Index - https://steemit.com/tax/@alhofmeister/3ibscz-accounting-and-finance-blog-index

Introduction

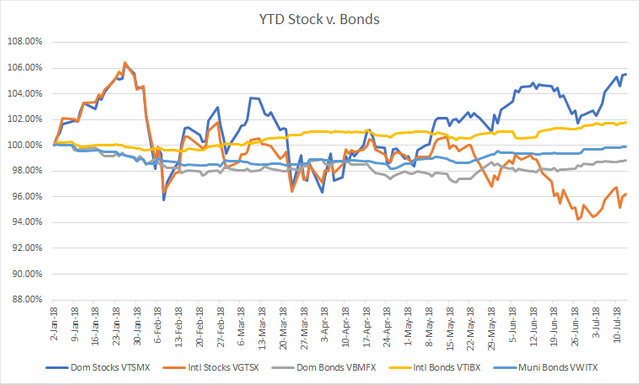

The purpose of this post is to demonstrate the YTD performance of domestic and international stocks and bonds by comparing various Vanguard index funds. As demonstrated by the graphs, bonds have been significantly more stable than stocks. I will continue to track the progress of these index funds in future posts.

YTD Performance

Note - Chart also reflects the periodic dividends paid by the various funds (stocks - quarterly; bonds - monthly)

References

https://finance.yahoo.com/quote/VTSMX/history?p=VTSMX

https://finance.yahoo.com/quote/VGTSX/history?p=VGTSX

https://finance.yahoo.com/quote/VBMFX/history?p=VBMFX

https://finance.yahoo.com/quote/VTIBX/history?p=VTIBX

https://finance.yahoo.com/quote/VWITX/history?p=VWITX

#nobidbot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@contentvoter

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What is the difference between a bond and a stock? Which is one id more advisable for a newbie to venture into? Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A bond is a type of debt whereas a stock is an ownership interest in a company. Bonds tend to be more stable than stocks. Whereas the value of a bond is largely based on the interest it pays out, the value of a stock might be based on the dividends it pays out or the expected future growth of the company. For someone new to investing, mutual funds or index funds are a good place to start as they provide instant diversification. The composition of a portfolio is going to be dependent upon the investors aversion to risk. Typically, investing in stocks is more risky than investing in bonds, but there is more risk where there is more reward. Personally, I recommend opening an account at Vanguard to anyone interested in investing in mutual/index fund. They have the lowest fees in the industry.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit