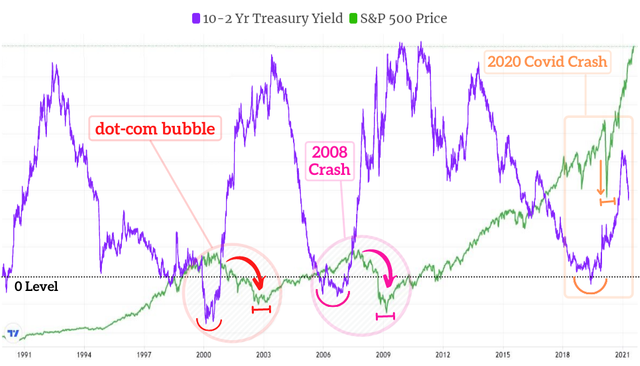

10-2 treasury yield spread is the difference between the Federal Reserve System's short-term borrowing rate and the long term treasury notes.

The spread is an excellent early-warning indicator for an upcoming recession. That is because the spread between the 2-years and 10-year treasury yield indicates inflation expectations. When inflation expectations fall sharply (as you can see in the 2nd chart below), it’s usually a sign of future negative GDP growth in the United States.