Have You been Doing Everything in your Power lately to Acquire more Ounces ??

I Know that this Past Year I have Done Everything Possible to get Out of the FIAT Currency to get into Gold and Silver............

Nobody knows the EXACT Time when FIAT Currency Hyper Inflates into Oblivion, but at this Point in Time you Need to make Every Effort to Protect your Wealth and Stuff Like Gold is what I'm Talking About...................

Gold and Silver are Going to make a Big Difference in Your Life very Soon................

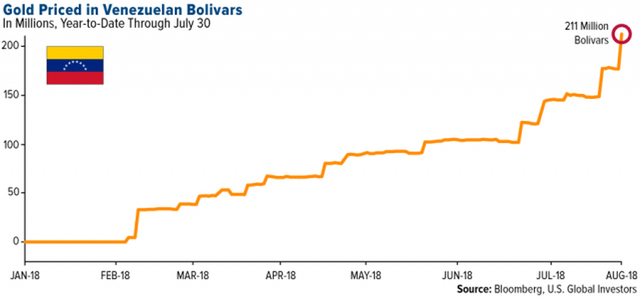

Just Look What Gold has done via this Chart just this Past Year in Venezuela...........

People Laugh and say This won't Happen Here in the USA, I don't know about You but I know what I want in my Hand and it's Not PAPER FIAT............................

Now is the Time to Get Yourself a little Piece whether it be Gold or Silver. Don't Hesitate Your Wealth is Important You Worked Hard to just get What Wealth you Have...............................

Even if It's just a Little Piece, that is better than Nothing........

You Won't Regret Stacking Precious Metals, Start Now don't Wait..............

Do all you can to exchange some of your FIAT Debt Notes for REAL MONEY !

If you enjoy content such as this then please feel free to UP Vote........

Follow me here on Steemit @stokjockey

Also Support all of the Silver & Gold Stackers as well as #steemsilvergold !!!

Need to go no further than looking at Venezuela. then Argentina, Brazil, South Africa, Iran, Turkey, Zimbabwe, and so on. So coming to a FIAT near you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Don't wait is right, as the paper silver is depressed the ability to buy the physical gets harder, and premiums go way up!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The tendency of gold is to high, as shown by the graph, in 8 months to drastically increased

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@francisespa Thank You for letting us know from Ground Zero...................

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh boy that's a chunky looking nugget!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Killer shot right her😍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's a ticking bomb waiting to go off big time!!! 🎆

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Some argue that before Silver and Gold see their big rise, the Dollar will see a temporary rise. The reason for this, they reason, is that the Dollar is a reserve currency that many will flee to as the markets take a hit and start to crumble. If they are right, it means there will still be an opportunity to buy relatively cheap Silver and Gold, but it will be a small window so better be ready.

The Copper price would suggest industry is slowing down while stock prices are going up. Draw your own conclusions!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think we still have room for a blow off top in the stock market. Guessing PM's will be manipulated lower with the rise of the dollar for the rest of the year. I don't hope that happens, but it seems just as irrational as the last 7yrs. Nice looking piece @stokjockey!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is a nice piece of gold. Need to get some of my own.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In financial terms, consider Venezuela to be "2 orders of magnitude" away from the U.S. dollar in terms of how much debt has been leveraged by their government. It's all based on lenghty explanations of currency values, swaps, loans, and shady banking contracts but look at what the gold and silver price has actually done there: It has gone up in value about 2,100 times!?!? That definitely won't happen in America, because of the "2 orders of magnitude" I spoke of earlier - but, to get through those two levels, divide each of them by 10. So, 2,100 goes to 210, goes to 21 - and silver & gold in America could increase in price by that much. So, silver is at about $15. Times that by $21, and we are looking at silver being $315 per oz. That is very possible in a dollar collapse - and that's being conservative. If you look at the U.S. Debt Clock, if silver value were based on the amount of USD debt that's currently out there, they say we're looking at silver going to $624. If you take the average of those two estimates, you'd be looking at $470/oz. I think that's a very fair possibility - but it won't last for very long. Big bullion holders will make big moves, in concert with each other, to maximize their own profits. But, even if you only get 1/2 of that - you're still looking at $235/oz. Whatever happens, all I know is that I'm backing up my truck to the silver store right now! Once the price breaks past about $25 or $26 on the way up, there won't be much more Silver to find - you won't even be able to get it. We're not talking about normal moves in the financial markets here - we're talking about extreme moonshot territory. Overall, gold will probably do a bit better than silver, and it's price will be more stable - but Silver will have more extreme up & down spikes, as usual. And, per my usual sentiments, I hope that I'm totally wrong about all of this - because that's going to be a very tough time for the entire world.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit