meaning of money for granted. No one teaches us about it.

I have found Andreas Antonopoulos's speeches very enlightening.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you have a link to any particular speech that interests you?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Check this one:

https://steemit.com/bitcoin/@alketcecaj/andreas-antonopoulos-in-an-old-but-good-introduction-to-bitcoin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Links to specific speeches would be good!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. I haven't seen much of Andreas speeches. Thought he was more of a blockchain guy, but I might have to study him up a bit more before I write part 2 :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I totally kno the feeling...ive been trying to tell people about our financial system for years now! the federal reserve is nothing part of our government and the fed got started in 1913 and was talked bout how to come about there ponzi scheme and rob the amerikan people. they print money out of thin air and charge interest on it and we tax payers have to pic up the bill! our money has no value and backed by debt not gold juss debt and is juss a fiat currency no worth shit. fractional reserve banking is where they can lend 10 times the amount they have in there banks! they been printing for over 100 years now and it will collapes and it will make the great depresstion and the 2007 2008 crash look like a disneyland trip!

ALL THEIR PLANS ARE ON THE US CURRENCY

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is interesting. I'm tempted to go and get some US notes now to try that out! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've tried to explain to people how our money isn't actually money but I too sound like a nut job. It's really an uphill battle against indoctrination. One paradigm shift that may help with helping your close friends and family to understand is by having them make the paradigm shift to understand that goods aren't getting more expensive, but their money is getting more worthless. Great post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's an interesting way of looking at it. Reverse the inflation paradigm. I might try that one too :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post, I’ve just found you one here and will be following you. I’m looking forward to the next part. It’s so hard to discuss matters like this with family and especially older family members.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. I'm still working on Part 2. Hopefully I can do the topic justice :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The colonies had no problem issuing their own FIAT money and then the king said "how dare you prosper" and mandated that they use only gold and silver, which being a commodity could never take the place of money, or an abstract unit of measure, which the colonial script was almost money, except that unit creation was still controlled by the government, and you cannot have a system of measure where units cannot be freely created for the function of representing value, or miles, or anything. Ultimately cryptocurrencies run into exactly the same performative impossibility: unit creation, unit creation which comes standard with any standard of measure, we had a war for independence thus because money supply with gold and silver was not capable to represent the value the people created. Equally intellectual property alone will overtake the supply of whatever precious or other vested value there is behind a currency.

www.bibocurrency.com Money indeed can be a hard thing to explain, especially considering that money for most of it's history wasn't really money but value in it of itself.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I’m not sure if you have seen the “zeitgeist” documentaries or not but they do an impressive piece on how modern day banking works (a bit of a scam if you ask me) I can did up the you tube links if your interested but by the sounds of things you’re pretty clued up on the topic.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have actually. I think it was the first Zeitgeist movie that kicked me down the rabbit hole again a while back and it was quite good though still a bit "full on" for mainstream consumption. The follow up Beyond Zeitgeist I think had a real socialist slant to it from memory which put me off. But the original was very good for a viewer already tasting the red pill ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ha ha yes. I couldn’t agree more.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i totally agree with you my parents still ask me how i make my money at first they say that its illegal because its bitcoin but i tried explaining it to them that it is another form of currency that doesn't use banks and somehow it worked with my parents. sometimes you need to show them visually whats happening for them to better understand, i think thats why most people trust bills and physical currency because you can feel secured if they have it physically.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm glad to hear that worked for you. My parents are getting quite elderly now so sometimes I have spent a bit of time explaining crypto and the next time I see them it's like they've forgotten. That's why I am working on the history side of things. I probably won't ever get them into crypto but if they even just get a handful of gold stocks or physical metal it'll be a small victory :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Gold and Silver are real money and not fiat money that is based on the value of each of the country's governance.

Look, for example, Indonesia, their currency is so low that SGD 1 = 10,000 rupiah. This is ridiculous. I just bought 10 silver 1-ounce coins as a start. Upvoted!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Money by definition cannot be a unit of measure and fluctuate in it's measure. Anything that can deflate or inflate cannot be money, it can only be commodity, money can only be an abstract, not a real tangible thing. If a large reserve of silver is unleashed on the market your silver will be in the same boat FIAT is in, and you cannot use silver for much, you might as well invest in any other commodity because most commodities have an utilitarian or intrinsic value attached to themselves.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good post. I studied this topic at university. It is simple. Sadly, money =debt and slavery. In the past banks would actually protect your gold in a vault . Money is not gold anymore, so what do banks do now??? Create debt for everyone :)

This is why I am so interested in crypto. Governments are controlled by bankers and rich ass familys. The people pay the debt, not the government. People cannot see it or they choose to ignore it as they are not taught, labelling it conspiracy theories. I tried to educate some people in the past, they just couldnt be bothered to understand. Most people I hang around do understand and agree. Not sure if people are waking up or I decided to associate with open minded people lol. Some guys at work believe I am stupid for buying some bitcoin when it recently dipped to 6k :) Diversity is important, just put money on different assets and pay debts fast.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Banks just skim off all economic activity. It's almost a private tax on the velocity of money. It's no wonder we have such a large, and growing gap between the "haves" and "have nots".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have to agree with you on all of what you say. Even getting a member of my family to watch a video would be tough, so good on you for even achieving that.

There's a reality bubble. Everyone's living in their own version of it, and unless their reality includes seeing the trouble that's been brewing for, well forever, then they won't see it until it's too late.

I've found that if you truly care about topics, you need to find arguments for and arguments against, and take all sides into account and then figure out what's true. It's a long, often difficult task, but being ignorant isn't a solution. No one's going to bail you out when everything comes crashing down. You'll either be prepared or you won't, and screaming, "Why didn't someone warn us?" won't have much weight, when someone did. Someone in our own family who we discounted repeatedly.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh man...the "Reality Bubble" - I love that!

I know I am going to have the "I tried to warn you" moment, just like I did after the GFC hit in 2008. But it's a small consolation and the funny thing is people never even remember the warnings. I've suffered from the Cassandra Curse for many years now. Maybe it's the way I deliver the message, that's why I'm looking for new ideas.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ooh, very teasy. I can't wait to see how you tackle this situation. I have seen plenty of people give the 'thousand yard stare' as I have tried to explain complex social systems to them. On a positive, I offered my parents to have a go at a little crypto and they were happy to try an investment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's great to hear your parents are having a go! I am also eager to see how I tackle this situation. It's very much an "in progress" thing and I am fishing for ideas here as much as sharing my own experience! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I worked some twenty years in corporate treasury departments so understand a little about finance and money. But never enough. I am a crypto virgin still.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If you're here on STEEM then you are no Crypto virgin. This is a great place to start. Owning STEEM and STEEM DOLLARS is owning Crypto. So well done on losing your virginity! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I was born in Brazil and we have a popular phrase : Santo de casa não faz milagres. Translating : A home saint opperates no miracles. People only believe in someone that is outside the family. For years I tried to make my parents think about silver and gold, to no avail. They started thinking about it only when a famous economist talked about it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sounds like we have a lot in common! Thanks for sharing your own personal experience :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post! A lot of information to chew on over lunch! I have been pouring silver for awhile and that kinda helped bridge the gap of bringing my family to silver and gold! 👍🏼🍺🥓

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Pouring silver - Very cool. That might be a novel way to approach this too. Thanks for the idea :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha, yeah. Better show them a video or article made by someone else if we can't inform them abt things as well as we'd like.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think the best way to discuss with someone else is showing them some short presentation just like you did, youtube or short video, and brochures with a good design will attract his/her attention more on it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great read. I’m the daughter of a broker/financial planner, and trying to explain Crypto has been met with great hesitation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I can only afford one bar... You think it’s enough?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

385.95 oz's

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My brother and I are working hard on the others. Mike Maloney's videos are great for showing the history of money and current state of money.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

there is some money can forget everything, forget his family, do not we are affected with money to forget family, family remain number one, happiness can not be bought with money, thanks @buggedout

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I always try to learn new things about money every day

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post lots of information! and I agree education is key!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Money is just a by-product of creativity, skill, strength and other minors. Money to me isn't all about the physical stuff @notes, it's about your worth even when the notes can't be seen.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've never think this side of the currency though. Thank you for the article :D @buggedout

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

🍜 terrific & impressed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post, great thoughts :):):)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have received an upvote from STAX. Thanks for being a member of the #steemsilvergold community and opting in (if you wish to be removed please follow the link). Please continue to support each other in this great community. To learn more about the #steemsilvergold community and STAX, check this out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice @sami100

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit