The Greek Alphabet Symbols

JWillette [CC BY-SA 3.0 (https://creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons

First I will reveal something personal yet potentially embarrassing, these symbols have always confused me. For most of my life I struggled with math because the same symbols would be recycled over and over for different strains of math leaving me in complete confusion as to which language is what. It wasn't until I discovered how to use a cheat sheet and accept that I'm never going to be able to memorize all the arbitrary meanings behind the different math languages that I actually learned to become fluent in math.

Delta - Vega -Theta - Rho - Lambda - Epsiilon - and sometimes Gamma

The Greek Alphabet has a specific meaning in options and derivatives which is not necessarily related to the meaning they may confer in for example statistics or various kinds of esoteric math. So this post is going to be based around understanding the very basic meaning behind "The Greeks" starting with the most fundamental of them.

Delta

Delta in my opinion is best understood by understanding what it does. Delta is an indicator of movement of the underlying asset price. The function of Delta is to provide an indicator of directional risk. To be specific, if you look at the number which represents the Delta indicator it is a ratio comparing the price changes between an asset and it's derivative. For example Steem Power is clearly based upon Steem so we can say Steem Power is a derivative of Steem. Even more useful is to think of Steem Dollars as a sort of derivative of Steem because we know some amount of Steem (unknown variable amount) is going to be redeemable for Steem Dollars on the internal exchange. So what exactly is the Delta? A final Steem example is that the new Mana Voting feature will only charge you for the Delta when you change your vote.

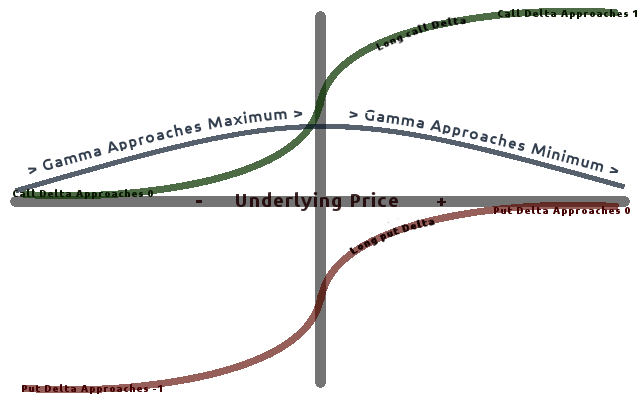

Let's now think of it in the context of options? A put option gives the buyer the right (but not the obligation) to sell a specified quantity of a security at a specified "strike price". A strike price is the price the options holder can buy or sell at. What influence does the price change of the underlying asset have on the price of the call or put option? This is what the Delta indicator will tell us by giving us a ratio. When the underlying security or asset moves the Delta indicator changes in response. If the stock price for example rises or falls the Delta will reflect the directional risk.

Call Deltas range from -1 to 0. Put Deltas range from + 1 to 0. This is because a Put option falls in value if the underlying stock price increases and gains in value when the underlying stock price decreases. A Call option increases in value when underlying stock price increases and falls in value when the underlying stock price decreases. At any point in time there are calls vs puts which can exist. To understand what impacts the value of an option we rely on these indicators called the Greeks from which Delta is the main fundamental indicator.

Options pricing relies on intrinsic value and time value. Time to maturity, volatility, rate of interest. When volatility is really high then every strike price has a higher probability of being hit. So in a crypto trading context higher volatility can be profitable in theory if options traders manage their risks but there is a big difference in practice vs in theory. Delta will give us the relationship for the intrinsic value.

So in practice you want the value of your options contracts to go up and you can hedge using options. For example if you are a Bitcoin miner you can use options trading to profit during a bear market. If you for example rely on a call option and the underlying price of Bitcoin were to go down, your call options contracts would go up in value and it would be reflected in the Delta indicator.

Gamma

Gamma is an indicator of the rate of change for Delta. The Delta of an option is continuously changing because it is an indicator. The rate that Delta is changing is given as Gamma. Delta is based on a $1 move upward, while call options have positive and put options have negative ratios. The Gamma is the rate that these ratios themselves are changing for the option. If for example the underlying stock is changing in it's price a lot then this would be reflected in the Delta changing, and this would also be reflected in the Gamma. Delta is the speed, Gamma is the acceleration.

Vega

Vega is an indicator of the impact of volatility on an option. 1% up in implied volatility, would indicate how much money you could make. Volatility is the unknown variable which can represent the opportunity to make money.

Theta

Always negative, indicating how close an option is getting to expiration and the closer an option gets to expiration the more Theta speeds up. In other words it represents the every day decline in the value of an option as it gets closer to expiration. It represents the value lost due to time decay.

Rho

The measurement of an options sensitivity to changes in risk free interest rate. It answers the question of how much money an option will lose or gain with a 1% change in interest rates.

There are more Greeks and I admit I merely glossed over them but this should reveal at least what they are and what they do.

What can derivatives do for Tau?

In markets where people must take risks there is going to be demand for hedging. In fact Bitcoin itself for many of us was bought as a sort of hedge against the current banking system. Some of us then bought Ethereum as a hedge against Bitcoin and so on and so forth. But with options contracts and with more sophisticated portfolios you can hedge much more effectively. We are now seeing the Ethereum community for example attempting to implement what they call Decentralized Finance. In essence this kind of hedging is based on for example using something like Compound to get interest and then pooling that interest to fuel fundraising and project development.

One problem people have in general not just in crypto is how can they store their wealth in a way where there is minimal risk of losing their wealth over time. Wealth preservation cannot be guaranteed merely by buying Bitcoin or Ethereum and holding it for life. It is for these reasons that the concept of a Stable token was invented. The first Stable token in crypto was called BitUSD and it came long before the Steem Dollar other Dai. The usefulness of a stable token is that it offers a method of storing wealth in a manner which it is less likely to be lost over time. More sophisticated derivatives could not only use the stable token but also according to theory use hedging strategies to slowly grow a token portfolio and even if it's just 1% interest a year, if it's compounded then you have compound interest which is enough where if you could represent compound interest as a token share in a smart contract which continuously reinvests in itself to always buy more and more shares then it's like having a gift which keeps on giving.

What could be done with such a token? You could give this sort of token to someone as a gift (tax free). The person for example could be a child so that there is enough time for the compound interest to grow into the hundreds of thousands or millions by the time they reach adult. If it's risk free interest, and anyone who buys the tokens gets a share of the risk free interest, then it's not all that different from buying shares in a mining farm for instance, and if that mining farm you know is also hedging it's bets so that even if Bitcoin price crashes to zero the farm simply profits from the price drop to zero, well then it's pretty obvious to see that having the digital equivalent of options here could make some sense.

And what could happen to the person you gifted the token to? Well if they are smart all they have to do is hold it and spend the interest when they become an adult. If crypto tech still exists and isn't completely banned, then this sort of compound interest generator token would be life changing for them. Of course while it is tax efficient you would still have to pay taxes if the token is beyond a certain threshold amount but the receiver of the token would not have to pay any taxes on gifts received. So in theory you could gain both ability to preserve and efficiently transfer wealth peer to peer presumably if decentralized finance and complex derivatives begin to work as imagined by some in the crypto space.

The Steem Dollar should be given some credit for being one of the first attempts. The Steem Dollar in the original design was supposed to pay interest. In my opinion a major flaw in the design of the current Steem Dollar is that it doesn't provide any interest which is why people don't have a reason to want to store their wealth in the Steem Dollar over Tether or Compound or the plain old options contracts. At the same time we know just holding a token whether it be Steem, or Agoras, or Bitcoin, is on all probability not an effective strategy to preserve wealth due to the fact that there is always the risk that any tokens we decide to hold at any point in time could crash and never come back up. The ability to do true decentralized finance with strong derivatives would allow for us not to have to care as much about the price of any particular token because we could have contracts which give us profit off movement in either direction, while also getting free interest to reinvest with for compounding.

Of course this is all theory, but it's theory backed by mathematics and the indicators we can see with the Greeks show us that we can model and map out these risks using these indicators. We can know which contracts to use and when and why, or we can possibly even automate it out so that a machine (agent) automatically buys any contract which matches our search criteria (which can be based on cheat sheets for the less mathematically inclined).