Return of mutual funds also far exceeded the JCI and benchmark index which rose 4.09 percent and 4.43 percent since the beginning of 2018

Illustration of mutual fund investors. manulife SMC Plus shares can be an investment choice for those of you who have long-term financial goals with an investment period of more than five years. Mutual funds are also suitable for you who want a high return on investment with a high level of risk as well. copyright: olegdudko / 123RF Stock Photo

Bareksa.com - The stock market fell after its record highs since mid-January 2018 as investors took the opportunity to realize their gains. however, there is still a stock-based mutual fund investment product that has significant profits.

In trading yesterday (Wednesday, January 24, 2018), Composite Stock Price Index (CSPI) weakened 0.3 percent despite still holding above the level of 6600. at the close of trading, JCI was in position 6,615.49. (Read)

The sector that became the biggest support JCI is not deeper corrected in yesterday's trade is the property sector, real estate and building construction. this sector recorded the highest increase in the day yesterday's trading, which is 2.49 percent.shares included in the sector such as PT Pembangunan Perumahan Tbk (PTPP), PT Ciputra Development Tbk (CTRA) shares and PT Waskita Karya Tbk (WSKT) shares experienced a surge in prices and helped shore up the JCI movement.

yesterday, PTPP was up 9.2 percent and CTRA rose 7.4 percent. Likewise WSKT, shares of publicly-listed red plate construction fired 6.1 percent on yesterday's trading day. High profit growth is one of the driving force of investors hunting WSKT stocks.

based on data from the Ministry of State Owned Enterprises (SOEs), Waskita recorded net profit growth based on the prognosis of financial performance throughout 2017. The company posted net profit of around Rp4.27 trillion, racing 136 percent compared to 2011 achievement of Rp1.81 trillion. (See )

The expectations of the company's performance will be brilliant in 2018, because the state-owned company has several major projects, helped boost the stock price movement WSKT drove quite high since early 2018.year to date, WSKT shares have registered a 26.24 percent increase (as of January 24, 2018).

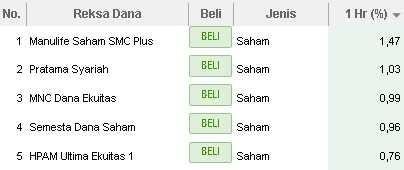

The significant rate at WSKT's stock price also contributed to the growth of mutual fund returns, especially on equity funds that placed considerable assets in these stocks. one of which is mutual fund. The managed fund of one of the largest investment management companies in Indonesia, which managed to give a return of 1.47 percent in yesterday's trading day.

even that number is the highest return in a trading day (Wednesday, January 24, 2018) based on marketplace data

mutual funds Bareksa.

a considerable investment allocation in WSKT shares also boosted Manulife's share of mutual funds. SMC Plus shares grew 10.17 percent since the beginning of 2018 (per January 24, 2018). WSKT shares are included in the top five shares with the largest allocation of mutual fund portfolios, based on the December 2017 fund factsheet.

so naturally, WSKT's share price spike up to 26.24 percent since the beginning of 2018 also contributed to the growth of mutual fund return of Manulife Shares SMC Plus.

in fact, the growth of this mutual fund returns far outstripped the growth of JCI and its benchmark index (stock index of mutual funds) was up 4.09 percent and 4.43 percent since the beginning of the year (as of January 24, 2018). (See

)

manulife SMC Plus shares can be an investment choice for those of you who have long-term financial goals with an investment period of more than five years. This mutual fund is also suitable for you who want a high return on investment with a high level of risk also (type of aggressive investor). (hm)