The recent Hindenburg report targeting the Adani Group caused some turbulence in the Indian stock market. The report alleged a conflict of interest involving the funds used by the Adani Group and the Securities and Exchange Board of India (SEBI) chair, Madhabi Puri Buch. On Monday, there was notable selling pressure, with the Nifty 50 Index dropping over 300 points in early trading.

However, this decline was short-lived. Within an hour, the market rebounded, and the Nifty 50 Index recovered, trading 80 points higher. Adani Group stocks also initially fell by 5.6% but quickly bounced back, with all Adani stocks returning to positive territory.

Asian Stock Market Resilience

While the Indian market was initially shaken, the broader Asian stock markets displayed resilience. A key factor contributing to this positive momentum was the statement from the former governor of the Bank of Japan (BOJ), who indicated that further interest rate hikes were unlikely in 2024. This assurance boosted investor confidence across the region.

This sentiment was reflected in various markets. Australian and South Korean benchmarks registered gains, and Taiwan Semiconductor Manufacturing Co.'s revenue increase lifted the Taipei Index. In contrast, Hong Kong stocks remained mostly unchanged, while Japanese markets were closed for a holiday. The positive performance of Asian stocks helped Indian investors remain optimistic, leading them to largely dismiss the Hindenburg report.

Outlook for the Crypto Market

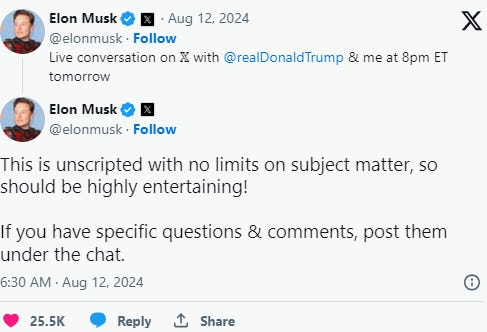

The cryptocurrency market has been under pressure recently, with Bitcoin's price plunging to $58,000 ahead of an interview between Donald Trump and Elon Musk. This decline has affected the broader crypto market, with altcoins also experiencing a downturn of 5-6%.

Despite this sell-off, there is a possibility of recovery in the crypto market, particularly as attention shifts to important macroeconomic events scheduled for the week. The upcoming release of the US Consumer Price Index (CPI) data for July, along with decisions from the New Zealand Federal Reserve on interest rate cuts, will likely influence market sentiment. With the positive momentum in Asian stocks, there is potential for short covering in the crypto market once the US markets open on Monday.

In summary, the Hindenburg report had a fleeting impact on the Indian stock market, with investors quickly regaining confidence. The resilience of Asian stock markets, bolstered by favorable statements from the BOJ and positive developments in key sectors, further contributed to this recovery. As the week progresses, global markets will keep a close watch on critical economic indicators, which will likely influence the direction of both traditional and crypto markets.