In one year, stock markets will look a lot different.

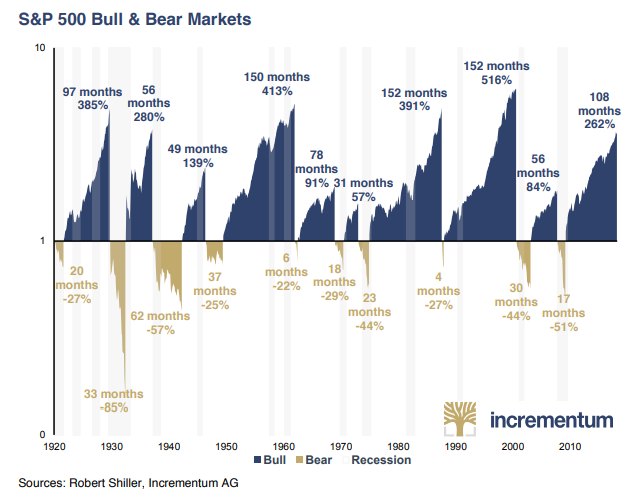

40 months from now, by August of 2022, the current bull market in equities will reach the 150 months mark, the same time span as the previous three bull markets. In other words, don’t expect to see the end yet.

As the chart below clearly shows, in the last three S&P 500 bull markets, the returns were 413%, 391%, and 516%, respectively.

Today, we sit at 262%, so we definitely have the potential to see another major rally with equities.

Check this out:

Courtesy: Incrementum AG

Portfolio Wealth Global has stressed this fact many times – bull markets end with euphoria, and we’re certainly not there right now.

With the Italian bonds crisis unfolding, the geopolitical tensions around the globe and the increasing debt levels, widening wealth gap and larger than normal government deficits, the central banks are normalizing and tightening monetary policy, as they realize that what they have done could get out of hand.

Still, government debt is cheap, with inflation still contained; though, I’m starting to see evidence to the contrary.

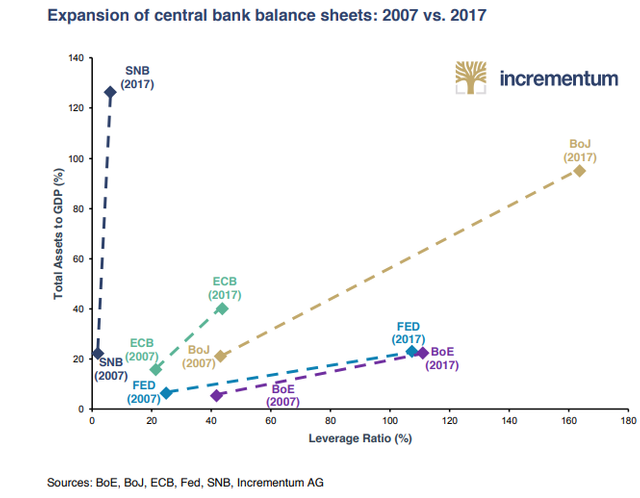

To fully understand how unprecedented these times are, I want you to see how central banks caused the middle-class erosion in the western world by elevating asset prices, instead of increasing productivity and allowing wages to rise.

Look at this unbelievable chart:

Courtesy: Incrementum AG

This chart, carefully studied, could only be described as lunacy.

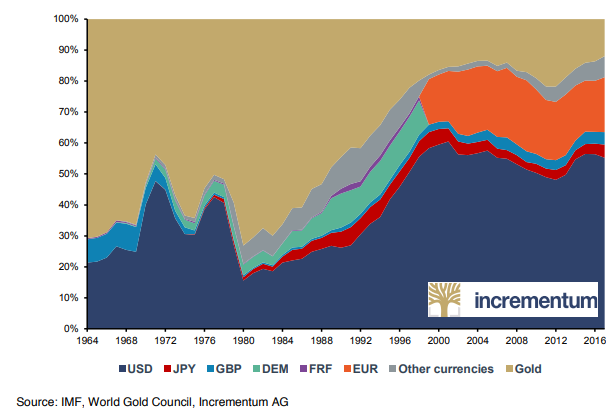

Yet, markets did not lose faith in fiat currencies or central banks. In fact, when I speak with multi-millionaires and even with billionaires, they explain to me that the USD cannot, reasonably, be replaced, for at least another decade or two.

So, how will the next 40 months feel?

The FED will continue to shrink its balance sheet, raising rates gradually. But what Portfolio Wealth Global projects is that inflation will reach over 3%, officially, in one year, causing a stronger gold market, but since gold has already risen from $1,050 to $1,300 already, we see gold equities, the mining companies, which have been lagging noticably, delivering extraordinary returns.

Courtesy: Incrementum AG

As you can see, nothing can currently act as an alternative for the USD, but what is emerging fast is technology to better our lives, using machine learning.

This will revolutionize our daily lives. Artificial Intelligence will advise us on many topics, as well as assist other businesses in serving us.

So, while it’s true that the USD situation will not change considerably in the next 40 months, financial technology, the way we use currency, will change dramatically.

Banking will evolve, competition will intensify, and I expect to see more transparency in financial markets.

While you may not notice it, gold is already attempting to rally big-time – look at this:

Courtesy: U.S. Global Investors

In other words, though I receive countless emails from subscribers, letting me know that they hold a massive cash position and expect to reap great rewards when the market drops 25% – my reply is that it will gain 50% before it gives up those 25%.

I’m bullish, not because I’m impressed with how this entire system is a profits machine at the expense of the poor, but because my primary role, as an investor, is to look at facts and make decisions according to the data.

Let’s recap this:

- Financial institutions are cash-rich right now, making them trigger-ready to buy stocks for the right price.

- The global economy is booming, overall. I’ve traveled to 12 cities in the past three months, and I can tell you that airports are busy, restaurants are full, tourists abound, construction cranes are all over the place, and young people are finding it increasingly easier to find gainful employment.

- Tax cuts are allowing middle-class people to enter the financial markets, which they will.

- Tariffs will cause even higher inflation.

Conclusion:

**We are entering the “Everything Bubble.” **

As people feel better and grow an appetite for gains, the large-cap stocks will lag, while riskier assets will take the lead.

This includes mining stocks, cannabis stocks, blockchain-tech companies, and especially, tech stocks with an emphasis on Artificial Intelligence.

The sophistication comes in at these two key points:

- FED increases rates by 50 bps, instead of 25. This will impact markets to the downside. Notice, with even more attention, when the FED Funds Rate eclipses the yield of the 5-yr bond because it will mark the end of the rally.

- Watch the “40-month window.” By June 2021, prepare to be in cash.

In the next three years, prepare to make more money than ever before. Don’t be greedy. TAKE PROFITS when possible!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.portfoliowealthglobal.com/bull-market-death-not-so-fast/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit