So, you are already familiar with cryptocurrencies? And, there are chances that you have even registered on several exchanges.

Great!

On the most basic level of crypto trading, each trade ends with either a profit or loss. Taking profit is usually a great and positive experience for the traders. And, if the market moves in your favor continuously after you have taken up profit, then you may begin feeling as you are missing out on something.

Knowing when to Take Profit is one of the key factors that distinguish profitable crypto traders from unprofitable ones. In order to know when to take profit, it’s really important for a trader to have a plan before entering the position.

When to take profit cryptocurrencies?

So, what’s the bottom line when it comes to taking profit on cryptocurrencies?

All this depends on your comfort level with risks and your goals. Nevertheless, there are a few strategies that are worth considering:

• Keeping your eyes on divergence

• Watching for the turning points

• Paying attention to the market ups and downs

Volatility has become synonymous with crypto trading and the violent uptrends and downtrends may leave you wondered how expert traders turn these moments into opportunities.

So, how can you know how strong your next move should be to maximize your profits?

Setting limit orders, take profits and trailing take profit orders are the solutions for traders who want to earn profits at a particular level or price. Setting a limit order on your trade lets you make profit in time and won’t let you lose money.

Take Profit (TP) and Trailing Take Profit (TTP) order let you ride the double digit gains on your crypto trading. These order types will help you secure your gains and control your losses.

Let’s understand about Take Profit and Trailing Take Profit order one by one:

Take Profit Order

Take Profit is an order that locks in the trader’s profit when the crypto asset price reaches to a certain level. The execution of this order type leads to the position closing with the profit.

If the price of a crypto asset reaches at that limit, it will automatically trigger the sale. And, if the price doesn’t reach that limit, the order is not acted on. This order is only related with an open position in the market or with the pending orders.

It is a short-term strategy that is only useful for those traders who want to take advantage of the quick rise in the price of cryptocurrencies to earn immediate profits. Generally, these orders are also known as limit or sell-limit order.

How does a take profit order work?

To use Take Profit (TP) order, the trader has to set a price at which he wants to sell an asset. This price is above the price at which the crypto asset was bought so as to make sure that he will make a profit on its sale.

Once the price reaches to this limit, the order will be triggered and the sale goes through as per the current market price. And, if that limit is not reached, the sale will not get executed.

If you are a crypto trader with short-term strategy, Take Profit orders will be helpful. Let’s understand it with an example:

Say, you bought LTC at $100, and set a take profit percentage at 10%.

This means that whenever the price for LTC reaches at $110, your TP order will be triggered, and the trade will be closed.

The key benefit of using a TP order is that the trader needs not to worry about executing the trade manually. Once you have set the price, the crypto trading bot will perform the trade automatically.

These orders can be accomplished at the best possible price regardless of the behavior of that underlying asset. There are chances that the crypto asset could start to breakout higher, but the TP order will get executed at the very beginning, resulting in high opportunity costs.

Most expert traders use take-profit orders in combination with stop-loss orders (S/L) to manage their open positions. If the asset price rises to the take-profit point, the T/P order is executed and the position is closed for again.

If the asset price falls to the stop-loss point, the S/L order is executed and the position is closed for a loss. The difference between the market price and these two points helps define the trade’s risk-to-reward ratio.

More often, Take-profit orders are placed at levels that are defined by other forms of technical analysis, including chart pattern analysis and support and resistance levels, or using various money management techniques.

Now, on the other side, the Trailing Take Profit order is designed to help traders catch the rise. You set your take profit on which trailing limit will activate and try to increase your gains as much as possible.

Trailing Take Profit

This is the most common and useful function in crypto trading used by the traders. And, Its ultimate goal is to increase profits. When the Take profit value is reached, but the price moves further into the profit zone, the position will not close.

And, Trailing Take profit will continue to follow the price, and at the slightest movement back, it will close automatically with larger percentage of profit as compared to choosing simple take profit order.

How Trailing take profit order works?

In the above example, your take profit value will be $110 when you have bought LTC at $100 and set a TP at $10. But in the case of Trailing Take Profit (TTP) order your profit will not be constant.

Yes! It will continue to change based on how the price has moved. For Trailing Take Profit orders, the trader has to define another parameter known as Trail limit i.e. how much is the price of the crypto asset allowed to fall from the peak before selling it.

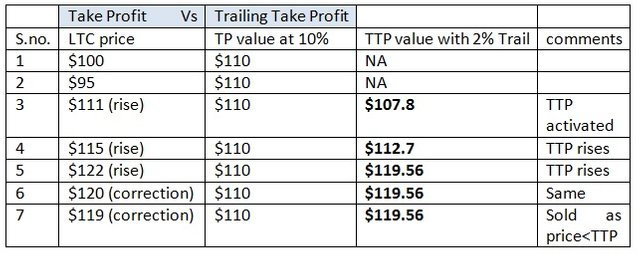

Let’s understand both Take Profit and Trailing Take profit in the below table. Let’s set Trail limit at 2%, and try to understand what will happen to the TTP value.

As a result of the above, TTP will help its traders maximize their profit and exit at the right time from the trade instead of exiting so promptly.

Trailing Take Profit orders only move in one direction and are designed to lock in profit and limit losses. The trailing profit only moves up (in case of a long strategy) once the price has exceeded the previous high and a new high has been established.

If the trailing take profit moves up, it cannot move back down, thus securing the trader’s profit and preventing losses.

Trailing Take Profit allows the trade to remain open and continue to profit as long as the price is moving in the trader’s favor. If the price changes direction and the change exceeded the previously set percentage the order will be closed.

If you want to maximize your gains and reduce the amount of loss, you can’t avoid using trailing orders to take profit. To place these orders, visit TrailingCrypto or any other crypto trading platform and select any of the advanced trading strategies like TTP, TP, stop loss etc. to earn profits.