The bull market in U.S. stocks is now, arguably, the longest in history.

In 1990, stocks fell 19.9%, just shy of an official bear market, but history has rounded it up. Alternatively, the longest rally ever has been 13 years long, stemming from 1987 to 2000.

It is true that a 20% decline in prices is considered a bear market, but the indicator, which just flashed, is pricing in a much bigger potential crash.

Let’s look at some stats:

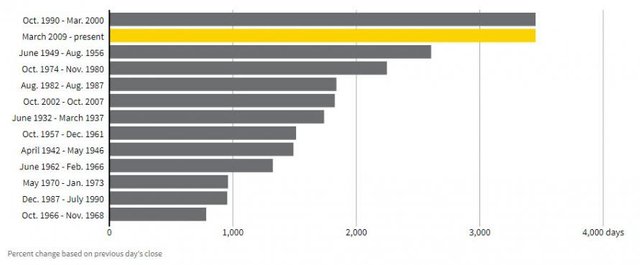

Courtesy: Zerohedge.com

Duration, of course, counts for something. All markets are cyclical, but the U.S. equities rallies since the 1980’s, have been longer than before.

The advent of the internet has made it possible for new types of companies to flourish, which is part of the reason stocks have returned such high returns, far above all other asset classes.

Returns: Duration isn’t everything, though. The returns, relative to duration, have been larger in previous times. For one, today’s investors are terrified of geopolitical events, so there is definitely no euphoria.

This is the primary reason the bull market isn’t going anywhere, for now. Trump’s victory had probably calmed the market down because it was heading for a top, but the elections changed sentiment and optimism levels.

Today, Main street is optimistic (small business), but not the multinationals, who have bribed (lobbied) politicians for so long to globalize trade and are seeing a U-turn in policy.

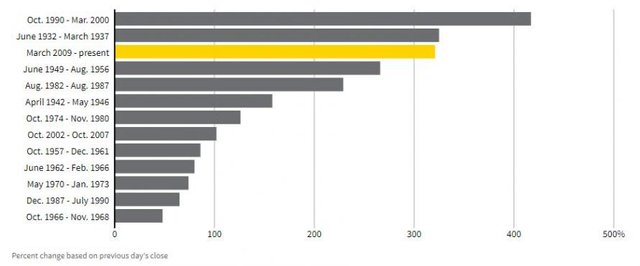

Courtesy: Zerohedge.com

You can see this isn’t a bubble, not even close.

The fact that central banks have intervened and jolted returns, along with the recent tax cuts makes the picture even more bullish, since without these turbo pumps, investors wouldn’t have even been sitting on today’s yields. As Charlie Munger recently said, “we’re all undeserving rich investors.”

FAKE ECONOMY: THE TRUTH

I’ve been hearing investors and “experts” calling this growth unsustainable, made-up, manipulated, or otherwise, since the 1970’s.

The truth is that the only entity in serious trouble is the Federal Government, but American businesses are alive and well.

Like I wrote on Sunday, the profits are becoming more concentrated, leaving the middle-class behind for good, but the viability of corporations is not to be doubted.

There is a major difference between a great business and a great opportunity because an expensive business, projected by an overvalued share price, isn’t a good sign.

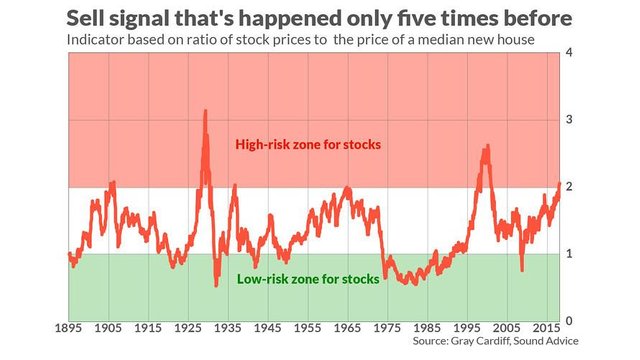

This is, in general, the problem with stocks right now. They are decoupling from the real economy, the real estate market.

Stock prices and real estate prices have foremd a tight relationship, since job creation fuels housing growth, which, in turn, elevates stock prices, because people have a sense of wealth and feel confident to put money into the markets.

This is not the case today:

Courtesy: Gray Cardiff, Sound Advice, Zerohedge.com

[Published on WealthResearchGroup.com 2018-08-23](This proprietary indicator has only flashed high risk three times in over 100 years; a severe, 40%-50% crash followed each time.We’re entering the fourth time it is flashing red in over 100 years!

All of this tells us that the bear market sell-off will, in most likelihood, be horrendous.

As a result, I’ve made several adjustments to my portfolio in the past 60 days.

I’m concentrating my positions (owning fewer stocks), taking profits on big winners, using short-term tools, such as writing covered calls and selling puts, and increasing cash levels.

Therefore, as I noted several weeks ago, on the third Thursday of each even month (August, October, December, and so on), I will publish my personal update, a behind the scenes look at my Dynasty Portfolio.

You can access it HERE!

In addition, I’ve written a bombshell report on the most immediate threat to the dollar – the domestic cancer, which is the intention of several states to issue their own currencies, bypassing the USD.

You can access it HERE!

Big changes are occurring in the world – live the markets, feel its pulse, and let the opportunities come to you.

Best Regards,

Lior Gantz

President, WealthResearchGroup.com)