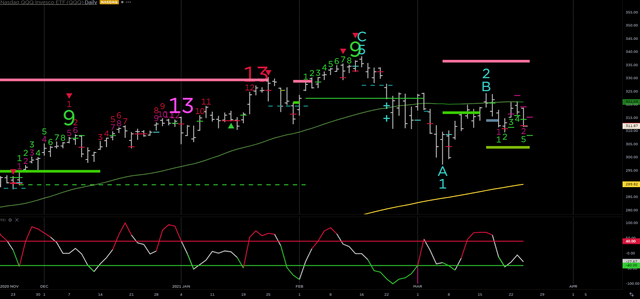

Below is a chart of the Nasdaq ETF, QQQ

I've been monitoring the situation closely and have been observing some cautionary signs in the medium term. First, our scope of reference is going to be through the lens of the DeMark indicators. Given that we had a qualified TD Prop Up several days ago and have now qualified a TD Prop Down, this is something to pay attention to. Furthermore, the price action has been brutal for long exposure.

Furthermore, I'm seeing exhaustion and a failure to qualify opening restriction up on the daily chart for the S&P 500 -- indicating underlying weakness. We closed firmly below the TD Ref Close price and only 5/9 on both the SPY and QQQ TD Buy Setups.

Lets see what the rest of the week might bring. If the market can hold these levels, there is a really solid chance of getting up to 4100 in SPX in the medium term but for now we have no reason to assume that is the next move in stocks.