Introduction

STEEM ecosystem is comprised of 3 tokens of value: STEEM, SBD and VESTS.

Vests are much like shares in a company. They represent the ownership, and give holders special priviliges (voting power and curation rewards). VESTS are also mostly protected from inflation.

But, who owns the VESTS?

Ownership Distribution

For ease of calculation, I have converted Vests into Steam Power (SP). Since we are looking at ownership in relative terms, we can omit the inflationary nature of SP.

Furthermore, the price of STEEM is ~$1, and we can imagine each SP could be worth about as much.

.

Classification:

| Class | Short | SP |

|---|---|---|

| Mega Whale | MV | 1 Million+ SP |

| Whale | W | 100k - 1M SP |

| High Middle Class | HMC | 10k - 100k SP |

| Low Middle Class | LMC | 100 - 10k SP |

| Minnows | M | Less than 100 SP |

| Dust | D | ~3 SP |

.

Distribution:

| Group | Users | Cumulative SP | Cumulative Power-Down |

|---|---|---|---|

| All | 74,948 (100.00%) | 132,845,571 (100.00%) | 1,025,293 (100.00%) |

| MW | 14 (0.02%) | 93,883,160 (70.67%) | 871,518 (85.00%) |

| W | 85 (0.11%) | 24,275,728 (18.27%) | 105,853 (10.32%) |

| HMC | 310 (0.41%) | 9,921,171 (7.47%) | 37,319 (3.64%) |

| LMC | 3,989 (5.32%) | 4,268,850 (3.21%) | 10,603 (1.03%) |

| M | 70,550 (94.13%) | 496,662 (0.37%) | 0 (0.00%) |

Dust Accounts:

| D | 44,895 (59.90%) | 130,702 (0.10%) | 0 (0.00%) |

.

Power Down

| Power-Down Whales | Cumulative SP | Cumulative Power-Down |

|---|---|---|

| 49 (0.07%) | 93,729,021 (70.55%) | 977,371 (95.33%) |

49 whales are responsible for 95% of all power-downs. 50 whales are not powering down at this moment.

This snapshot was taken on August 25th.

Ownership Redistribution

I have re-ran the distribution snapshot a few days later, August 30th.

This is how the wealth distribution looks like. The top 0.13% own 90% of the stake.

.

Distribution:

| Group | Users | Cumulative SP | Cumulative Power-Down |

|---|---|---|---|

| All | 79,033 (100.00%) | 136,401,970 (100.00%) | 1,119,533 (100.00%) |

| MW | 15 (0.02%) | 96,917,185 (71.05%) | 944,673 (84.38%) |

| W | 89 (0.11%) | 24,559,020 (18.00%) | 127,808 (11.42%) |

| HMC | 321 (0.41%) | 9,962,043 (7.30%) | 36,152 (3.23%) |

| LMC | 4,141 (5.24%) | 4,442,727 (3.26%) | 10,898 (0.97%) |

| M | 74,467 (94.22%) | 520,995 (0.38%) | 2 (0.00%) |

Dust Accounts:

| D | 48,532 (61.41%) | 141,641 (0.10%) | 0 (0.00%) |

Not much has changed in 5 days. It looks like Mega-Whales got some extra shares at the expense of smaller Whales. Middle-Class has lost a a small fraction of their stake as well.

.

Power Down

| Group | Power-Down Whales | Cumulative SP | Cumulative Power-Down |

|---|---|---|---|

| MW+W | 58 (0.07%) | 102,585,930 (75.21%) | 1,072,481 (95.80%) |

58 whales are responsible for 96% of all power-downs. 41 whales are not powering down at this moment.

This snapshot was taken on August 30th.

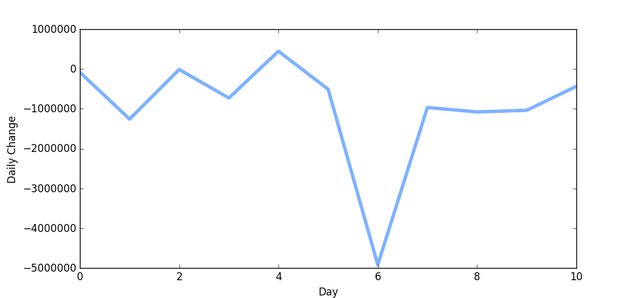

Cumulative Power up vs Power Down

If we want to understand the recent decline in the price of STEEM, we have to look at supply/demand dynamics between stake holders (whales) and investors.

One metric that can be used to guage this is the power-up vs power-down ratio. Big thanks to @lukestokes for the idea.

| Power Ups | Power Downs |

|---|---|

| 980,885 STEEM | 11,526,383 STEEM |

These metrics are collected from a 10-day range from August 19th to August 29th.

It looks like the power-up vs power-down ratio is a whopping 1:11.

The price will keep dropping, until the ratio reaches equilibrium (1:1), by either whales stopping the power down, or by investors stepping up to buy cheap coins.

The daily power-down pressure. Interestingly enough, ~900,000 STEEM are created daily right now. This might be purely coincidental.

Analysis

How could the middle class increase their stake in the platform?

One way to earn SP is by participating in Mining and Content Creation.

New STEEM is created with every block. A block is created about every 3 seconds, whereas 2 STEEM are created for the rewards pool, and about 1 STEEM gets created for the witnesses/miners.

A blogger gets at least 75% of the post reward, where its split evenly to 1 part STEEM in a form of SP (VESTS), and 1 part STEEM as SBD. Remaining 25% goes to curation, unless the curators voted early (within first 30 minutes). In that case, the curation reward is shared with the author.

Mining:

| Stake | Benefactors (paid as) | Group |

|---|---|---|

| 19/21 (90.4%) | Witnesses via dPOS (SP) | Whales |

| 1/21 (4.76%) | Backup Witnesses via dPOS (SP) | Anyone |

| 1/21 (4.76%) | Miners (SP) | Anyone |

Content:

| Stake | Benefactors (paid as) | Group |

|---|---|---|

| up to 25% | Curators (SP) | Whales |

| a fraction off 25% | Authors (SP+SBD) | Anyone |

| 25% | Authors (SBD) | Anyone |

| 25% | Authors (SP) | Anyone |

Now, surprise, surprise: all of the main witnesses are whales.

Also, since the whales own 90% of all SP, there is a mathematical certainty that they get most of the curation rewards.

Thus, it might be safe to assume that this venue won't increase the stake of the middle class anytime soon.

Going Forward

I believe that we need a broader group of stakeholders to increase platform's reach.

Having 100 committed whales is great, but their reach is limited to their skills, influence and social circles.

To reach mainstream adoption, we may need more people with skin in the game.

Committed Minnows

If whales continue to sell their tokens, they will eventually become cheap enough so that regular people can buy into the system. A person with a few hundred or a few thousand dollars invested is much more likely to recommend the platform to others, and therefore contribute to its organic (word-of-mouth) growth.

Committed Influencers

Whales could power-up a selectfew influencers, instead of selling the coins outright.

This way, the net-worth of these tokens will be dependent on influencers performance, and thus, we can expect them to take this job more seriously.

Conclusion

Its nice to see a coin that isn't owned and manipulated by miners, who don't really give a damn. Ownership should be handled prudently, and only given to those who deserve it.

It will be interesting to see how the re-distribution gets handled in the future. If there is interest, I will create a weekly report.

Don't miss out on the next post. Follow me.

Don't miss out on the next post. Follow me.

I have a few questions about this data:

Is the 'steemit' system account included? Both including it and excluding it are relevant in terms of understanding wealth distribution and changes to wealth distribution. Either way it is a huge factor so please specify.

Does the groupwise power-down data net-out power ups. If one whale account is powering down and another (with either the same or different owner; more on this later) is powering up that does not indicate any kind of distribution across the wealth spectrum (or otherwise, in the case of a common owner).

A clear caveat with any analysis of this form is that accounts are not the same as people. There is a very serious Streetlight effect and its importance can't be overstated. I have >1000 accounts. How much stake do I have in the accounts other than the obvious ones (@smooth and @smooth.witness)? No one really knows the answer to that, and I suspect in the case of other whales (and even non-whales, or more importantly non-identified whales) the answer is even more significant, perhaps by a very large degree. Conversely, accounts may have shared ownership where a single large account may not be evidence of concentrated ownership at all (we are seeing more of this now with "group" accounts like @robinhoodwhale being created). This degree of opacity on the distribution of wealth ownership may be frustrating to data junkies and community members alike but it is reality and disliking that fact should not be taken as a reason to disregard it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

1.) Yes, steemit account is included. I don't know of any reasons for not doing so.

2.) This is a very good idea. I was only interested in a total power-up vs power-down delta over a period of time, however your question begs for development of a more useful metric, in regards to wealth redistribution. Furthermore, it might be interesting to just extract the re-distributive power-ups, where the whales power up a non-whale account.

3.) As you've pointed out, the ownership of an account is hard to prove. Perhaps a deeper dive into the data and analysis thereof would help identify some whale sub-accounts with limited degree of confidence based on shared behavioral patterns (ie. if a whale created accounts with the intent to bot-vote content, the activity history on all accounts will have a common pattern. If the whale funded those accounts directly from a known whale-account, or a known proxy account, we could make an ownership assumption).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is certainly an outlier. There aren't any other accounts that have a significant portion of their holdings specifically earmarked to be given away to new users. Another significant portion is earmarked to be sold to provide funding for development. Both require powering down, meaning that any powering down by that account is not a discretionary decision being made on the basis of desire to reduce investment (or transfer stake between accounts). Power downs for the purpose of creating new user accounts do not lead to selling at all (though this would also apply to other power downs intended to power up another account). It isn't owned by a person, it is owned by a company, and we don't know how many owners the company has. Finally, that account also does not vote, so it has no bearing on the distribution of content or curation rewards.

Those are some of the reasons to not include it. On the other side, some of its power downs do hit the market, so it is meaningful to include it in that sense.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It doesn't make sense to me to exclude the largest owner from the ownership table, or the power-down metrics.

Giving a tiny fraction of coins away, or paying for development are all good causes - but not good enough to pretend that the money doesn't exist.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The budget for coins being given away is not 'a tiny fraction', it is half of all the coins in that account. I'm not suggesting that the money doesn't exist, although that is one perspective too. Since the account is part of the platform design, it isn't entirely unlike the undistributed coins (currently about 5 million) in a system like Bitcoin. If Bitcoin had an "undistributed coins" account on the blockchain would you include it? It would be the largest known holder of Bitcoins.

Anyway, my primary purpose in raising the issue was not to argue whether it should or shouldn't be included or how, it was primarily to ask that it be clearly stated. For example, in the statistics on steemd.com/distribution, the steemit account is not included, but that was not specified until I asked that a clarification be added. Now that it is clear, those statistics can be interpreted accordingly. Likewise with yours.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

To me it would seem the equivalent of adding @null to similar SBD analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello furion, we would like to inform you that you have been chosen as a featured author by the @robinhoodwhale initiave.

More about robin hood whale

Great Analysis - Keep on Steeming!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's an extraordinarily high amount of dust accounts. It indicates people signed up, but then didn't bother to do anything. Perhaps they joined for the free $3 and then discovered they couldn't withdraw it yet, and abandoned the system.

Could you do some analysis on the dust accounts? Like how many of them have ever posted anything, even just a comment?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, most of the dust accounts are made by bots. The creation has slowed down a bit, now that good names are taken and, well, you can't really spam steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If most of the dust accounts are bots, then the real number of users on steemit is about 5000? That puts things in a different light!

If you exclude the bot dust, then the whales own a smaller % of the eco-system than is being claimed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I do a weekly report, and right now we have about ~10,000 active users. Real users is more than that, but probably nowhere near 80k.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Maybe but "active users" also includes some bots, duplicate accounts, spambots, etc. I don't really see a good way to measure "real users" on this system.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mega Whale - Board member - 1 Million+ SP

Whale - Shareholder - 100k - 1M SP

High Middle Class - Management - 10k - 100k SP

Low Middle Class - Workforce - 100 - 10k SP

Minnows - Interns - Less than 100 SP

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is fairly insightful. What do you or others think it indicates about the system?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The system is initially constructed as a network structure but then transforms itself into a pyramid structure. Like many sustainable systems in our past, present and future. Pyramid structures are hard coded into the human DNA and define us as humans (not ants or rats).

Steemit is the first (I can tell) successful simulation of a new type form of organization, where pyramid and network structures are naturally combined.

*The know-how, we extract here, one day will be either used for transit to type 1 civilization (see "Michio Kaku - 3 types of Civilizations ") or ww3. In both cases that is quite expensive technology, and only high qualified operators must maintain it.

We will discuss more in private.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I love Steemit, I really do. I spend hours each day reading, curating posts and I have a small amount of SP I hope will generate a passive income some day.

BUT I can tell you what I feel is going on. I've been trading, speculating and following crypto for over 3 years now. Developers of Coins/platforms with a bit of talent and hard work, can generate a new crytpo coin/blockchain and start promoting it on Bitcointalk or reddit or Poloniex Exchange, I've seen it done many times, some of the these developers have good intentions and I feel are trying to make a successful platform.

HOWEVER, they will always hedge their bet with large pre-mines and insider ICO's to leave themselves with plenty of the currency "just in case things don't work out" they can cash out quickly and some do very well, just read POLO exchange for a few weeks and you will see what is going on.

Blockchains and currency values are created out of thin air by well meaning developers in most cases. Cashing out large amounts early on at any price is too tempting to ignore.

Essentially developers and coin/platform creators and their team of "experts" promote and discuss and cast a great vision up front about their newest revolutionary software platform, while cashing out any chance they get into the buy orders of the NEWBS and excited early adopters. Would you prefer a few million now while the hype is good or hold and wait until the crypto they created may or may not survive and be worthless later.

I find no fault in this, it is capitalism working at its best, just don't be naive about what is going on in the background, if you can live with this mentality you can also profit on early ICO 's and hype surrounding new coins.

Some work out nicely, some don't, that's life, don't invest more than you are willing to lose.

I believe STEEMIT will succeed in spite of the dumping and profit taking of large whales, I believe it will grow past this some day, just hang on it will be a wild trip!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Steemit was not pre-sold, like other ICO's. The developers own most of the coins, and rightfully so. If they choose to dump it, its up to them.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

And the opportunity cost of simply dumping all of their liquid tokens would mean that they would likely mortally wound the ecosystem. @dantheman and @ned appear to be captains that would go down with the ship, not jump at the first sign of danger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you make a case against steemit but end on a positive note..why do you believe in steemit then?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice analytics stats :D

I'm in Low Middle Class

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

0.02% users (14 ) have 70.67% / 93,883,160 / of the all SP. Pareto's law in action. And Gini's coefficient not equalize the situation. Rich will get rich - and the poor become poorer.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How do "the poor become poorer"? They are protected against deflation if they are powered up. Do they become poorer just because the actions of the whales drive the price down which lowers their value? If so, wouldn't the whales become "poorer" much quicker in that situation because they have a much larger stake which is losing value?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Unfortunately, the opposite is true.

rich with their weight multiplies its share. the poor can not. and inflation is the same for all - agree.

statistics suggests otherwise. can not see the trend that more and more users own more and more SP. On the contrary - all fewer participants (top 15) kept increasing share. and this trend is maintained every week.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

74,467 (94.22% Users) = minnows = 520,995 (0.38% SP)

next week - will increase the number of minnows, but their total assets (SP) decrease. This trend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm asking a specific question though. You said "the poor become poorer."

So let's say Person A has 5 Steem Power today. A few months from now they will have a little more than 5 Steem Power. I'm confused how that individual became poorer? Just because the poor can't make as much as the rich, that doesn't make them "more poor," does it?

There will be more new users, but that doesn't mean someone today becomes more poor than they were yesterday. The value in terms of purchasing power is defined by supply and demand for STEEM and SBD. If it goes up, those with the largest share make the most. If it goes down, they lose the most. No individual "becomes poorer" because someone else becomes richer.

If I give one person $100 and another person $5, the person I gave $5 to didn't become poorer because of the person who got $100.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A lot of really good informations , now i know more . Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Whales generally gone a long voyage, many authors do without the attention :(

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been linked to from another place on Steem.

Real-Time Update of RobinHood Whale Project 罗宾鲸火贴实时更新 01-09 by @laonie

What Class Of Steemit Are you? by @virtashare

The QC - Quality Content Featurette (#5) by @krnel

Learn more about linkback bot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am very new and very interested in how all this comes together so thank you so much for this great explanation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Love these, seriously keep making them!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit