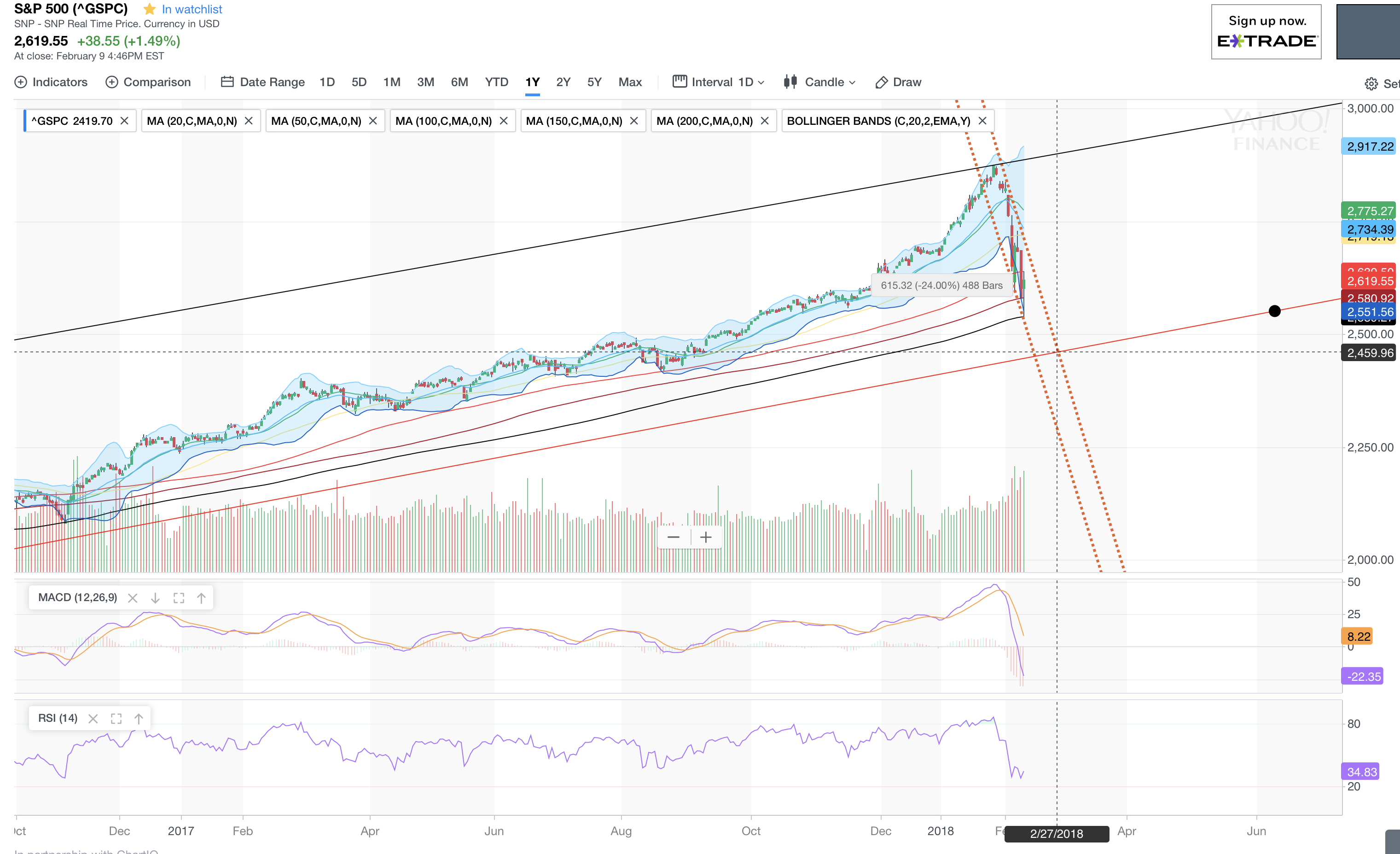

This recent correction doesn't quite qualify as a crash yet...yet.

Almost any advisor will tell you to keep calm, think long term, buy the dip and keep investing.

So far, roughly 3 months worth of gains were wiped out in the stock market.

At this point, a wait and see strategy is really not out of the question.

Before selling your hard earned stocks, consider these factors:

• The Fed claims they will raise Interest Rates

• The new Fed chair may be a bit more hawkish than Yellen

• After the bloodbath in bonds, yields are up

• Inflation rates may be rising

• The Dollar overall has been weakening

• The Fed is unwinding their balance sheet

• The CAPE is relatively high, though not ridiculous

• The Vix spiked, though it's cooling off

• The Dow to GDP ratio is historically high

• Experts say everything is ok, which isn't always true

• This Bull run is about 9 years old

• The new corporate tax rate may help earnings in the future

Of course there are a fair few other factors we consider before buying or selling but one main question you have to ask yourself is: When do you need the money?

Passive index investing with a dollar cost average strategy has done fairly well for the last 9 years.

Whatever you do, don't panic sell.

Panic selling is the worst thing you can do.

If you do choose to sell, make sure it is for very specific reasons that suit your strategy and timeline.

Although at this point in time, having a nice cash reserve waiting to strike and ready to deploy is highly recommended.

This is a very important week for technical analysts, it will very much help determine if we are going up...or down.

Then again, when are those guys ever right? :)

The next few weeks and months could dole out quite a bit of pain, erasing much of past gains.

Ultimately, having some volatility return to the stock market keeps everyone honest and shows that everything is not all unicorns and rainbows.

Even a 20% crash from the high set on Jan 26, 2018 would still keep us in a long term uptrend.

What direction do you think the stock market is heading and what have you done to prepare yourself?

- James Miller

All of those things are true, after such a long time of nearly zero volatility, something was bound to happen.

I'm not a stock bull by any means, but I don't think this is the crash either. Judging by where we are in the business cycle, it's about time to book profits and up your allocation to cash and gold.

Personally, I am long Gold and Commodities. I think those are the places to be for the next 2-3 years.

What about you?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In general, all experts will tell you to never try and time the market but I am somewhat of an active retail investor who subscribes to a dollar cost average buy the dip, sell the high mentality. In fall 2017 I scaled back stocks, In late fall 2017 I scaled back cryptos, I have been very heavy Silver/Gold since winter 2015. Recently I bought the dip in cryptos and stocks very gently. My cash position is higher than normal right now because I do sense there may be another opportunity to seize. I haven't touched bonds in 5 years, except for tax-exempt munis, but now may be time to consider buying the blood on the streets. Although I am never more than 5% in bonds since I still have 25 years to retire.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The economy is stronger than ever right now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I certainly won't argue that but that can be a chicken or the egg scenario. Meaning which came first, a strong economy or all-time highs in the stock market. Looking back, it does seem that crashes in the market ultimately have an overall negative effect on the economy. Since the market acts as a barometer for economic health it definitely pays to study the cause and effect. To be less vague, I pose the question "if" the stock market crashed 20% would the economy still be stronger than ever. Since human psychology is a strong factor and losses can be devastating, it is worth noting that recessions do occur after market crashes. Ultimately the boom and bust cycle is somewhat predictable and it is very possible that we will be going through a de-leveraging. Think of it like this: for 8 years you run up your credit card and max it out, then for 2 years you tighten your belt, cut spending and pay off the bill. We might be entering the "pay the bill" phase of things but I do agree at present the economy is very healthy on paper.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @jamesmillerband! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @jamesmillerband! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit