In November 2007 stocks started to fall, but the 'real economy' was doing good: everything was fine. No crisis yet.

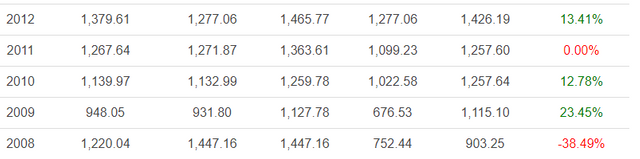

In addiction, between 2009 and 2012 the stock market recovered the losses (image below). Although, from 2009 to 2012 were the years with the most negative news. Banks were in the proccess of bailing out, people lost their houses, retirees saw their stock market savings drop by 40% by the end of 2008 and countries like Portugal (where I live), greece and ireland needed finnacial help from the IMF.

If you go back the dot.com buble the same thing happened.

I think the 'real economy' doesn't perform the same way the stock market performs. Usually the stock market falls before the economy because the 'smart money' knows when to exit. I really enjoy the majority of your posts and I think you should focus more on what the central banks are doing because those guys drive the stock market up and down.

Tell me what you think.

In my steemit account I only do technical analysis, but I think it's important to watch what central banks are doing. Tell me what you think of my last analysis on the S&P500 which is related to this one.

Awesome comment and posts. Yes, the Markets are on avg. 9 months ahead of the economic cycle. I do follow the US Feds and currently paying attention to the yield curve and interest rates. I thought the yield curve would invert in Dec...I might be wrong...and 3.5% on the 10 yr is when I said things should really get interesting in the equity markets.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit