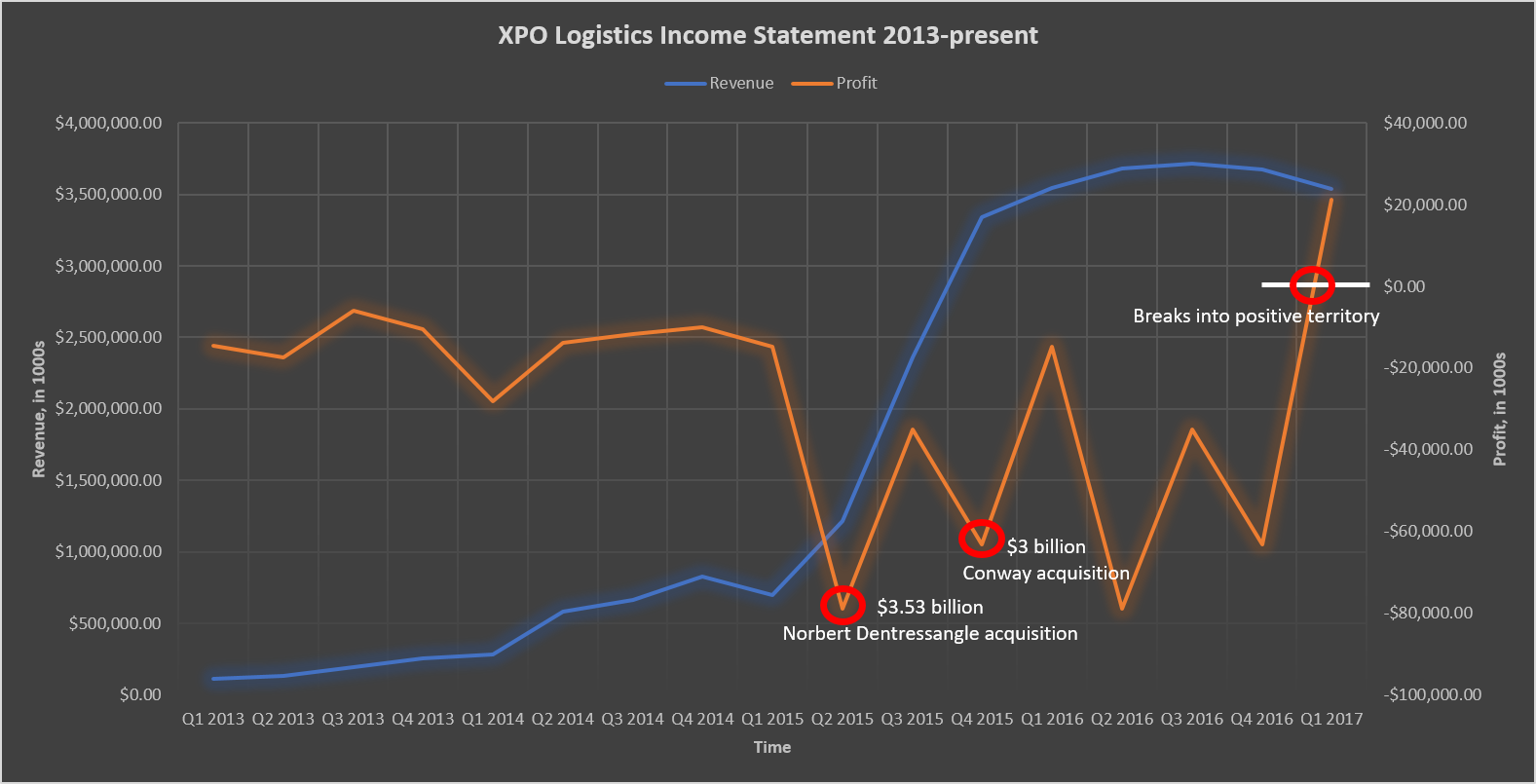

XPO Logistics (NYSE: XPO) is a global logistics and transportation company operating in the U.S and Europe. Its highly skilled management team, led by Brad Jacobs, increased and diversified the company by acquiring good undervalued truck brokerage companies. However, these mergers and acquisitions put XPO into a lot of debt, putting its stock price plummeting last 2015-2016. Below, I decided to crunch the numbers and show XPO's (GAAP) revenue and profit since 2013.

Blue line represents revenue, and it increased substantially from $113 million in Q1 2013 to $3.5 billion in Q1 of this year. This approximately 3000% increase in revenue, heavily aided by the acquisition of profitable companies, ate up all profits into the net loss column obviously because of the one-time non-recurring acquisition expenses. However, the last quarter of 2016 was the turning point of the company: after all the integration of the acquired companies into the XPO system and minimizing expenses, the company for the first time became profitable, earning a positive $21 million.

As the rebranding and integration costs of these acquired companies complete, we will see an increase in the bottom line of XPO logistics. The Q2 financial reports is expected to be on August 2, 2017.

What do you think? Next up: we'll examine XPO's balance sheet.