After earlier tend to rise steadily, the Dow Jones Industrial Average (DJIA), as you know, since the beginning of February, yesterday began to move down until it got closed in position 23.860, or 10.3% drop from its highest position i.e. 26.616. In theory, if the stock index is down to 10% from its highest level, then does that mean the stock market in the country concerned ' official ' entering a period of correction/bearish. And the Dow is down concerning the dkk (S & P500 and Nasdaq is also down), that in fact is the benchmark of the global stock market movements, then the question is now, how the influence of the decrease of JCI DJIA?

But before answering the above question, we must first answer the following questions: what is actually happening in the United States there, so the DJIA down? Isn't it the American economy, at least according to the claims of the President of Trump, thus being bagus-bagusnya?

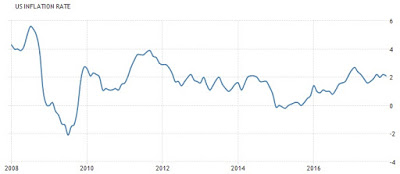

Well, if you read it-read the news coverage in the mainstream media about the decline in the Dow, then the issue is the existence of fears of high inflation in the US, as a side effect of the low interest rates and economic growth that is too fast ( the relationship between inflation, interest rates, banks and economic growth can be read here). But the fact that inflation in the US was the last still controlled secure on level 2.1%. Indeed, the figure is higher than the year 2015 and then a 0%, but only in the last 10 years, the rate of inflation in the U.S. Yes stable in level range 1 – 2%. And if in the future there is the risk that inflation would rise, then the Federal Reserve as the Central Bank raise rates live United reference/Fed Rate, which is currently still at the level of 1.5%, or far below the level at the beginning of the Decade of the 2000 's which reached the 4 – 5% (so still open wide space for the fed's rate to be raised).

Inflation data in the United States in the last 10 years. Source: www.tradingeconomics.com

Then if it is not a question of inflation, then what's the problem? Well, if the truth be told yes dont no problem anything. After experiencing the subprime mortgage crisis in 2008 then, it could be said that Americans at this time have really recover from the crisis, in which big companies there vying to obtain performance positive, particularly technology companies. Event Twitter Inc., one of the most popular technology companies but there used to be almost always posted a loss, in the year 2017 yesterday for the first time registered a profit, and is ever rising.

So if it is said that the drop in the Dow caused by ' something wrong ' in the US economy, then quote the statement of the President of Trump, it's fake news. However it should also be noted that the existence of problems of economic and fundamental changes/company performance is not the only cause of the decline in the stock market. The second cause is, it's when the economy is bagus-bagusnya, then often stock prices continued to rise to valuasinya no longer reflects the value normally (the term overvalue), so normally will going on a healthy correction to return stock prices to a reasonable position of their respective.

And indeed when the Dow was at levels 26.000 's, some time ago, then based on points PER and PBV of the 30 DJIA components, then the stock valuations stocks in the U.S. are at the highest level, one of which is only ever achieved 3 times in 100 years last. Remember the DJIA has gone up almost 4 times within the last ten years (at the lowest point of the crisis of 2008, the DJIA was at the level of 6.626), then this is not a surprising fact. In particular, the increase in DJIA also added tight in the last two years, in which experiencing after the last correction with down to 16.000 in October 2015 and then, next to the Dow continued to rise up to a total of 10.000 points (26.000) in two years three months old, almost without correction means.

And the author himself is actually a bit distracted with the DJIA rising as relentlessly, until the technopreneur like Mr. Bezos and Zuc suddenly just biting with Om Bill and Opa Warren in the list of Forbes magazine (which is ridiculous). So when the Dow finally come down too, then that's precisely the already-awaited. Then, because his main problem was limited to the high valuation stocks in America, if in future the Dow continued its normal down again (and rightly so. Historically, every time the Dow went down a lot, then he will not be directly recovered again in less than a month), the author think his descent won't be too deep/will not return until the Dow to a level before he started the rally two years ago, i.e. 16.000. However, if it comes down to the level of 20.000 's, then it's still possible.

Then how about JCI?

In general the condition in Indonesia now is similar to Americans: the economy more good, stocks again rising, and the rise in JCI also feel tighter in the last two years (the highest position JCI currently is 6.686, or take 40% compared to the end of January 2016 at level 4.771). And as is the case in America, now it's very difficult to find shares blue chip that valuasinya is still cheap.

Because the conditions are similar, then in theory when the Dow fell 10%, should the JCI would join down much for more or less well. But in fact the JCI yesterday just down to Muscovy duck at 6.427 (down 3.8%), then membal again to 6.500. But this is interestingly: If you notice the movements of individual stocks, then there are many stocks that are down significantly when The Dow began to fall, with a total decline of a much deeper downturn than JCI itself. On the other hand there are some big caps stocks that their influential movement of JCI, like UNVR, and an HMSP is precisely his own ride when the markets start under attack because of the decline in the Dow, sentiment usually rise at the time of the session pre-order closing. This is what causes the JCI, which probably totals went down 1-2% on a certain day, at a late afternoon impromptu ride up to a total of penurunnya only 0.5% only.

Well, so you've understand right? Yup, market conditions in February is similar to market conditions December 2017 yesterday, where despite the JCI outstanding ride when it's more up to 6% (from 5.900-ness to 6.300), but there are a lot of stocks are mainly second liners which are precisely bertumbangan (read more reviews market December 2017 and then here, try reading her comments also). So if we see is the movement of the shares itself, and not of JCI, then Indonesia's stock market since early February yesterday also I actually middle of the rectified/down, with the decline more or less the same as the the decline in the Dow Jones. How to read market like this is probably hard to do: correction of my ass? Obviously the JCI still safe-safe course kok! But you are trying to ask about that to the Fund, the fund manager performance they almost all lose badly than JCI: how the market situation throughout the year 2017, and also along the beginning of 2018? Whether a majority of the shares in January 2017 year-round BEI really rise up to 20% as well as a rise in JCI? Or the spectacular rise in JCI is only stocks supported by an it-that's it??

Conclusion

Okay, so let's summarise again: 1. Dow Jones is currently undergoing a ' healthy correction ' that are not caused by economic problems, but because valuations stocks there are already expensive enough, avail 2. Normally this correction will not directly done in the the near future, but it took at least 2 – 3 months, other than because of valuations stocks in America cannot yet be said to terdiskon, and 3. When American Stock Exchange down, stock-stock exchanges all over the world will join the down was no exception in Indonesia, let alone the condition here is similar to that in the U.S. (so will be another story if JCI is now still at level 5.000 's, for example).

But again, if the guideline is the JCI movement, then even if later the Dow really further drop to level the author's, 20.000 guess JCI still won't go down too deep (or down dalem briefly, but straight up again). However, the experience in December 2017 yesterday, and also along the year 2017 itself, have been taught that the relative (or even rise) JCI does not necessarily mean that stocks indeed are all rising, but could just be JCI rose himself while most stocks the tumbling instead.

So, Yep, after had given the ' breath ' in January of yesterday, for now we can be more alert again. And don't worry, unlike the correction due to macroeconomic issues, healthy correction because of the expensive stocks is usually just a minute/matter of weeks until 2-3 months, so do not be prolonged as in year 2008 and 2015. Even if we look at it from the point of view of value investing, so for those of you who missed the big stock sale! in December 2017 yesterday (that time construction stocks and coal is still cheap at all), then in the near future will probably roll out BEI big sale once again. We'll see!

Congratulations @ferryji! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @ferryji! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit