That’s right, you can earn the most valuable crypto in existence ($BTC) just by holding what’s going to be one of the most valuable cryptos in very near future ($STX).

Stacks 2.0 is a layer-1 blockchain that extends the capability of Bitcoin and brings scalable transactions and smart contracts to Bitcoin, without modifying Bitcoin. Stacks 2.0 uses a novel consensus mechanism called Proof of Transfer (PoX). Miners in Stacks blockchain spend Bitcoin to mint new Stacks ($STX) tokens. STX holders lock their Stacks and participate in Stacks blockchain consensus to receive the Bitcoins spent by miners. The election of the winning miner for every Stacks block happens in Bitcoin blockchain. PoX makes use of Bitcoin’s security and stability to secure Stacks 2.0 blockchain.

Proof of Transfer (PoX) is an implementation of Satoshi Nakamoto’s vision: a completely separate blockchain that shares the computing power of Bitcoin.

Stacks 2.0 embeds Satoshi’s vision in its genesis block.

Proof of Transfer (PoX)

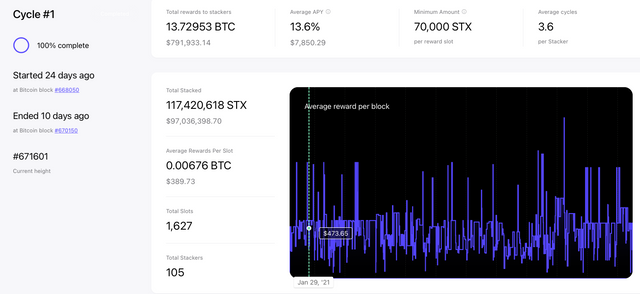

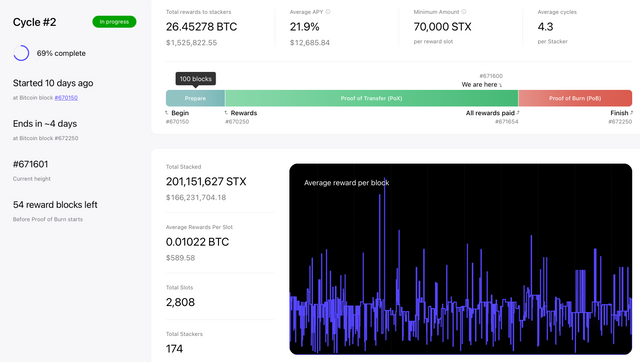

Stacking: Stackers lock their STX for the number reward cycles they want and provide a Bitcoin address for receiving the rewards. Each reward cycle lasts for 2100 blocks (equivalent to 2100 Bitcoin blocks, approximately 2 weeks). There are only 4000 reward slots per reward cycle. Stackers should lock at least a minimum amount of STX to occupy a reward slot (70,000 STX at the time of writing). The reward slots a stacker occupies depend on the amount of STX the stacker locks. For example, based on the current minimum threshold (70,000 STX), if a stacker locks 140,000 STX, they occupy 2 reward slots and could get rewarded two times in a reward cycle. The minimum threshold is determined based on the total amount of STX participating in stacking. Only two stackers receive BTC rewards per STX block. For every stacks block, the consensus algorithm uses a verifiable random function (VRF) to select two stackers from the eligible stackers in the reward cycle. VRF ensures that in a given block, each participating miner node will select the same two stacking addresses for reward.

Mining: Anyone with BTC can mine Stacks (STX), no need for expensive, specialized mining hardware. To bid for a chance to mine the next block in the STX blockchain, the miners transfer Bitcoin to stackers selected to receive rewards for that block. The consensus algorithm randomly selects a miner, taking into consideration the amount of BTC each miner committed. The winning miner receives the newly minted STX, the transaction fees and smart contract execution fees in the newly added block. The selected stackers receive the rewards, just for locking up their STX and participating in the consensus.

What if a STX holder doesn’t have the minimum amount required to participate in stacking? Stacks 2.0 blockchain has a built-in delegating mechanism to help create a stacking pool. STX holders can delegate their STX to another STX holder and pool their STX together to achieve the minimum threshold. The beauty of all of this is that your STX never leaves your wallet and you could earn ~21% APY on your stacks holding (based on the current reward cycle). There are also exchanges like OkCoin that will help stack lower amounts of STX for a very good yield (~15% APY).

How to start stacking?

If you have the minimum threshold required for stacking, you can start stacking by using Stacks Wallet from Hiro PBC.

If you have less than the minimum threshold, you can currently use OkCoin to earn a yield on your STX (~15% APY). There are also other upcoming services like Boom Wallet and Xverse Wallet actively working on integrating STX pooling feature.

Wondering if this is just a hype or for real? See for yourself.

Clarity smart contracts

Stacks 2.0 also introduced a new smart contract language called Clarity to enable developers to build complex smart contracts in a safe way, leveraging Bitcoin’s unmatched security. It’s a decidable, interpreted language that gives visibility to Bitcoin blockchain.

If you are a smart contract developer, you should definitely consider Stacks 2.0 for building your next smart contract. Here is its advantages over Ethereum (as explained by Jude, a core developer in Stack blockchain team):

- For smart contracts, it’s night and day. Ethereum is an undecidable VM that runs compiled bytecode, whereas Stacks is a decidable LISP language (http://clarity-lang.org) with native types for fungible and non-fungible tokens and proactive security via post-conditions.

- Clarity’s decidability means that all execution paths of a contract have known upper-bound runtime costs and halting states, so you not only do avoid the need for an out-of-gas error condition, but also you can determine all the possible things that could happen.

- Clarity’s lack of a compiler means that all source code, with comments and formatting, is published to the chain. What You See Is What You Run (WISIWYR), and there’s no chance for a buggy compiler to produce bytecode that doesn’t do what your code says it should.

Learn more

https://stacking.club/

https://www.stacks.co/

https://www.hiro.so/

https://www.secretkeylabs.com/

https://boom.money/

https://www.joinfreehold.com/

https://clarity-lang.org/

https://paper.dropbox.com/published/stacksblue-Stacks-Brief-JOEqkfUQsrhINkQyCyBc5cK#

https://walter-neumann.medium.com/stackanomics-the-bull-case-for-stx-97aa4478a303

Thanks for reading!