It was an interesting day with the Dow down about $666 points. Don't think they don't like these numbers? See my post from 1/20/18 where my study indicates a possible top at Dow of $26,666 which was a number almost hit before the market started moving down. In fact the number was $26616 on 1/26. They like the 6's no doubt.

I grabbed some next week $186 $SPY puts (1/31 not 2/2 which is unfortunate) before the close on 1/26 with the fluffy move up into the close and closed those puts out on 1/30 for an approx 400% gain. Not what I was going for but a nice gain nonetheless, albeit small position so the gain is really negligible.

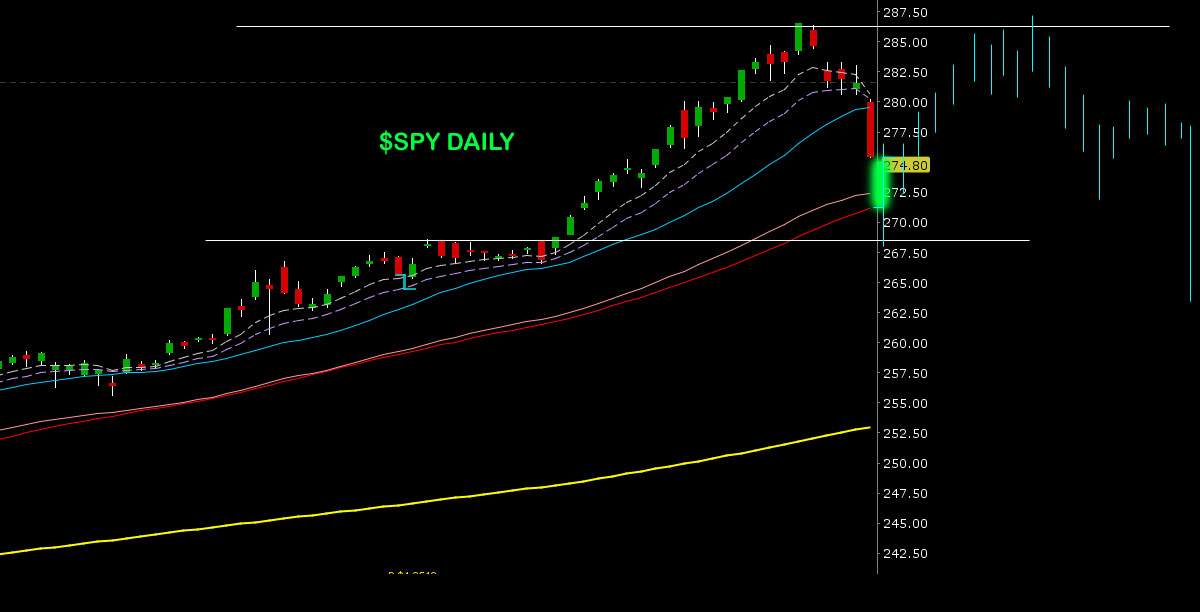

Now what happens. Today 2/2/18 closed at the lows very weak. Some bulls are coming around to a bit of a reality check after today.

I'm gonna throw out a possible scenario and it is based on my usual method of scenario building, how to screw the most people. My bias is, I hope it happens this way because it would be the best for me so take it with a grain of salt. To screw the most people consider where most people are what they are thinking and how they are feeling. Up until today, 95% of bulls were still bullish. After today, not as much, maybe 70%. Now there is that little bit of doubt in the back of their minds whether they will realize it or not it will affect their trading. Monday to make that doubt bloom, we need to see a big gap down and sharp move down on margin calls and stops. At that point, the bulls will realize their doubt and the market can go back up, now with them having short hedges or playing with reduced size. They will end up stopping out at the lows and then feeling stupid later in the day as very bullish action takes over again. Their hedges will become losses and their reduced size or stop outs will also be losses or reduced gains.

Also, for retail, BTD means any dip, the bigger the better. Retail will buy the dip and be rewarded. The market goes back to ATH over the next weeks and breaks to new highs to get the last bit of retail long. This next move up will be a sell off period for smart money. After some time in a choppy sideways confusing volatile consolidation near the highs we again move down. Buy the dippers buy the dip. Bulls are again confident and bullish buying all the way down until they finally realize it ain't goin back up. Bears will be unsure. Markets are then free to move down. As it moves down selling will get heavier and heavier. Buy the dippers will begin to stop out and retreat, some will average down till they are broke, bears will step on as the move progresses. Once it begins it will be hard to stop and will accelerate as it goes until it bottoms where there will be much consolidation before a real move back up.

Or is today the beginning of the real move down? Maybe we don't go back to the highs. I think that's too easy, but a nice trap was set today and we can't ignore that fact. With everybody buying for Dow 30,000 and Apple $1 trillion (2 things that were almost a certainty to 95% of people only a week ago now seeming far distant). Also everyone is okay with their 401K because Trump has another 3 years. Everybody and their dog knows the market will keep going up at an incredible pace for at least 3 more years. Another thing we can't ignore is that everyone is convinced (me included) this isn't the move down. This is just a sharp and necessary pullback because of January exuberance. In a way, you could say that almost everybody is on one side of this trade, that this isn't the move down. For that reason alone, it may actually be. After all, how to screw the most people is the name of the game.

The exuberance of January's move up in the market was beyond extreme, absolutely thorough, and those highs set should be tough to retest. We would in a way be lucky to see those highs broken at all. However this move down was to be expected simply because of the exuberance of that move it was a V top on an already extremely overextended market. It had to come. Further move down from here is not guaranteed. Today was easy, now it will likely get a little more tricky as this move gave us most of what we needed to "stabilize" the chart.

$AAPL's chart is looking a bit broken after today, over 10% off the high of $180.10. I think we will know more at the end of next week. I'll likely repeat the same thing at the end of next week.

Now with Wells Fargo $WFC dumping 6% after hours today on news, Monday is looking to be interesting.

So what happens Monday?

Closing at the lows today amid a huge selloff is enough to keep people holding shorts comfortably. On a gap up with strength (a surprise), we should move up. On a gap down we should sell off quickly. On a flat open probably a choppy inside day or down move. Monday could be a day where a lot of panic buttons are hit and should be interesting. On a big move down I will be looking for an afternoon recovery and possible short squeeze developing in the days after as the market gods laugh in the face of the bears once again. But this time I believe that laughter will only be temporary (as in weeks).

Trump's market needs to survive the $666 down day of 2/2/18, then it will have proven that it can do anything and anyone still on the sidelines will be totally convinced that now is the time to buy. Bulls that got a little scared today will realize how they just got played and vow to not let that happen next time. In fact, next time they will double down over and over as the market keeps going against them.

Janet Yellen's last day today with new fed chairman stepping in who is already trying to save the market with promises that he will be as weak on interest rates as she was.

Imagine the Dow down $800 on Monday and rallying back to close green. It will mess with everyone, except retail, BTD always wins, hahaha. But that so far is what this market is doing, rewarding the worst traders. We know that won't go on forever, and those paper gains will end up turning into real losses at some point in the future. It can't work any other way.

Plan it, wait for it, see it, attack it.

(waiting for it being the most important part)

Below is my predicted scenario in chart form (not to scale horizontally, but this is the overall idea I am describing here, where it cuts off at the right side it will continue down)

Legal Disclaimer:

This is my opinion only.

This is for entertainment purposes only.

This is NOT financial advice nor a recommendation to buy or sell anything.