Content

The charm of DeFi is that it can always give people unexpected things. DeFi is constantly expanding its boundaries. From the observation of Blue Fox Notes, DeFi was a parallel world of traditional finance at first, but it was like a black hole, with increasing gravity, eventually reshaping the financial interaction mode of people in the future. The future of DeFi will give people more surprises. Sushi's MISO is also one of them.

MISO’s crowdfunding for Sushi in 2017 was very hot, but the chaos was reborn, and eventually it was a chicken feather and tended to die out. But new projects need to be developed and financial support is needed. This is just needed. 2018-2020 is an important year for the construction of DeFi Lego. During these three years, lending, trading, and derivatives have seen obvious developments. At the same time, various stable coins have been born, the two largest assets in the crypto world, btc and btc. eth has also survived these three years, and these are important building blocks of DeFi. Now defi’s Lego is gradually taking shape, which means that what can be done before can now be done better, and things that could not be done before can now be experimented. One of them is decentralized crowdfunding. Sushi's MISO is showing this to people. What is MISO, Minimal Initial SushiSwap Offering, that is, project crowdfunding based on the Sushiswap platform. If more and more projects get early seed funding through Sushiswap, what does this mean? It will not only change the ecology of defi project crowdfunding, but also change the ecology of DEX, and then reshape the ecology of DeFi. Unlike previous centralized crowdfunding, Sushiswap-based crowdfunding is a decentralized model, not only the platform itself, but also the project. Once these projects are successfully crowdfunded on sushiwap, these projects will follow the trend and launch their trading pairs on Sushiswap. As a result, Sushiswap's liquidity will get better and better. Especially the liquidity of the long tail project. This is very important for Sushiswap. Currently uniswap has better liquidity in long-tail projects than Sushiswap, but this gap is narrowing. In terms of encrypted mainstream assets, the liquidity gap between uniswap and sushiswap is not large.

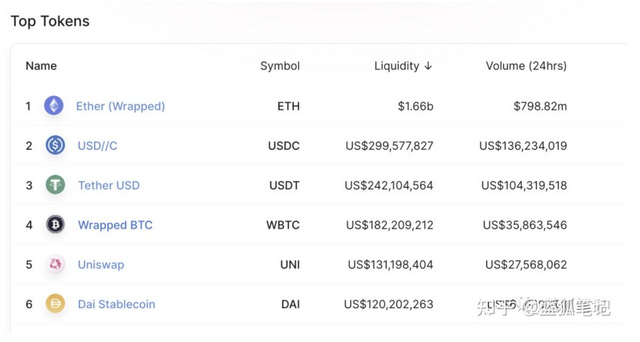

(Liquidity of Uniswap's main assets, Uniswap)

If the follow-up Sushiswap catches up in the long tail project, it means that its liquidity may reach the uniswap level. In addition, as long-tail projects increase, their trading volume will catch up. The current gap between the two is not too far away. From the perspective of liquidity, as of the writing of the Blue Fox Notes, Uniswap's liquidity was 3.9 billion U.S. dollars, sushiswap's liquidity was 2.9 billion U.S. dollars; daily transaction volume was 800 million U.S. dollars in uniswap, and sushiswap was 380 million U.S. dollars. From this perspective, if the MISO ecosystem is built, it will not be impossible to catch up with the current gap between Uniswap and Sushiswap. Therefore, the success of MISO will have a potentially important impact on Sushiswap in the future. Of course, if MISO is unsuccessful, then all the above is meaningless. How to play MISO From a technical perspective, MISO is a set of open source smart contracts that can help projects launch new projects in Sushiswap. Through MISO, project tokens can be created, and non-technical founders are also allowed to issue tokens and start projects. Project founders with non-technical backgrounds can customize the issuance of their projects, including the initial issuance of tokens, treasury, and liquidity mining. Through such a process, MISO can build an ecosystem of token issuance and transaction for its new defi project.

What does MISO have?

- Token Factory (TokenFactory) creates tokens for the project; it can have a fixed upper limit, or it can be generated by mining.

- Fermentation (Fermentation) Token treasury custody or custody option, lock the tokens according to time.

- Contracts for initial token issuance in the initial issuance market; including fixed-price crowdfunding, batch auction (IBCO), and Dutch auction *Mining can be set to generate tokens for mining

- Simple liquidity migration for listing transactions; can be included Part of the crowdfunding funds are used to create a new sushiswap pool and migrate in a trustless manner. The core of MISO is its initial token issuance market. That is, before the project is finally traded on Sushiwap, people make initial purchases based on their understanding of the project. For the project party, the initial funds for the development of the project can be obtained to promote the development of the project. One transaction in MISO can accomplish the following tasks:

- Create a fixed supply of ERC20 tokens*Deploy a crowdfunding contract

- Use new tokens to fund the crowdfunding contract*Create a liquidity initiator *Use some new tokens to initiate liquidity

- Deploy a new Sushiswap pool . Create a new MasterChef liquidity mining

- Use incentive tokens to fund liquidity mining

- Register SLP tokens and set distribution points in the new liquidity mining

- Will remain Tokens sent to the wallet/multi-signature.......Sushi is undergoing transformation More than half a year ago, Sushiswap launched a "vampire" attack on Uniswap, not only copying the uniswap code, but also trying to leverage its liquidity. This is the most classic in the history of encryption. One of the battles. Of course it is also a very controversial battle. The most bloody thing was that the “chef”, one of the founders of sushiswap at the time, tried to cash out and dumped sushi tokens, alarming the crypto community, and having a bad influence on Sushiswap. Later, under the efforts of community participants such as SBF, sushiswap finally survived, but the impression of its copy and rugpull remained deep in people's minds. Even so, under the promotion of 0xMaki, AC and others, sushiswap is moving towards a completely different DEX development path. In this regard, Blue Fox Note also talked about this issue before, "Uni to the left, Sushi to the right". Uniswap and Sushiswap are evolving on different paths. As more measures taken by Sushiswap follow up, Suishiswap is transforming into a DEX different from Uniswap. The future evolution of DEX will become more and more exciting, and the current pattern is far from certain. -------Risk warning: All articles of Blue Fox Note cannot be used as investment advice or recommendation. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make your own investment decisions carefully.