Summary

- Glaciers are massive, steady, slow moving forces of nature. The same traits can be identified in companies.

- Verizon's large, steady telecom business offers investors safety and a nice dividend yield. However, it's also somewhat limited as a wealth generator and valuation can prove critical to your returns.

- Verizon is trading below its 10-year valuation norms. We like Verizon here as one of the key players in the continued roll out of 5G technology.

When something is described/compared to being "glacier like", the phrase is meant to assign a very specific set of characteristics. A glacier is a gigantic structure that moves with very (very) slow speed but absolute unstoppable momentum. When we take a step back, this description can fit different businesses that we may invest in. An example is telecom giant Verizon Communications (VZ). The company is a $250 billion (market cap wise) titan in one of the core sectors of how modern society functions. But often times, these traits can result in what is a slow growing entity. We look at the pros and cons of Verizon's glacier like tendencies, and determine just how appealing shares currently are as they hover just under 52-week highs.

PRO: Verizon's Massive Size Brings Financial Stability

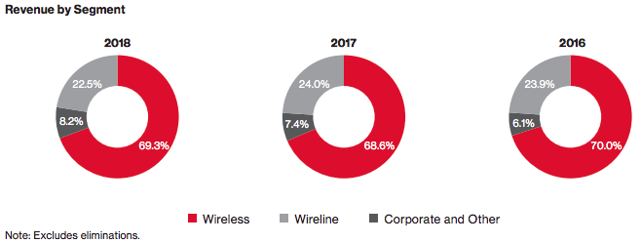

Verizon owns the largest wireless network in the United States by a volume basis (number of connections is around 118 million between consumer and business segments). The company generates approximately $130 billion in annual revenues, and roughly 70% of that is generated by the company's wireless network. Because the wireless segment carries higher margins, it contributes an even higher percentage of EBITDA - roughly 75%.

Source: Verizon Communications

When you add in the wireline segment (the dying legacy hardline telephone business is combined with video services such as Fios), that total revenue contribution rises to 92%. Verizon's reputation of having a stellar network along with its ability to lock many customers into device financing plans results in a churn rate of approximately 1%. This means that the wireless segment is a very stable business for the company as a whole. This brings stability to the company's cash flows and top line as well.

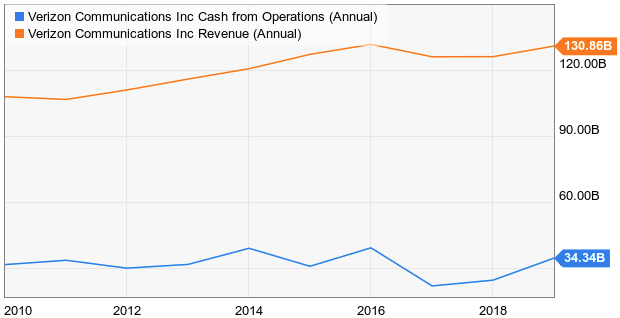

Source: Ycharts

The remarkably stable nature of the telecom segments gives Verizon a reliable cash flow stream that can be used to leverage its balance sheet effectively (investment grade credit rating of Baa1), and reliably distribute cash to shareholders.

PRO: Strong Dividend Payout

The most notable way that Verizon does put cash in shareholder pockets is in the form of a sizable dividend. That dividend comes in the form of a quarterly check, good for an annual payout of $2.46 per share. The resulting yield of 4.08% makes Verizon a great income generation vehicle when you consider the yield abundance (10-year US treasuries offer just 1.67% by comparison), and the safety of the payout provided by a lower payout ratio (just 60% of FCF goes towards dividend payments) and stable business model.

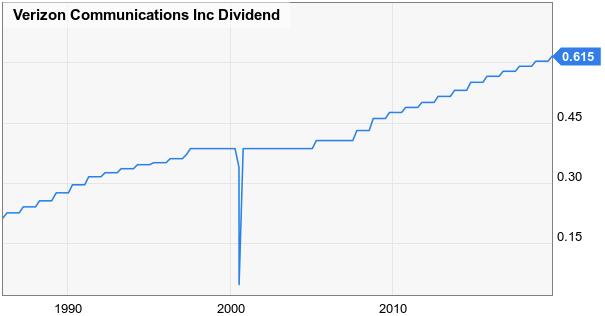

Source: Ycharts

Verizon may not have the long growth streak of other companies, but its dividend payment has grown steadily over time. The company's payout has been increased in each of the past 14 years, and it has grown at a CAGR of 3.1% over the past decade. For investors looking for solid income generation that keeps up with inflation - Verizon is an excellent choice.

CON: Verizon's "DNA" Limits Upside

To this point, we have covered the benefits that Verizon's immense scale and stability can offer to investors. This, however, also comes with an inverse set of characteristics. The drawback of this size and stability is that Verizon's business can be a large ship that is difficult to turn. While this provides stability to revenues and financial metrics, it works against Verizon when the conversation turns to growth and overall wealth creation.

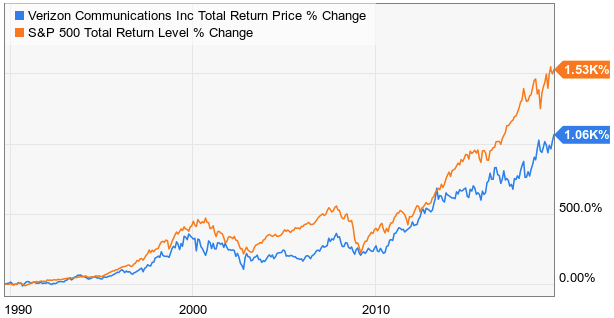

Source: Ycharts

When you look at long-term patterns, Verizon has typically underperformed the S&P 500. Why is this? Well, the very stable telecom business that makes up the vast majority of Verizon's business just doesn't grow very much at a time. This results in an overall growth rate for Verizon's earnings that hums along at a low to mid-single-digit rate over time.

Read the Full Article on Seeking Alpha

Author Bio:

This article was written by Wealth Insights. A well-known investment author on Seeking Alpha with over 6,000 followers.

Steem Account: @wealth-insights

Profile on Seeking Alpha

Steem Account Status: Unclaimed

Are you Wealth Insights? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo team is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Thank you for posting from the https://steemleo.com interface 🦁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It would be great to get some of these authors here on the platform. Have you had any luck yet converting any over to Steem?

Most of the posts that I read from Leo.Syndication are always more of what I want to read!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit