Content adapted from this Zerohedge.com article : Source

by Tyler Durden

We noted earlier that US equity futures were extending losses after the close, but the real panic action is in the volatility complex.

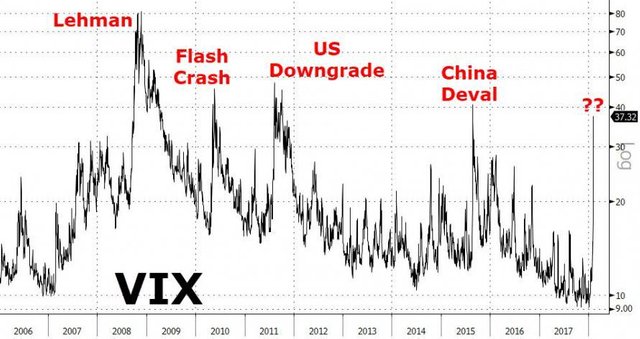

Putting today's VIX move in context, this is among the biggest ever...

And it appears Morgan Stanley was right to bet on VIX hitting 30...

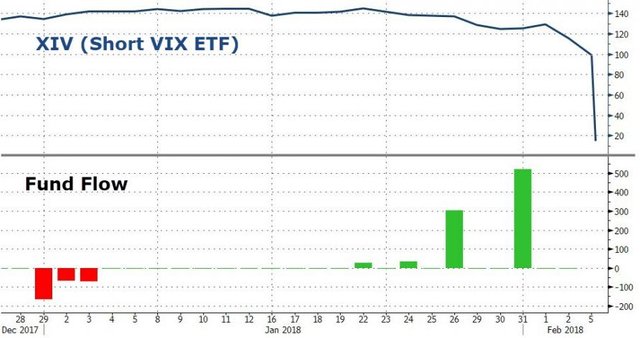

But the real action is in the super-crowded short-vol space.

XIV - The Short VIX ETF - after its relentless diagonal move higher as one after another Target manager sold vol for a living... just disintegrated after-hours, down a stunning 90% to $10.00.

Which is a problem because as we explained last summer, the threshold for an XIV termination event is a -80% drop. What does this mean? Well, in previewing today's events last July, Fasanara Capital explained precisely what is going on last July:

Additional risks arise as 'liquidity gates' may be imposed, even in the absence of a spike in volatility. In 2012, for example, the price of TVIX ETN fell 60% in two days, despite relatively benign trading conditions elsewhere in the market. The reason was that the promoter of the volatility-linked note announced that it temporarily suspended further issuances of the ETN due to "internal limits" reached on the size of the ETNs. Furthermore, for some of the volatility-linked notes, the prospectus foresee the possibility of 'termination events': for example, for XIV ETF a termination event is triggered if the daily percentage drop exceeds 80%. Then a full wipe-out is avoided insofar as it is preceded by a game-over event.

The reaction of the investor base at play – often retail – holds the potential to create cascading effects and to send shockwaves to the market at large. This likely is a blind spot for markets.

Others expect the same:

Data is chaotic now but key numbers show $VXX IV value at +96.10 % for the day and $SVXY IV down -96.67%. It's likely $XIV & $SVXY terminated. If so their final values will be set by what value the futures were when they closed out their position. Likely at least down 80%.

— Vance Harwood (@6_Figure_Invest) February 5, 2018

Those curious can read more on what a XIV termination event is here.

Also, recall that last Thursday saw investors poured a record $520 million into an exchange-traded note that gains when VIX drops...

They chose... poorly.

As one veteran trader (who has seen numerous volatility cycles) exclaimed, "I've never seen anything like this... this is it" referring to the start of the unwind of the biggest aggregate short volatility position the market have ever known.

Nice post @zerohedge

Its unfortunate but the stock market has been a bubble for a while now...

Anyone believing that the Dow was going to hit 30k ..

well..

I got a nice bridge to Brooklyn you'd like to buy.

I don't expect today to be as bad as Monday.

Infact i think it will be a slight decline...a slower one..though i expect 10-20% more in the next few months.

A slow blood letting.

A true correction.

If anything...the yen seems to have become (at least for now)became a safe haven...

The yen rose 0.3 percent to 108.79 per dollar after rising 1 percent on Monday.

The euro was barely changed at $1.2376.

The pound was steady at $1.3966.

The Australian dollar traded at 78.39 U.S. cents, down 0.4 percent.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

WE REACHED OUT TO WWW.ZEROHEDGE.COM AND RECEIVED CONFIRMATION THAT THEY ARE NOT AWARE THAT THEIR CONTENT IS BEING USED ON STEEMIT AND THAT THEY DO NOT CONSENT FOR IT TO BE USED HERE FOR PROFIT.

Copying/Pasting full texts without adding anything original is frowned upon by the community.

These are some tips on how to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

First thanks for sharing this article because I learn alot of information by your posts.

Second Terminal velocity crash signaled by Greenspan, Katz and Yellen. The Jews ran for the exit, this spooked the herd.

Robot AI trading programs triggered a reverse market, making money going down, these trading systems, make money going up and make money going down. In this case, when will it stop? We could see each session a sell off as huge positions take time to unwind.

In the back ground, we're seeing a global sell off. How long this continues is the question, but we could be seeing a global economic realignment.

Derivative bets are now making money on the down side. The down side market now has a mind of it's own.

Where it stops no one knows, hang on. It was the best of times, it was the end of times...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So where is all the money gonna go? Are they pulling it out to buy back in, are we going to see money flowing into other assets, what are your thoughts? I sure don't love having my 401k locked up during this time, feels like we've got some major trouble coming to nearly every market, I thought crypto would be safer and money would flow away from stocks to there, but looks like I don't know anything haha. Would love to hear some opinions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for this article @zer0hedge, I'm glad to see that you share a wide range of articles, not only cryptocurrency related topics.

It is interesting to see different market falling like this, I guess there is a downward trend all round due to a general negative sentiment.

I guess Morgan Stanley got it right. It also has become clear from seeing this graph that volatility is evident in every market, and over-hyped prices nearly always return to normal prices, even if that means a big crash to bring prices back to normal.

Thanks again for sharing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This was the scariest thing I've seen on the stock market ( speaking about XIV dropping from 99$ do 10$ after market). I really can't imagine how much money was lost in these inverse VIX ETF's, sure A LOT! I am very interested what will happen tomorrow, as those people will be margincalled in their other positions also. lol.

I also wrote a bit about this termination event few minutes ago in my blog, would be glad if you check it out HERE

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Can someone explain this for the laymen, sorry I don't know much about financial markets. How are they measuring VIX and what's happening to cause it to skyrocket?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In short VIX measures velocity of changing prices in near-dated options, so it's often referred to as the "fear gauge". Low VIX means stable market, high VIX means capital is shifting about. In equities/bond markets, low VIX has been the goal/result of central banks QE policies propping up markets. Yesterday possibly signals the long awaited shift in this decade long trend.

Please read this article I've written on volatility for more info.

https://steemit.com/cryptocurrency/@maven360/volatility-you-vixen-why-vol-is-crypto-s-best-friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

we´re gonig to see who is the real financial bubble?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for sharing a wonderful post, keep it up...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

First thanks for sharing this article because I learn alot of information by your posts.

Second Terminal velocity crash signaled by Greenspan, Katz and Yellen. The Jews ran for the exit, this spooked the herd.

Robot AI trading programs triggered a reverse market, making money going down, these trading systems, make money going up and make money going down. In this case, when will it stop? We could see each session a sell off as huge positions take time to unwind.

In the back ground, we're seeing a global sell off. How long this continues is the question, but we could be seeing a global economic realignment.

Derivative bets are now making money on the down side. The down side market now has a mind of it's own.

Where it stops no one knows, hang on. It was the best of times, it was the end of times...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is says all about yhe traders

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvote and resteemed !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wows it is wonderful. You are awesome @zer0hedge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Disclaimer: I am just a bot trying to be helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit