( )

)

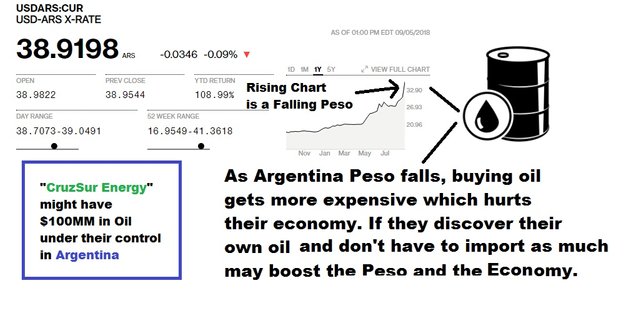

So Oil is light or heavy and sold in dollars or other currencies. The capacity to deliver is what gives the seller the right to fetch a given price for what barrels he/she can deliver. Lose that capacity, you lose the price setting priviledge.

"Brent" oil is the price Europe pays for its energy, named after the Brent Goose in the UK. Mideast Oil is benchmark compared against Brent. So when I say "priced in Brent" its so many dollars and a geo location and is based on volumes sold at a certain price.

o When markets price their goods in terms of energy input costs, what happens if the input costs were to fall (oil price falls) then the elements or inputs that make up the price of a good or service that uses oil,gas, energy would rise or fall some % when an input price rises or falls.

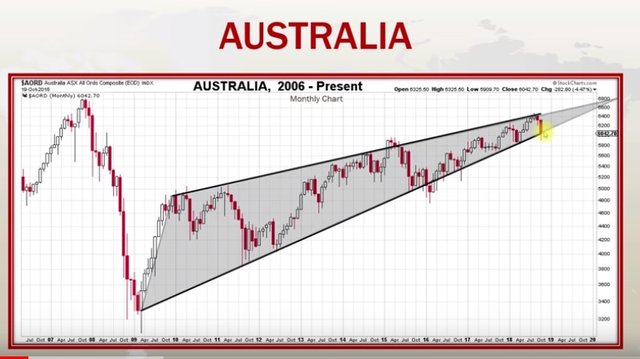

o Australia is topping, and its markets are topping - the pattern known as a rising wedge is dangerously at risk of a quick, steep, correction or drop in value.

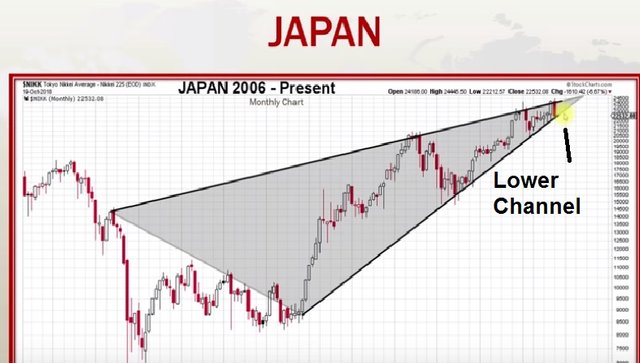

oJapan is also topping when japan markets liquidate the Yen will rise, as cash is needed to settle transactions that need Yen to settle. The pair of USD/Yen will spike when this occurs. The prices of goods will go volatile as this happens.

o Oil by mid 2020 is facing converging factors that will have no effect but one, that is a spike in far east oil prices and the timeframe is unavoidable and will occur by mid 2020 this is going to cause re-thinking financial policy worldwide but the only bank that can print now is left to the fed, and they will have to print 1 trillion or more to pay the interest on their own debts. This printing will lower the value of the USD over time and this will cause the commodities to inflate in price as the USD falls in purchasing power. This will start by 2020 and will go on until the markets solve the supply / demand imbalances ![nzon.jpg]

( )

)

o Alberta Oil is dropping fast and steep. This is not what it appears, its the author of the next bull market. The demand destruction can occur in 2 ways, lack of demand from slowing economies or lack of demand by higher prices that slows demand for purchasing at a given price

o Tag Oil in the ground in Taranaki is largely exported to asia via singapore and the rest is domestically consumed. .jpg)

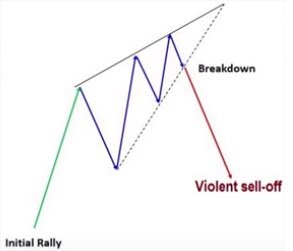

o What a rising wedge means is open to debate, but it has meant the 1929 crash the 1971 oil crisis, the 1987 market crash and the 2008 crash. It likely means the same thing today. ![risingw.jpg]

( )

)

o What happens when the rising wedge (rising emerging markets) actually pops? We don't know, but liquidity slows and trade and spending slows and the idea that the Fed can continue to raise rates in that environment is possible but not probable and they would do a 180 about face and revert to QE (printing money) on steroids and that would light a fire on energy stocks because the denominator is the value of the USD and it would drop in size or value or purchaing power by a huge amount and that would effect the final number for oil price by raising the sell price alot. That narrative won't be understood now, it will be an all at once reversal and what is OVERVALUED in world markets will be sold at a loss and what is UNDERVALUED in ENERGY will get large sums of flight capital chasing a select few companies with low debt and lots of barrels already discovered. Investors will make 15-20X there money in 5-6 years.

o Oil is necessary for life on this planet until further notice.

So when a company like Tag Oil that produces 1300 barrels a day goes up for sale, its not going to get as much attention as an Exxon or Shell. However, its barrels in the ground are likely to be more valueable 5 years from now than they are today. The 2.5% royalty might be on a $115 price tag per barrel rather than $60 in 2018. This makes the value of the SALE of Tag Oil worth pondering. The permits to drill in NZ are limited, the seismic work to identify new barrels takes time and money to do. In a bull market, drilling takes risk and time so mergers occur to grow faster by just buying barrels from a competitor. This makes the low oil and bear market right now a set-up for big gains in a few years. You can gamble on Tag at 40% off and buy the barrels in the ground at a discount to the price they will be worth when lifted out in the future. To take that risk, the downside is near none at the current prices. The upside is 40-45% on a reasonable bounce back to normal. However if iran and saudi go toe to toe the world prices for energy could go parabolic by mid 2019 and that may or may not happen but its what makes the story of Tag Oil worth a read as an investor in marginal barrels at a discounted price to what may occur in just a few weeks or months.

So to read more visit @TulliiLLC on Twitter and search #Tagoil and read the new releases on the company website. you won't be wasting your time.

The SALE announcement https://tagoil.com/news/tag-announces-sale-of-new-zealand-assets-and-operations/

says that the $30 Million USD offer will close by Q1 2019. Thats around 50 cents per share. The shares are 32 cents as of Nov 9th, 2018. The USD could go higher, Oil production and Oil prices and Currency fluctuate. The 2.5% Royalty is a perk for holders of TAG who ride out the merger into the new entity.

Supplejack could bring up to US$5 million more in event specific payments payable on achieving various milestones for PMP 60454 (Supplejack).

So what are the oil reserves worth? What are the steel (pre-tariff) assets at Cheal worth? What is the Cash in the bank? What are the Netbacks? All these answers will start coming out week of NOV 12th when the Q3 financials are released.

The low end. 50 cents a share and say no new counteroffers. Or The high end $1.25 a share from new entrantsin the bid before end of Q1 2019.

Tamarind has alot of cash, and technical expertise so if they buy out TAG, the royalties might be a % of much larger numbers. The Beijing investor YF Finance and its affliates came in late summer scooping up 26% of Tag Oil at a 40 cent ish price. So what do Tamarind and YF Finance have in % right now? Do they have the 66% they need? If not the last few shares needed will go for a higher price in the final auction process. The numbers released next week willbe crucial for determining the value of this offer and as markets and investors digest whether its a fair deal the price will unfold in real time.

If you look at the once $10 per share of Tag Oil in 2010 t 2013 time frame, that won't happen at $60 oil. It could if the mideast had supply or capacity problems. The likes of which are threatened by Iran lobbying missiles from Yemen at its competitor in Saudi Arabia. It's possible in low probability math stats but still it does exist if the Straight of Hormuz was closed as the Iran/Saudi and Saudi/USA relations inflate tensions over who gets to export what oil across the Straight where 30% of world oil exports have to pass through the narrow channel.

At the end of the day - nobody can predict the price of oil or geopolitics with any degrees of accuracy until the event has happened that moves the needle of supply, demand, currency.

I don't know the price Tag Oil will fetch. I just know the available amount of Non-opec, Non-state oil owned barrels that can be bought up by investors going into 2020 is very limited. 1 Barrel is important if you are on your last one. Some countries are facing the problem of scraping the bottom of the barrels they have. By 2020, we will have a problem we will be short -500,000 barrels a day. We know this today, without more than 5th grade math. We know what russia and saudi can do, we know what non-opec can do, we know what opec capacity is within a range. All that known, we are short 500,000 bbls. so what is the market willing to pay for one of thse 500,000 barrels? I don't know, I only know 1300 of 500K available are sitting in New Zealand beneath the land of Tag Oil.

If the barrel is empty, the next available full barrel is worth incrementally more. That reality is coming by mid-2020.

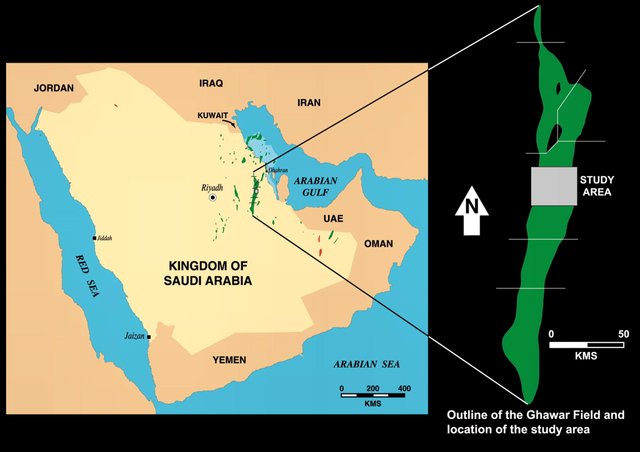

By march of 2019, before the WARRANTS expire March 20, 2019 the Largest Oilfield in the world in Saudi Arabia will start to really decline fast. The slope of the curve of the decline is Y=mx+b from good ole math 101. We the negative slope of that curve is going to really accelerate in march 2019. So follow this, when 5% of the worlds oil price which is made up by the reliable daily output of the GHAWAR Oilfield starts to not deliver its goods and goes into freefall decline, then what.

"Ghawar is ready to peak, and once it does Ghawar may decline much more rapidly then 5% per year after it peaks. The field has been drilled and redrilled. They are pumping in water at the bottom to force all the oil to the top. Right now they are pumping only from the top and percentage of water in the wells get worse every year. When it finally peaks it may be like the Mexican Cantarell field, which dropped to near zero in just a few years after peaking"

- Mathew Simmons

Then what is the price of a marginal barrel in New Zealand, - or anywhere? We don't know, only the moment it happens do we know. I do know, that if overvalued AMAZONs and APPLEs start to selloff, that what is real right now, what is consumed and in demand right now is going to be sought after with both fists and that is why you should re-read this article and check it facts for yourself. Then watch what happens in the next weeks as the markets digest the reality of weather, oil markets, trade disputes and the remaining market dynamics for pricing exploration assets.

Do you want to buy a foreign barrel, will you be able to get delivery of that barrel even if you desire it?

Will Venezuela win its finance demands using Ethereum or will the experiment fail putting more stress on the suplly/demand balance for global oil markets by 2020?

Good luck to all.