Introduction:

Moving averagesare fundamental tools in technical analysis, used by traders and investors alike to understand trends, identify potential entry and exit points, and gauge the overall market sentiment. They offer a smoothed representation of price data over a specific period, helping traders filter out noise and highlight underlying trends. In this article, we will delve deep into the concept of moving averages, exploring their types, calculation methods, practical applications, and their significance in trading strategies.

Understanding Moving Averages:

Moving averages (MAs) are statistical indicators that calculate the average price of a security over a defined period, continually updating as new data becomes available. They provide insights into the direction and strength of trends by smoothing out price fluctuations. There are various types of moving averages, but the two most commonly used are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

Simple Moving Average (SMA):

The Simple Moving Average is the most straightforward type of moving average, calculated by summing up a set of closing prices over a specific period and dividing by the number of periods. For example, a 20-day SMA would add up the closing prices of the last 20 days and divide the total by 20. The resulting value represents the average price over that period. SMAs are easy to calculate and interpret, making them popular among traders.

Exponential Moving Average (EMA):

The Exponential Moving Average gives more weight to recent prices, reflecting a faster response to price changes compared to SMAs. Unlike the SMA, which assigns equal weight to all data points, the EMA applies a greater weight to the most recent prices, making it more sensitive to recent price movements. The formula for calculating EMA involves using a smoothing factor, which determines the weight given to each data point. While EMAs react quicker to price changes, they are also more prone to whipsaws, leading to false signals in volatile markets.

Practical Applications of Moving Averages:

Moving averages serve various purposes in technical analysis and trading strategies:

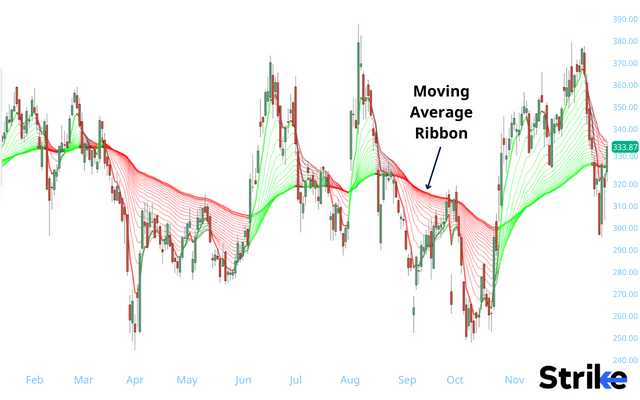

Trend Identification: One of the primary uses of moving averages is to identify trends in price movements. When the price is above the moving average, it indicates an uptrend, while a price below the moving average suggests a downtrend. Traders often use crossovers between short-term and long-term moving averages to confirm trend reversals.

Support and Resistance Levels: Moving averages act as dynamic support and resistance levels, where the price tends to bounce off or find resistance. Traders often observe how prices interact with moving averages to determine potential entry or exit points.

Signal Generation: Moving averages generate trading signals when they cross over each other or when the price crosses the moving average. For instance, a bullish signal occurs when a shorter-term moving average crosses above a longer-term moving average, indicating a potential buying opportunity. Conversely, a bearish signal occurs when the opposite happens, signaling a potential selling opportunity.

Volatility Measurement: Moving averages can also help traders gauge market volatility. During periods of high volatility, moving averages tend to widen, while they contract during low volatility periods. This information can assist traders in adjusting their risk management strategies accordingly.

Incorporating Moving Averages into Trading Strategies:

Traders utilize moving averages in various trading strategies to capitalize on market trends and minimize risks. Some common strategies include:

Moving Average Crossover: This strategy involves using two or more moving averages with different timeframes. When the shorter-term moving average crosses above the longer-term moving average, it generates a buy signal, indicating a potential uptrend. Conversely, when the shorter-term moving average crosses below the longer-term moving average, it triggers a sell signal, signaling a potential downtrend.

Moving Average Convergence Divergence (MACD): The MACD combines two EMAs and a signal line to identify trend changes and momentum shifts. Traders look for bullish and bearish crossovers between the MACD line and the signal line to enter or exit positions.

Support and Resistance Trading: Traders use moving averages as dynamic support and resistance levels, buying near the moving average in an uptrend and selling short near the moving average in a downtrend.

Conclusion:

Moving averages are indispensable tools in the arsenal of traders and investors, offering valuable insights into market trends, support and resistance levels, and potential trading opportunities. Whether used independently or in combination with other technical indicators, understanding moving averages can significantly enhance one's ability to analyze markets and make informed trading decisions. By mastering the art of moving averages, traders can navigate the complexities of financial markets with confidence and precision.