In an era of low interest rates, many investors are looking for higher yields. Standard savings accounts only pay an average interest rate of 0.06%, and certificates of deposit (CDs) fare little better with an average interest rate of 0.25% for a 12-month CD, according to the FDIC. Dividend paying stocks, which historically paid lower yields and did not guarantee cash flow as bank accounts did, now appear to be more favorable income vehicles. Today, dividend paying stocks pay an average dividend yield of 2.03% in 2016, and some stocks pay dividends with double-digit returns. However, higher returns could also indicate increased risk, so investors need to investigate these stocks beyond the dividend yield before obtaining a position.

According to Oxford Reference, a dividend is “the distribution of part of the earnings of a company to its shareholders.” Dividends can be paid in cash, stock, or other holdings. They can be paid out in any time period chosen by the Board of Directors, though they’re paid out quarterly in most cases. Investors are often drawn to dividend paying stocks because they like the stream of income, other investors see the dividend payments as a source of strength. Although many stocks have above average dividend yields, risk often increases along with the yield.

Dividend stocks can often be a value trap, meaning the stock has challenges and limitations for which the higher dividend may not compensate. If a stock pays a higher dividend than its peers, that signifies a need for further investigation. Additionally, volatility may be a factor. If a stock falls significantly in price, the dividend yield is going to go up with it. It’s possible a dividend cut could soon follow, returning the dividend yield closer to where it was before the stock price fell.

Another important factor is the payout ratio, which refers to the percent of profits paid out in dividends. If a company earns $1/share and pays an annual dividend of 5 cents, the stock has a payout ratio of 5%. For most stocks, that ratio is sustainable. If the stock earned $1/share and the dividend is $2, that’s a payout ratio of 200%, meaning the dividend is exceeding the profitability of the company and is not sustainable in the long term. Barring a near-term spike in profitability, either the dividend will have to be cut, borrowing will have to increase, or shares will have to be issued, which dilutes the value of the stock.

An analysis of the stocks with the highest dividend yields shows the importance of analyzing divided sustainability. The types of companies that pay dividends are typically basic materials, oil and gas, financials, real estate investment trusts (REITs), utilities, and healthcare stocks. Of the top twenty stocks in dividend yield, eight are in a category of energy stocks called royalty trusts. The stock with the highest dividend yield is BP Prudhoe Bay Royalty Trust (BPT), paying an annual dividend of $4.29/share for a yield of 21.07%. However, both the stock price and the dividend have seen substantial volatility over the last five years. At its recent peak dividend payment on July 11, 2014, BPT paid a dividend of $3.03. The closing price of the stock that day was $94.90, signifying a quarterly yield of just over 3.19% (12.77% if extrapolated to an annual rate).

Oil prices started falling in 2014, and the stock price of BPT and its dividend fell quickly. By April 13, 2016, the dividend was down to $0.072 and the stock was trading at $16.14, taking the quarterly yield to 0.45% (1.78% annual yield). Royalty trusts structured similar to BPT may present a similar decline in dividend payouts. Mesa Royalty Trust’s (MTR) monthly dividend peaked at the height of the oil boom in September 2014 at $.46/share and fell all the way to $.01/share in March 2016 with a corresponding fall in oil prices. Overall, an important concern about royalty trusts are their inability to acquire new assets. Once the reserves are exhausted, payouts will end, and the stocks will likely lack the asset base to maintain their stock prices.

Dividend payment issues are not limited to the royalty trusts. For example, Suburban Propane Partners L.P. (SPH) has consistently paid dividends for decades. Its quarterly dividend payment stands at $.8875. It was increased from a level of $.875 in June 2015. Although the company has maintained a stable dividend, this payment history is no guarantee of future dividends. In fiscal 2016, net income was $.24/share, yet SPH paid a dividend of $3.55/share, indicating a dangerously high 1,492% dividend payout ratio for 2016. Another example is a REIT called CBL & Associates Properties, Inc. (CBL), which specializes in regional malls, open-air centers, and community centers. At current stock prices, CBL has a dividend yield of approximately 12.5%, greatly exceeding that of its direct competitors. An analysis of the payout ratio does not bode well for the long-term health of the dividend. The 2016 net income attributable to common shareholders stood at $.75/share, distributions per unit amounted to $1.09/share, indicating a payout ratio of 145%. Unsustainable dividend payout ratios appear to be common among stocks with the highest dividend yields. Of the top twenty stocks in terms of dividend yield, only Sandridge Mississippian Trust (SDT) and the Sandridge Mississippian Trust II (SDR) have payout ratios at or under a 100% ratio of sustainability.

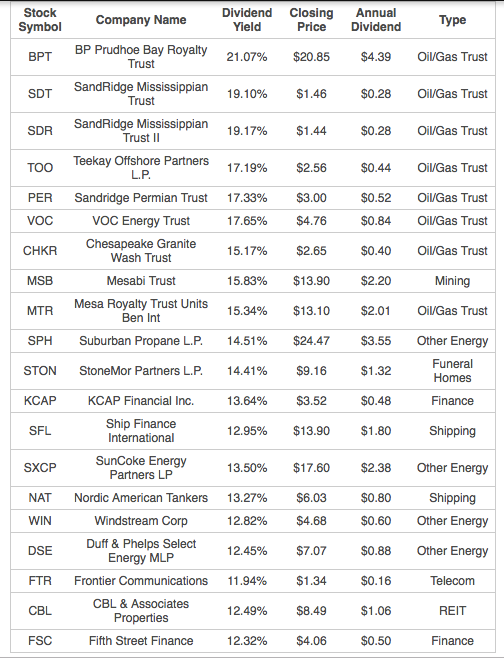

Below is an overview of the highest yielding dividend stocks on the market to date:

Sustainable dividend payout ratios and consistent dividend payments are factors that any investor in dividend stocks needs to investigate. Though high dividend yields can appear attractive, these yields tend to be accompanied by a great deal of risk. With most of the top twenty dividend-yielding stocks, the payout ratios greatly exceeded 100%, and none of these stocks were investments that paid consistent dividends while maintaining a dividend payout ratio under 100%. Given the difficulty of finding both consistent dividend payments and a sustainable dividend payout ratio among the highest-yielding stocks, one must conclude that at best, the twenty yielding dividend stocks are short-term trades and should not be purchased or traded without due diligence.

Authord by Dr. Brandon K. Chicotsky

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.careythetorch.com/2017/07/an-overview-of-the-highest-dividend-yields/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you think dividend would pay the capital in 3 years ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit