This is the story of Rakesh Jhunjhunwala’s mentor and billionaire, Mr. Radhakishan Damani.

Early Career in Business

Before making a name for himself in the stock market, Radhakishan Damani ran a ball bearing business. Initially, he earned money through trading and investing in multinational companies (MNCs). In the 1990s, when Harshad Mehta was dominating the stock market, Damani made his fortune through a technique called short selling.

Understanding Short Selling

If you’re not familiar with short selling, let me explain it simply: Usually, we buy stocks and then sell them later when their price goes up. Short selling is the opposite. In short selling, you sell stocks first and then buy them back later. You profit from short selling when the stock price goes down. If you haven't seen our video on Harshad Mehta, it’s a great resource to understand this concept better. You can find the link in the description.

When a trader thinks a stock’s price might drop, they might choose to short sell that stock. We’ll cover short selling in detail in another video.

Harshad Mehta’s Market Manipulation

In the Harshad Mehta scam, we learned that Harshad Mehta used bank funds to manipulate the stock market. He made huge purchases of certain stocks, which pushed their prices up dramatically. For example, he drove the price of ACC stock from ₹200 to ₹9000 in just a few months. However, the fundamentals of these stocks didn’t justify such high prices. Even though the companies' fundamentals didn’t change, their stock prices kept rising.

Mr. Damani saw these stocks trading at such inflated prices and was concerned. He knew Harshad Mehta was manipulating the stock prices and that these high valuations wouldn’t last. He figured that once Harshad Mehta ran out of money, the stock prices would fall. So, Radhakishan Damani started short selling the stocks that Harshad Mehta was investing in. While Harshad Mehta was buying up stocks, Damani was short selling the same ones.

The Impact of Harshad Mehta’s Collapse

However, Damani didn’t know the full extent of Harshad Mehta’s financial backing. Harshad Mehta was continuously pulling funds from banks and making large stock purchases, which kept pushing prices up. This led to a few significant losses for Mr. Damani. But when the Harshad Mehta scam was revealed, those stocks crashed, and Damani made substantial profits, which greatly increased his net worth.

Transition to Value Investing

A few years later, value investor Mr. Chandrakant Sampat found success using value investing techniques. Inspired by him, Radhakishan Damani shifted his focus to long-term value investing. In early 2014, he invested in two logistics companies, Gati and TCI. Following the value investing approach, whenever stocks with strong fundamentals became available at low prices, Mr. Damani bought them and held onto them for the long term. Both of these stocks were fundamentally strong and available at rock-bottom prices, leading to significant returns.

We’ll explore value investing in detail in the next discussion. Most of Mr. Damani’s profits came from long-term investments, but he also takes advantage of short-term opportunities when they arise. For example, in 2000 and 2001, when Ketan Parikh’s scam caused stock prices to rise through manipulation, Mr. Damani made a lot of money through short selling.

Success with Long-Term Investments

In 2000, Mr. Radhakishan Damani bought a large number of shares in VST Industries at an average price of ₹85, and now these shares are trading above ₹3600. He also saw great returns from investments in HDFC Bank, Gati, Blue Dart, Sundaram Finance, Gillette, India Cement, and other stocks. He prefers to hold onto stocks for 5 to 10 years. Mr. Damani has always had a keen interest in the consumer business. Before starting D Mart, he bought a franchise of the Apna Bazar cooperative store chain in Nerul, Navi Mumbai. This experience gave him valuable insights into the retail business.

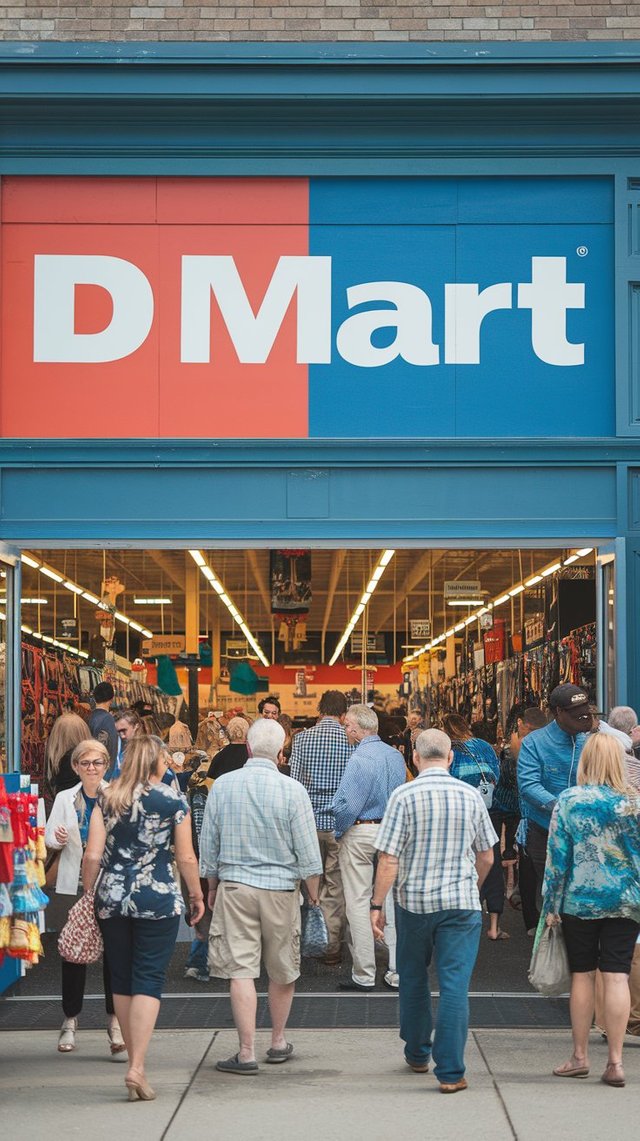

Establishing D Mart

Later, in 2002, he founded the retail chain D Mart. Whether in business or investing, Mr. Damani always thinks long-term. In the fiscal year 2001-2002, when real estate prices dropped, Mr. Damani seized the opportunity to buy properties for D Mart in various locations. He bought properties in the outer areas of Thane and Navi Mumbai, where prices were low, anticipating future growth. Today, D Mart stores are located in prime, densely populated areas, reducing the risk of relocation and saving on rent costs. This has greatly contributed to D Mart’s profitability.

D Mart’s Unique Model

D Mart stores are not located in malls but are mostly in standalone locations. This reduces costs and allows them to offer great discounts to customers. Mr. Damani sticks to his philosophy in both business and investing, ignoring popular opinion. While many investors were focused on expansion, Mr. Damani concentrated on D Mart’s profitability. He perfected the business model before starting rapid expansion. In the first nine years of D Mart, up to 2011, it had only 25 stores. In the last 5-6 years, he opened more than 100 new stores quickly. Even with enough funds, he only opens new stores when he is confident they will be as profitable as the existing ones. That’s why none of D Mart’s stores are closed today.

Response to E-Retail Trends

When e-retail became a trend, experts advised Mr. Damani to enter e-commerce, but he focused solely on improving his physical stores. The results are clear today, with D Mart being India’s most profitable retail company.

Investment Philosophy

Similarly, in 1995, when Mr. Damani was a major shareholder in HDFC Bank, some investors questioned his continued investment in HDFC Bank shares, even though other stocks were available at lower prices. That share eventually became a multi-bagger, answering those investors’ questions. Mr. Damani has consistently followed his own philosophy.

Education and Background

Mr. Radhakishan Damani himself is not highly educated and comes from a modest background. He is a college dropout, having left after completing the first year of a B.Com degree at the University of Mumbai. Despite lacking formal qualifications, he is recognized as one of India’s top investors and entrepreneurs. He has shown that determination and passion are more important than formal education. Mr. Damani acknowledges his mistakes and has learned how a successful business should operate.

Lessons from Mr. Damani

Stock market investors are expected to identify high-performing companies, but Mr. Damani has not only found good businesses but also demonstrated how to run a successful business. This has created wealth for him and other investors as well. He believes that investing has taught him many valuable life lessons. Despite managing a successful business, he continues to dedicate time to investing. Rakesh Jhunjhunwala, India’s top investor, has said, “If I didn’t have my father and Mr. Radhakishan Damani advising me, I wouldn’t have become so successful.”

Legacy and Influence

Both Mr. Damani and Rakesh Jhunjhunwala have investments in companies like Aptech Ltd and Crisil Ltd. Mr. Radhakishan Damani is known for his simplicity, often seen in a white shirt and white trousers, earning him the nickname Mr. White & White. He prefers to stay away from the media and public events, focusing instead on his work. His actions speak louder than words. Mr. Damani’s quiet work ethic and remarkable success offer lessons that are rarely found in books.

Many people, rather than learning from successful investors, focus more on buying the stocks these investors own. According to Forbes, in July 2017, Radhakishan Damani’s net worth, along with his family’s, was $7.7 billion, making him one of India’s wealthiest individuals. Mr. Damani is also a philanthropist who prefers to keep his charitable efforts private