Nothing is exempt from cycles. We wake up everyday with a clean slate and disorder increases throughout the day only to end up into the nothingness of the sleep. Human nature is repeat and just like seasons, we keep doing things again after particular break time, more often people who make mistake repeat them after some time again, thinking they would improve, and that's where money is made, a speculators is more keen in understanding phase of the market rather than trend of the market. Market is ready to reward in a particular phase to limited people, and that the best time make tons of money.

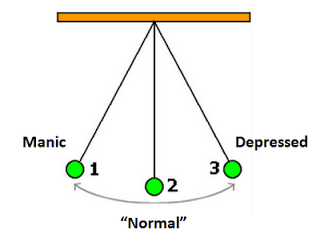

Markets follow similar pattern. Now, we are no longer thinking in terms of binary bullish and bearish terms.

A better model of market movement is therefore not bullish/bearish one but rather one that focuses on finding which point or phase or cycle market is going through.

Once you figure that out, finding the direction is relatively easier by using any crude method.

Authors get paid when people like you upvote their post.

If you enjoyed what you read here, create your account today and start earning FREE STEEM!

If you enjoyed what you read here, create your account today and start earning FREE STEEM!

Perfectly!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting. Upvoted and followed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing .

we can mutually benefit each other following up & upvoting each others blog.

my blogs are related to Yoga ,personal development & crypto currency .which you will differently like .

have upvoted above post .waiting for you coming to my Small home of wellness .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit