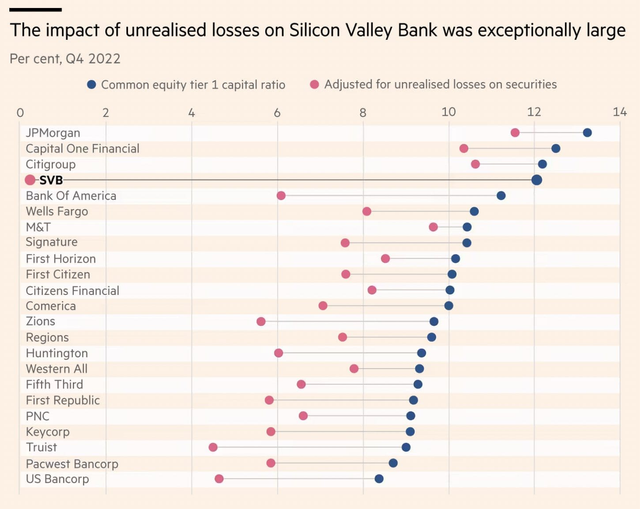

You can see how SVB is such an outlier to the industry quite well here. Though note my previous post. Unrealized market losses on securities are only one part of the equation for bank health. Banks can make money off of rising interest rates as deposit rates don't perfectly match the Fed Funds rate.

For example Bank of America made $14.7 billion in net interest income last quarter, a significant 29% year over year growth thanks to rising interest rates. Bank of America is better hedged against interest rate risk than SVB and has far fewer uninsured deposits (~38%).