The euphoria is still not upon us, which means that the market will keep being the gift that keeps on giving, for the time being. Though the three major indices (S&P 500, Dow-Jones and NASDAQ) have enjoyed a tremendous 10-yr rally, nothing is pointing towards the immediate ending of our blow-off top script.

Not only is the investment community, in general, scared shitless because of the trade tensions between China and the U.S., but everyone is also nervous about the yield curve inversion, the $1T annual deficit, and the fact that stocks are trading at record highs already.

Being bullish today is, actually, the contrarian trade, and history tells us that the freshest juices, the biggest profits, are going to be squeezed between now and May of 2019.

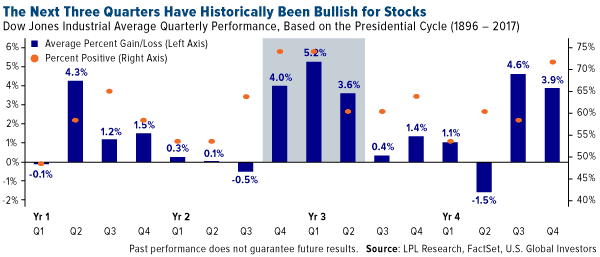

120 years of history tell us that the mid-term elections are the perfect time to back-up the truck on the right plays:

Courtesy: U.S. Global Investors

As you can see, once the confusion over who will win the mid-term elections is resolved, no matter who is the actual winner, the market rallies when a clear picture emerges.

Obviously, the President wants to get re-elected, so he holds all his aces for the third and fourth year in office, so stocks can enjoy euphoria, once he uses them. Wealth Research Group sees this upcoming rally as the last one for this bull market.

There are two possible scenarios:

Republicans Gain Control of the House: With about a 30% chance, at the moment, this result will allow Trump to continue deregulating binding laws and cutting individual taxes, which will send stocks into a hyper-bubble.

Though the S&P 500 is already at an all-time high, we anticipate a Republican victory would send the index towards 3,800 points and even above 4,000 points, before it finally peaks.

This is a potential 25%-33% rally in two years – that’s massive.

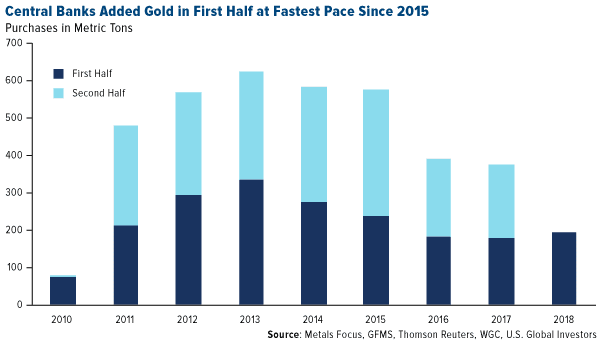

- Democrats Win the Mid-Term: Not only is this twice as probable, but central banks are already betting on this.

Courtesy: U.S. Global Investors

Democrats will want the administration to push the infrastructure program forward, offering job security to more people.

The result would be higher inflation, since wages will have to rise, as the government will compete with the open market economy for skilled labor and for contractors.

In either case, what President Trump must do before the next elections cycle is to give the impression that these current trade fears are over-blown and present a viable solution.

Nothing would please the global markets more than that.

I see this as the most likely catalyst for the euphoria stage, which characterizes the end of a bull market. The problem, the “event” that marks the end, will be, in all likelihood, the realization that these problems with China are not “contained.”

In other words, when investors start to see that this is probably a situation, which will linger for 10-20 years, as both economies compete for dominance, it will be like the bubble popping.

In the case of a democrats win this November, I anticipate precious metals to do better than in a republican one, as they go from distressed conditions to normal ones, but the bull market for gold and silver will not start, until certain conditions prevail – we’re not there yet.

There’s much money to be made in these sorts of short-term bounces, though, so we’ll track the situation closely.

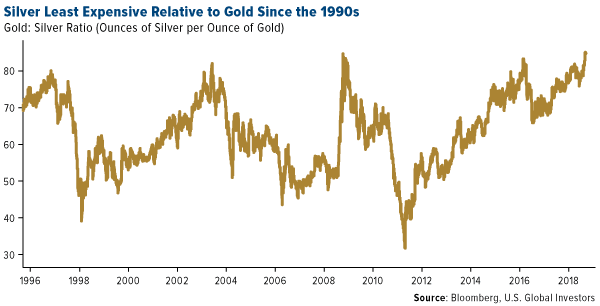

Courtesy: U.S. Global Investors

We certainly have the most important catalyst for a quick and short mining stocks rally – a crazy gold/silver ratio, a bearish sentiment, which is only rivaled by the 1991 and 2000 sentiments, and a reason to believe that the USD rally is over, coupled with a reverse in trend for interest rates.

We’re talking about a bounce, not a long-term trend, though. On Tuesday, I’ll explain when Wealth Research Group sees a genuine commodities bull market to finally occur.

With mining shares, it’s best to be patient than early. In 2016, for example, the bull market was epic, lasting from January to August, but even if you missed the January-April move, the remaining four months gave us a 300% upside potential, in and of themselves.

What we don’t want is to position in a false-breakout, which is the reason we currently stick with cannabis plays and our Dividend Aristocrats portfolio.

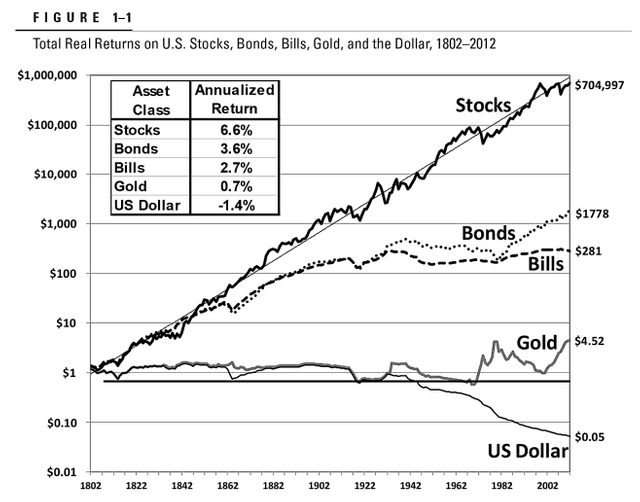

No need to “head for the exits,” then, as countless doom analysts keep reciting since 1971, and will probably continue to drum in our ears. We’re in a bull market.

A permanent bear investor can never become wealthy, bottom line. There has never been and there never will be an investor, who becomes wealthy by sitting on cash or by sitting on his gold. The market, for all its woes, is up 75% of the time and is the greatest wealth generator!

Be a contrarian – make money!

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.wealthresearchgroup.com/head-for-the-exits/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @wealthresearch! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @wealthresearch! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit