In my opinion, so far this is a short-term correction against the backdrop of good economic statistics from the US, in part because of Friday data on employment in the US. The growth in the number of jobs in January 200 000. The unemployment rate is kept at a low level of 4.1%. Annual wage growth rates in the US jumped to + 2.9%. This increases the likelihood of a faster rate increase on the part of the Fed and market participants are experiencing that this is the end of the "Era of cheap money."

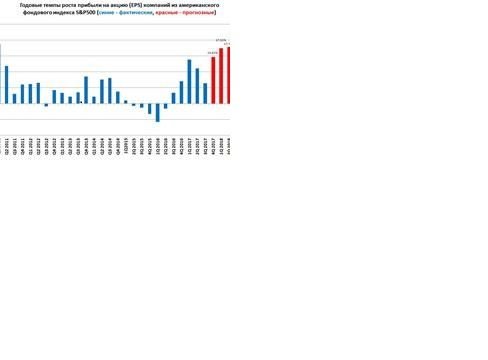

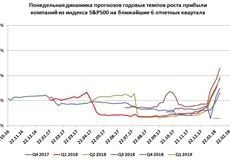

However, from the point of view of the future prospects of the US economy, so far everything is very good. Expectations on the annual growth rates of profits of 500 companies from the S & P500 index remain good. Drawings with forecasts on the growth rates of profits for the coming quarters are presented below. From this point of view, there is still no expectation of a recession in the US: under such conditions, as a rule, similar as now the US stock market downward correction, they recoup up within 1-2-3 months.

It is necessary to see how the situation will develop this week. Also, while the situation on the US bond market is quite good: the difference in interest rates between 10 summer and 2-year government bonds in the US is above zero, that is, the situation on the bond market is stable overall. Recessions and long falls in the US stock market occur usually when this curve falls below zero.

https://fred.stlouisfed.org/series/T10Y2Y

Subscribe. To all the wonderful mood!

Authors get paid when people like you upvote their post.

If you enjoyed what you read here, create your account today and start earning FREE STEEM!

If you enjoyed what you read here, create your account today and start earning FREE STEEM!