Many investors will say that you have to buy stocks whose price is very low with the expectation that them will revalue over time. This strategy could be the correct one for a Venture Capital that invests in companies of new creation and that does not mind to assume great risk of loss of its capital in 9 out of 10 new investment opportunities. When entering the value of the stock right at the beginning, if one of the 10 shares manages to succeed, only this will cover all the losses that may cause you to invest in the other 9 companies and possibly in the long term get to get very good returns.

In our case, since we do not have sufficient capital such as that available to investors such as Venture Capital or Angel Investors, our strategy is going to be exactly the opposite of what these investors do.

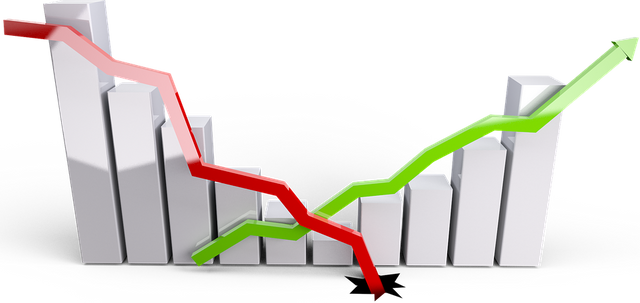

We will invest in stocks that already have a definite trend over time. Specifically, if we choose to trade in bullish stocks, we will invest in stocks that just break their historical maximum, making sure to enter that upward trend along with other investors who are already in profits.

If we decide to trade in bearish trend stocks, we will invest in stocks that just break their historical minimum taking advantage of the fact that we can have in our favor the panic that is generated in the investors that sell when seeing how a stock goes down and down.

This would seem to be contradictory to what most people might think about when investing, but believe me that is the strategy that investment professionals use constantly.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.nasdaq.com/news/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit